Oriental Rail Infra Bags ₹4.77 Cr Railway Order: A Silent Multibagger in the Making?

With a debt-free balance sheet, RDSO-approved monopoly edge, and a fresh Central Railways contract, this small-cap stock is ticking all the right boxes for long-term investors. But does the recent surge justify an entry? Our deep dive reveals the numbers behind the hype.

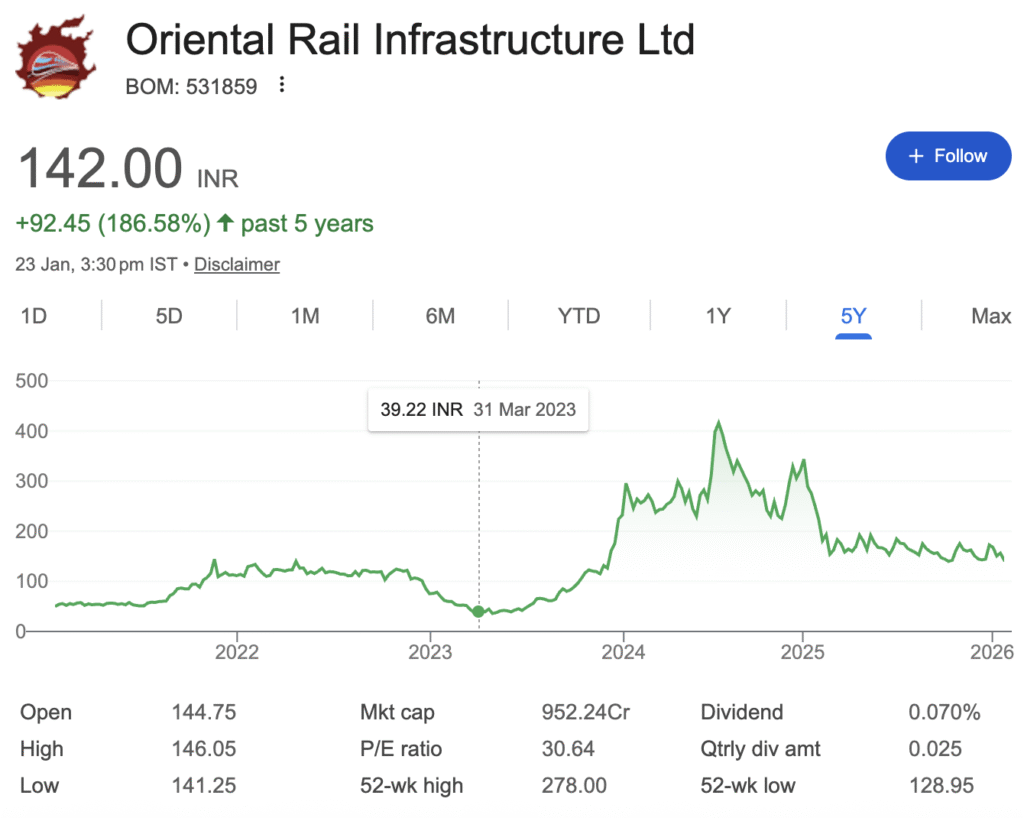

In the bustling universe of small-cap stocks, where whispers of government contracts can trigger seismic price movements, Oriental Rail Infrastructure Limited (BSE: 531859) has just given investors a concrete reason to sit up and take notice. The company’s recent disclosure of securing a ₹4.77 crore order from Central Railways isn’t just a routine regulatory filing—it’s a spotlight on a niche player strategically parked in the heart of India’s massive railway modernization story.

But beyond the headline-grabbing order lies a more compelling question: Is this stock a fundamentally sound investment, or merely a speculative bet riding on railway sector momentum? We crunch the numbers, dissect the financials, and gaze into the crystal ball of growth prospects.

The Catalyst: More Than Just a Contract

The order, for supply of RDSO-approved vinyl coated upholstery fabric, underscores a critical advantage: RDSO approval is a formidable moat. It’s not just about supplying fabric; it’s about being a certified vendor to the Indian Railways, an entity embarking on a ₹10-₹15 lakh crore modernization journey over the next decade. This contract, though modest in size, reaffirms the company’s trusted vendor status and opens doors to repeat, larger orders in the railway coach refurbishment and new manufacturing ecosystem.

Financial Health Check: A Story of Robust Growth and Pressuring Margins

A dive into the company’s financials reveals a business scaling rapidly but facing profitability and leverage challenges. The following table breaks down its vital statistics:

The Bottom Line: Oriental Rail is a classic “growth” story. Its revenues have exploded, climbing from ₹173 Cr in FY23 to ₹526 Cr in FY25. However, this growth has come at a cost—profit margins have been squeezed, and the company carries a notable debt load, though it is on a improving trend. The current Price-to-Earnings (P/E) ratio of nearly 30 suggests the market is already expecting strong future performance.

The Investment Thesis: Riding the ₹50 Lakh Crore Wave

The bullish case for Oriental Rail is fundamentally macro-driven. India’s railway sector is on the cusp of unprecedented investment.

- A Colossal Addressable Market: Independent research estimates a ₹50 lakh crore (approx. $600 billion) capital investment opportunity in Indian Railways by 2030. This encompasses everything from new tracks and stations to rolling stock—the very coaches Oriental Rail supplies components for.

- Sustained Government Capex: The sector benefits from direct government capital outlay, with a strong order book-to-income ratio of 2.77 across railway companies. The passenger rail segment, Oriental Rail’s core market, is the largest and fastest-growing segment in India’s railroad market.

- Strategic Positioning: As a manufacturer of RDSO-approved components, the company holds a regulatory moat. Its diversified product portfolio within coach interiors positions it to benefit from both new coach production and the refurbishment of existing fleets.

Risks: The Bumps on the Track

- Customer Concentration: Heavy reliance on Indian Railways and its units (like ICF) is a double-edged sword. It provides a steady stream of business but also exposes the company to bureaucratic delays, pricing pressure, and client-specific payment cycles.

- Margin Pressure: The recent financials show that skyrocketing revenues have not translated into proportional profit growth. Rising input costs and competitive bidding could keep margins tight.

- Valuation and Liquidity: At a P/E of ~30, the stock is not cheap. As a small-cap, it also faces liquidity constraints, which can amplify price swings in either direction.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.