NMDC Reports Robust Growth in FY26 Nine-Month Results: Can India’s Mining Giant Overcome Margin Squeeze and Deliver on its Growth Promise?

NMDC Limited (NSE: NMDC), India’s iron ore behemoth, is painting a classic tale of two narratives. Its operational engines are firing on all cylinders, breaking production records. Yet, its profit machine is sputtering under the weight of falling realizations and soaring costs. For investors, this presents a critical dilemma: bet on the structural volume story of India’s infrastructure boom, or fear the cyclical squeeze of commodity margins? Our bottom-to-top analysis deciphers the numbers and the path ahead.

I. The Financial Deep Dive: A Story in Two Tables

Forget surface-level headlines. The real story of NMDC is in the conflicting signals between its Nine-Month (9M) and Third Quarter (Q3) scorecards.

Table 1: The Growth Narrative (9M FY26 vs. 9M FY25) – The Bull Case

| Metric | FY26 (9M) | FY25 (9M) | Change | What It Screams |

|---|---|---|---|---|

| Iron Ore Production | 368.86 LT | 307.65 LT | +20% | Unmatched operational scale & execution. |

| Revenue from Operations | ₹20,381 Cr | ₹16,715 Cr | +22% | Top-line growing powerfully on volume. |

| EBITDA Margin | 38% | 44% | (600 bps) | The first crack: Erosion despite growth. |

| Profit After Tax (PAT) | ₹5,401 Cr | ₹5,196 Cr | +4% | Profit growth severely lagging revenue growth. |

Table 2: The Squeeze Narrative (Q3 FY26 vs. Q3 FY25) – The Bear Case

| Metric | Q3 FY26 | Q3 FY25 | Change | What It Whispers |

|---|---|---|---|---|

| Avg. Domestic Realization/Tonne | ₹4,681 | ₹5,361 | -13% | Core Problem: Pricing pressure is acute. |

| Operational Expenses | ₹2,539 Cr | ₹1,582 Cr | +60% | Alarm Bell: Cost inflation is raging. |

| EBITDA Margin | 33% | 43% | (1,000 bps) | Collapse: The perfect storm hits profitability. |

| Profit After Tax (PAT) | ₹1,738 Cr | ₹1,944 Cr | -11% | The bottom-line consequence. |

The Analyst’s Decode: NMDC is selling more but earning less per unit. The 60% surge in Q3 operational expenses—likely from logistics, royalties, and input costs—has completely devoured benefits from record production. The margin contraction is not a blip; it’s a trend that demands scrutiny.

II. Future Growth Catalysts: What Could Reignite The Engine?

- Infrastructure-Led Demand Inelasticity: India’s CAPEX boom is non-negotiable. As the primary domestic supplier of iron ore, NMDC’s volumes are underpinned by national steel demand. Disruption risk is low.

- The Volume Leverage Play: If commodity prices stabilize or inch up, NMDC’s expanded production capacity (evident in 44% QoQ production jump) will act as a massive lever, translating directly to disproportionate profit growth.

- Subsidiary & Vertical Integration: Investments worth ~₹1,420 Cr in subsidiaries (like Nagarnar Steel Plant) aim to move the company up the value chain, potentially shielding it from raw material price volatility in the long run.

- Fortress Balance Sheet & Shareholding: With the Government of India holding 60.79% and LIC at 4.97%, the shareholder base is ultra-stable. The company remains virtually debt-free, providing a cushion during downturns and ammunition for investments.

Valuation and Financial Fortress: The Bull Case

Despite operational headwinds, NMDC’s foundational strengths are formidable and form the core of the investment thesis.

