Systematic Industries: From IPO Flop to Growth Juggernaut? Why This Wire Wizard Could Wire Up Your Portfolio with 30% Returns by 2027

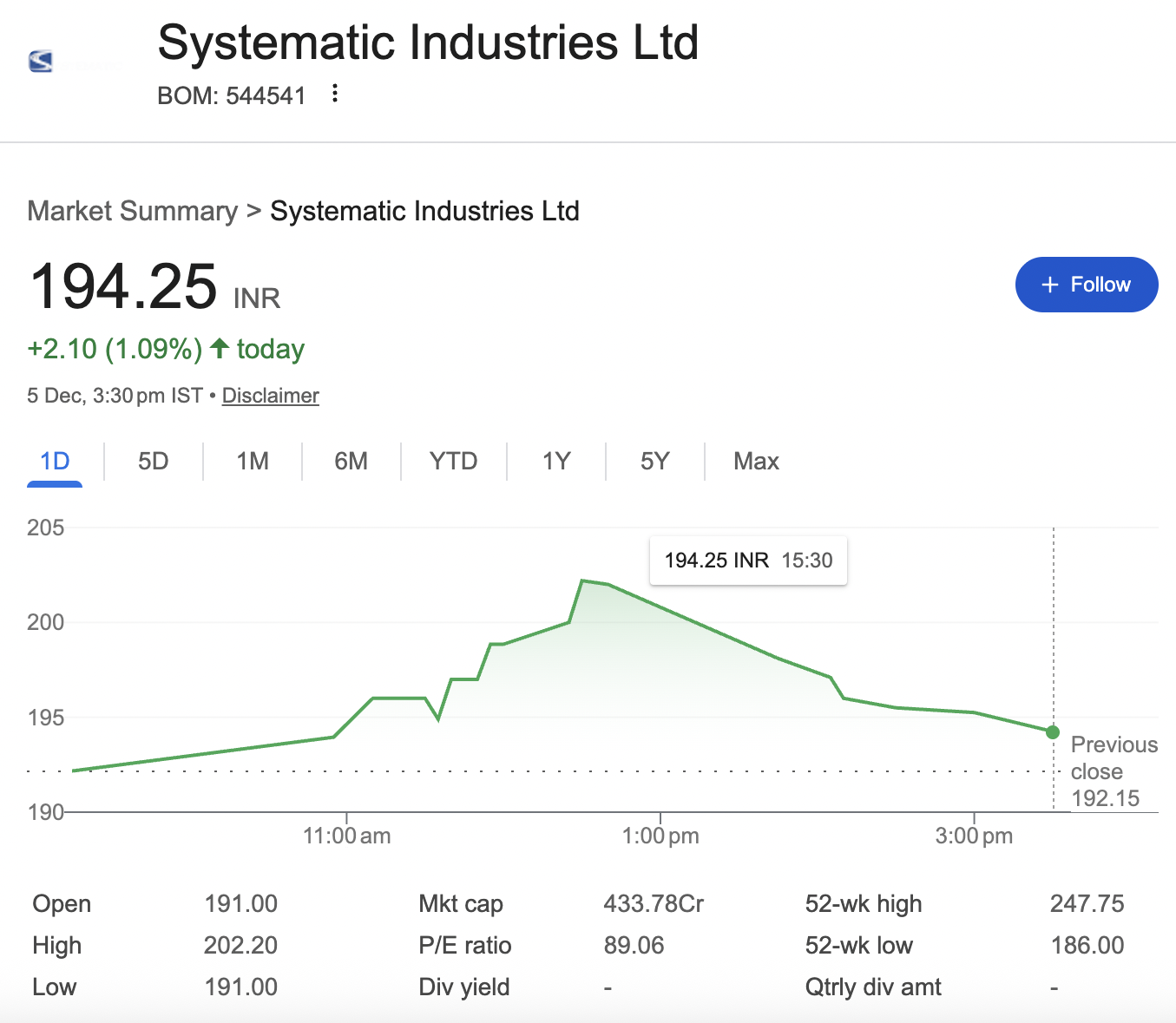

Picture this: A quiet Mumbai-based wire maker, fresh off a lacklustre IPO debut that shaved off 0.6% on listing day, suddenly surges 15% in a single quarter amid whispers of a booming infrastructure spend. Sounds like a plot twist from a Bollywood underdog story? Meet Systematic Industries Ltd (BSE: 544541), the galvanized iron (GI) wire powerhouse that’s quietly threading its way into India’s $161 billion fencing and cabling market by 2030. But here’s the million-rupee question: With sales exploding 21% in the trailing 12 months and profits leaping 49%, is this small-cap sensation a buy for the bold—or a tangled risk in a debt-laden web?

