Saptak Chem & Business: A Phoenix Ready to Rise from the Ashes? A Deep-Dive Analysis

In the bustling ecosystem of the stock market, where high-flyers often grab the headlines, value investors are perpetually on the hunt for overlooked stories with transformative potential. One such script is playing out at Saptak Chem and Business Limited, a company that presents a paradox of a battered balance sheet juxtaposed with a sudden, significant revenue opportunity. Our bottom-to-top forensic analysis uncovers a narrative that is far more complex and intriguing than its recent financial statements suggest.

The Bottom Line: A Story of Two Halves

Let’s not mince words. The company’s recent financial performance has been abysmal. However, focusing solely on the past would be a disservice to the potential unfolding in the present.

Table 1: The Hard Financial Truth (Standalone)

| Financial Metric | FY 2024-25 | FY 2023-24 | What This Screams |

|---|---|---|---|

| Revenue from Operations | ₹ 0.00 Lakhs | ₹ 0.00 Lakhs | Core business was comatose; no trading activity. |

| Total Income | ₹ 0.06 Lakhs | ₹ 0.00 Lakhs | Mere interest income; operational hibernation. |

| Net Profit / (Loss) | (₹ 8.62 Lakhs) | (₹ 3.48 Lakhs) | Consistent losses, burning cash for sustenance. |

| Accumulated Losses | (₹ 1,298.90 Lakhs) | (₹ 1,290.28 Lakhs) | Massive hole in the balance sheet, negative net worth. |

| Earnings Per Share (EPS) | (₹ 0.08) | (₹ 0.03) | Value destruction for shareholders. |

| Current Ratio | 0.07 | 0.07 | Severe liquidity crunch; assets cover only 7% of liabilities. |

| Cash & Equivalents | ₹ 0.82 Lakhs | ₹ 2.55 Lakhs | Dwindling cash reserves, raising survival concerns. |

The picture painted by Table 1 is undeniably bleak. The company has been a non-operating entity in any meaningful sense, surviving on nominal income and burdened by a negative net worth of over ₹ 225 lakhs. The minute cash balance and paltry current ratio signal extreme financial distress.

The Catalysts: The Phoenix Feathers

This is where the story flips. A top-down look at recent corporate actions reveals a management aggressively attempting a resurrection. Two pivotal events stand out:

1. The Lifeline: A ₹ 5.50 Crore Purchase Order

On September 29, 2025, the company disclosed a significant purchase order from Shree Nakoda Agro Trading for the supply of fruits and vegetables, valued at ₹ 5.50 Crores to be executed over FY 2025-26 and FY 2026-27.

- Why it Matters: This is not just an order; it’s a resuscitation. It provides assured revenue visibility for the next two years and marks a strategic pivot towards the agri-trading segment, moving away from its struggling chemical past.

2. The Surgical Strike: Capital Reduction Scheme

The company has received approval from the Hon’ble NCLT for a 90% capital reduction. This is a masterstroke to clean up the balance sheet.

- How it Works: The company is extinguishing 90% of its issued capital. This will not affect the share price proportionally but will be used to write off a significant portion of its colossal accumulated losses.

- The Outcome: Post-reduction, the balance sheet will emerge significantly cleaner, with the negative net worth drastically reduced or potentially eliminated, making the company more attractive for future financing and strategic initiatives.

The Anatomy of Survival & Risk

How did a company with near-zero revenue survive? The answer lies in its liabilities.

- Source of Funds: The company has been propped up by unsecured, interest-free loans from “Relatives of Directors” amounting to ₹ 236.85 Lakhs. This indicates promoter faith but also highlights an inability to secure formal banking channels.

- The Sword of Damocles: A contingent liability of ₹ 1.19 Crores related to a GST dispute for FY 2018-19 is pending with the Assistant Commissioner of GST. An adverse ruling could deliver a severe financial blow.