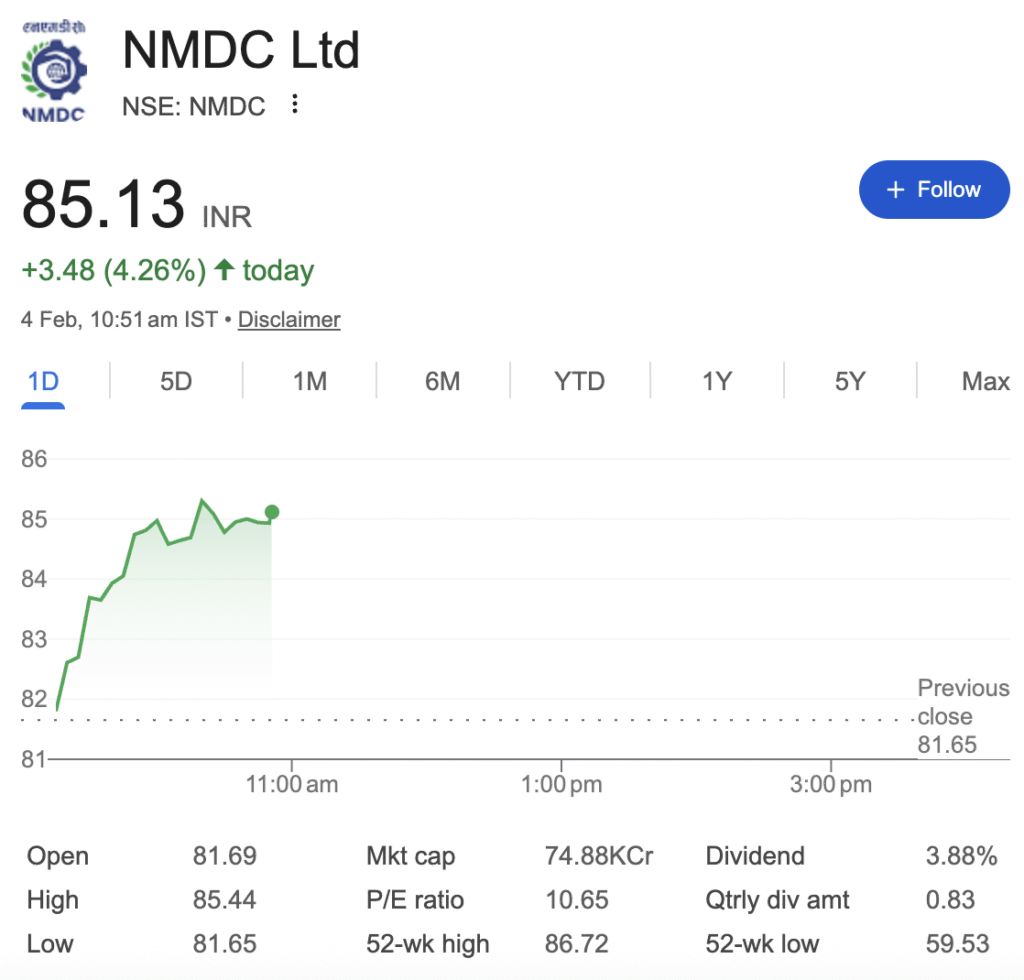

1. Compelling Valuation: Compared to its peers, NMDC trades at a significant discount. With a trailing Price-to-Earnings (P/E) ratio of around 10.4x, it sits well below diversified miners like Vedanta and integrated steel players. This discount may already price in current cyclical pressures, offering a margin of safety.

Table 2: NMDC vs. Key Mining Peers – Valuation & Returns

| Company | P/E Ratio (TTM) | Return on Equity (RoE) | Debt-to-Equity | Dividend Yield |

|---|---|---|---|---|

| NMDC | 10.40 | 23.08% | -0.21 | ~4.29% |

| Coal India | ~8.36 | ~39.06% | -0.22 | ~4.95% |

| Vedanta | ~16.4-27.6x | N/A | High | N/A |

2. Rock-Solid Balance Sheet: The company is virtually debt-free with a net debt-to-equity of -0.21, meaning it holds more cash than debt. This fortress balance sheet provides immense financial flexibility to fund growth, weather commodity cycles, and maintain shareholder payouts.

3. High Profitability Metrics: Despite margin pressure, NMDC’s core profitability remains strong. Its Return on Equity (RoE) of over 23% and average Return on Capital Employed (RoCE) of 43.13% are best-in-class, demonstrating exceptional capital efficiency.

Competitive Positioning & Moat

- Key Competitors: Vedanta (diversified resources), OMC (Odisha), and captive mines of steel players like TATA Steel.

- Market Share: Dominant merchant supplier of iron ore in India.

- Pricing Power: Limited. While it sets prices monthly, they are heavily influenced by global seaborne prices and domestic demand-supply.

- Entry Barriers: Very High. Obtaining new mining leases and environmental clearances (EC) is extremely difficult and time-consuming, protecting NMDC’s position.

- Switching Costs/Brand: Moderate. Steel mills have long-term contracts, but NMDC’s brand is synonymous with reliable, domestic supply.

- Scalability: The business is highly scalable, as seen in its ambitious expansion plan, leveraging existing expertise.

Growth Triggers & Future Outlook (2–3 Years)

8. Valuation Analysis

- Current Multiples: Trades at a TTM P/E of ~9.3x-11.4x, a significant discount to integrated steel players and diversified miners like Vedanta (~16.4-27.6x).

- Peer & Historical Comparison: The valuation is at a discount to its own historical averages and peers. The market is clearly pricing in the margin weakness and cyclicality.

- Cheap, Fair, or Expensive? Cheap on an absolute and relative basis, but for a reason (margin squeeze). It’s a “value trap” if margins don’t recover, and a “value opportunity” if they do.

- Valuation Justification: The low multiple reflects low growth expectations from the street. A successful demonstration of margin stabilization or progress in critical minerals could lead to a rating rerating.

9. Risk Factors

- Business & Financial: Complete dependence on iron ore; persistent cost inflation eroding margins; volatility in global iron ore prices.

- Industry: Slowdown in domestic steel demand; environmental, social, and governance (ESG) scrutiny on mining.

- Regulatory: Changes in royalty rates, export duties, or mining laws.

- Execution: Delays in capacity expansion or critical minerals projects; inability to control operational expenses.

10. Investment Thesis

- Bull Case (Why It Can Outperform): NMDC successfully controls costs, stabilizing EBITDA margins above 30%. Volume growth continues smoothly to 68 MT. The critical minerals subsidiary secures strategic assets, and the market begins to value this new growth vector. The stock could see a double boost from higher earnings and a higher P/E multiple, leading to significant outperformance. Brokerage Systematix sees a 16% upside (Target: ₹95) based on long-term growth.

- Bear Case (What Can Go Wrong): The margin squeeze continues or worsens, making volume growth meaningless for profits. Global iron ore prices enter a sustained downturn. Diversification efforts fail to materialize or burn cash. The stock remains stuck in its low valuation range.

- Key Monitorables for Investors: 1) Monthly Sales Volumes (track progress to 68 MT); 2) Quarterly EBITDA Margins (signs of cost control); 3) Updates on Critical Minerals (acquisitions, partnerships); 4) Domestic Iron Ore Price trends.

- Clear Conclusion: NMDC is at an inflection point. It possesses an unassailable market position, a fortress balance sheet, and a clear growth roadmap backed by national policy. However, it is grappling with severe near-term profitability challenges. The investment case rests on a bet that management will navigate this cost inflation cycle and that its long-term diversification will bear fruit. It is a high-risk, high-potential-reward play on India’s industrial and strategic minerals future, currently available at a discounted price due to well-understood temporary woes.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.