Sifting through balance sheets and sector tailwinds, I’ve crunched the numbers on this recent IPO entrant (listed October 1, 2025, after raising ₹115.6 crore at ₹185-195 per share).

Spoiler: The fundamentals scream “undervalued growth machine,” but volatility lurks. Let’s unspool the story.

The Wire That Binds: A Quick Company Primer

Systematic Industries isn’t just twisting steel—it’s fortifying farms, powering transmission lines, and fencing off India’s infrastructure boom. Part of the 25-year-old Systematic Group, the company churns out premium GI wires, chain-link fencing, ACSR conductors for power grids, and even optical ground wires for telecom towers. Exports to Asia, Africa, and Europe add a global sheen, serving 1,500 clients with zinc-coated precision that meets BIS standards.

Post-IPO, promoters hold a rock-solid 73.4%, signalling skin in the game. Funds raised? Slated for capex in plants at Tarapur and Pune, debt repayment, and working capital—fueling a pivot from domestic drudgery to export ambition. With India’s fencing market projected to swell at a 6% CAGR through 2030, driven by agri-reforms and 5G rollouts, Systematic is positioned like a stay wire in a storm: essential, yet overlooked.

Financials Unraveled: A Table of Triumphs and Telltales

Forget vague vibes—let’s dive into the digits. Systematic’s books paint a portrait of accelerating momentum, with operating margins inching up from a measly 4% in FY20 to 8% in FY25, thanks to scale and cost controls. But debt lingers at 48% of liabilities, and cash flows swing like a loose cable in the wind.

Here’s the bottom-up breakdown, straight from audited trails:

| Metric (₹ Cr, unless stated) | FY21 | FY22 | FY23 | FY24 | FY25 | TTM (Sep ’25) | 3-Yr CAGR | Notes |

|---|---|---|---|---|---|---|---|---|

| Net Sales | 175 | 234 | 320 | 370 | 447 | 536 | 24% | Explosive post-pandemic rebound; Q2FY26 at 254 Cr alone. |

| Net Profit | 3 | 4 | 6 | 12 | 18 | 21 | 68% | Profitability flip: From 2% margins to 4%—efficiency magic? |

| EPS (₹) | 44.01 | 59.03 | 95.75 | 125.56 | 10.99 | 10.86 | 36% (5-yr) | Post-IPO dilution hit, but trajectory upward. |

| ROE (%) | 8 | 9 | 13 | 19 | 26 | 25.8 | 21% (3-yr) | Beats sector avg of 15%; equity base ballooned to ₹22 Cr. |

| ROCE (%) | 9 | 12 | 13 | 19 | 21 | 20.6 | N/A | Capex paying off—fixed assets up 130% to ₹61 Cr. |

| Debt/Equity (x) | 0.74 | 0.84 | 1.27 | 1.30 | 1.55 | 0.60 | N/A | Peaked at 1.55; IPO trimmed borrowings to ₹100 Cr. |

| Cash from Ops | 2 | -1 | -7 | 15 | 8 | N/A | N/A | Turned positive FY24; investing outflows signal expansion. |

| OPM (%) | 3 | 4 | 4 | 7 | 8 | 7 | N/A | Raw material hedges shielding from steel volatility? |

Source: Company filings; TTM as of Sep 2025. At ₹194 (down 21% from 52-week high of ₹248), the stock trades at a P/E of 21.1— a steal versus the industry’s 42x. Book value? A comfy ₹85 per share, with P/B at 2.3. Curiosity piqued: Why the post-IPO slumber? Blame small-cap jitters and a tepid grey market premium of zero. Yet, Q2FY26 delivered 7% sales growth QoQ, hinting at revival.

Growth Prospects: Tangled in Tailwinds or Short-Circuited?

From an investor’s lens, Systematic is no one-trick pony. Agri-fencing demand could spike 15% annually with PM-KISAN’s drip-irrigation push, while power sector orders (ACSR wires for 132kV lines) ride the ₹9 lakh crore grid capex wave. Telecom? OPGW sales for BSNL’s 5G backbone could add 20% to top-line by FY27.

Projections? Absent analyst swarms (a SME hallmark), our back-of-envelope math: Sustain 20% sales CAGR on 8% margins, and EPS could hit ₹15 by FY27—implying 50% upside to ₹290 at current multiples. Exports, now 10% of revenue, target 25% by 2028 via Dubai expos.

Risks? Steel price swings (60% input cost) and competition from Tata Wiron could snag the thread. Plus, only 40% independent directors raise governance flags.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.