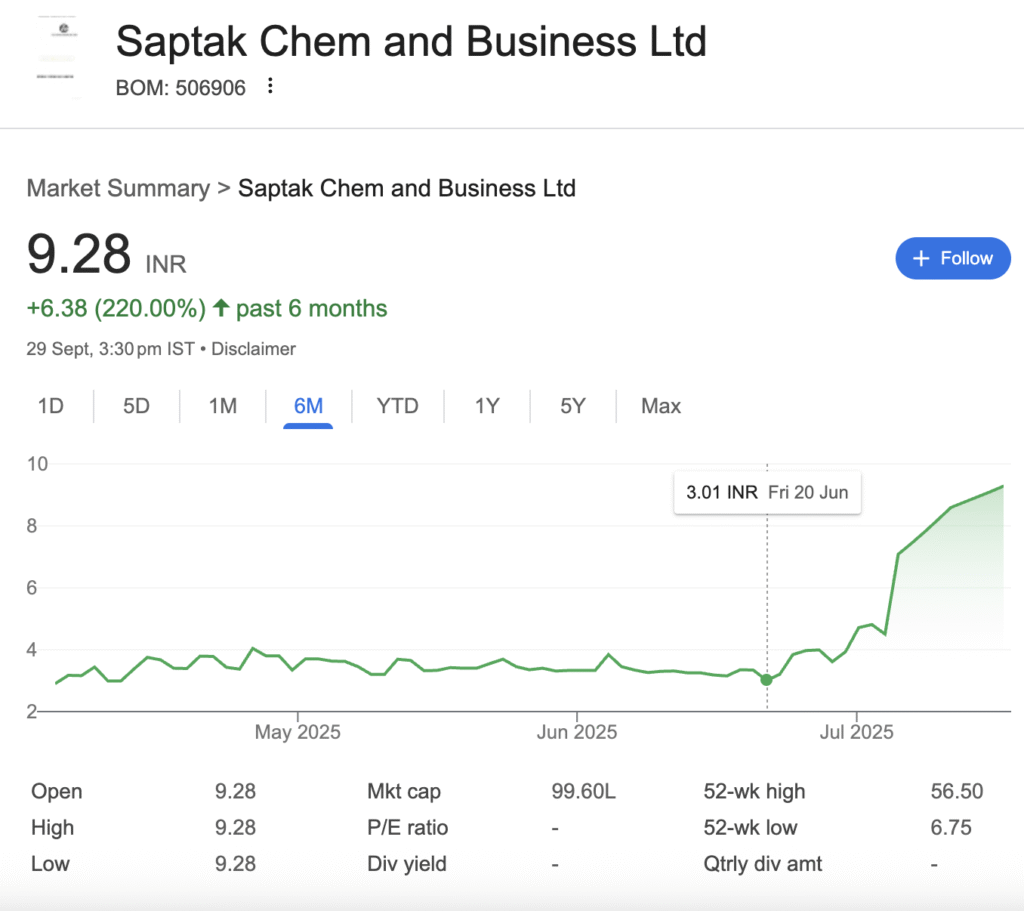

Stock Price Movement: A Speculative Bet

The stock price action over the last year is a classic chart of a speculative script reacting to news flows rather than fundamentals.

Table 2: The Rollercoaster Ride (BSE – 2024-25)

| Month | High (₹) | Low (₹) | Likely Driver |

|---|---|---|---|

| Dec-24 | 4.80 | 3.25 | Speculation around the Capital Reduction scheme. |

| Jan-25 | 4.36 | 3.51 | Profit-taking/Volatility post-approval news. |

| Feb-25 | 4.15 | 2.71 | Reality of weak fundamentals setting in. |

| Mar-25 | 3.28 | 2.70 | End-of-year squaring up; low liquidity. |

| Post-Result & PO News | Expected Volatility | Anticipation of the ₹5.5 Cr. order’s execution. |

The price has been volatile, trapped between ₹2.70 and ₹4.80, reflecting the market’s tug-of-war between the hope of a turnaround and the fear of its underlying weaknesses.

Verdict: To Invest or Not to Invest?

As a Research Analyst, here is a clear-eyed assessment:

The Bull Case (Reasons to Consider):

- Transformation Trigger: The ₹5.5 Crore order is a tangible starting point for a new business chapter.

- Balance Sheet Surgery: The capital reduction is a bold and necessary step to wipe the slate clean.

- Promoter Skin in the Game: Continuous financial support from promoters suggests they haven’t given up.

- Extreme Asymmetry: At a low price, the risk-reward could be favourable if the turnaround succeeds.

The Bear Case (Reasons for Extreme Caution):

- Execution Risk: The company has no recent track record of executing an order of this size. Can it deliver?

- Financial Frailty: The near-zero cash balance and low current ratio pose a serious threat to its ability to even initiate the order.

- Historical Baggage: The massive past losses and GST dispute are significant overhangs.

- Liquidity & Promoter Dependence: Survival is entirely dependent on promoter loans, not organic strength.

The Analyst’s Call:

Saptak Chem is not an investment for the faint-hearted or the retail novice. It is a high-risk, high-potential-reward speculative bet.

- For the Speculator: If you believe the management can successfully execute the new order and leverage the cleaned-up balance sheet for further business, the current price could be a low-entry point for exponential returns. It’s a binary bet—either it works spectacularly, or it doesn’t.

- For the Prudent Investor: Steer clear. The fundamental risks are too high. The company needs to demonstrate consistent execution, improve its financial health independently, and resolve its legal disputes before it can be considered a serious investment candidate.

Bottom Line: Saptak Chem is a phoenix that has gathered the feathers for a potential flight—the ₹5.5 Cr. order and the capital reduction. But the fire to ignite its ascent—operational execution and financial stability—is yet to be proven. Watch this space closely, but invest only with capital you are prepared to lose entirely.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.