IRIS RegTech Secures Key International Contract: Is This ₹642 Cr Stock Your Next Big Bet?

IRIS RegTech Solutions Ltd (NSE: IRIS), formerly known as IRIS Business Services, has announced a strategic contract extension for its work with the South African Reserve Bank (SARB). While the company states the engagement is in the ordinary course of business with no disclosed material financial impact, the news spotlights the company’s growing footprint in the global RegTech space.

This development comes on the heels of a major corporate rebranding to “IRIS RegTech Solutions Limited” in November 2025, a move strongly endorsed by shareholders and signaling a sharpened focus on regulatory technology.

Financial Performance: A Story of Robust Growth

A bottom-up analysis of IRIS RegTech’s financials reveals a company in a strong growth phase, characterized by rapidly expanding revenue and profitability.

Balance Sheet Strength & Valuation Multiples

The company’s growth is underpinned by a fortified balance sheet, providing a solid foundation for future investments and operations.

Strategic Analysis: The Road Ahead

The recent contract extension with the SARB, executed through partner Xpert Decisions Systems, validates the company’s partnership-led model for international expansion. This strategy allows IRIS to leverage local expertise while deploying its core RegTech solutions, like the CODI deposit insurance platform, to prestigious central banking institutions.

Growth Drivers:

- Secular Tailwinds: The global regulatory landscape for financial institutions is becoming increasingly complex, driving demand for automated compliance (RegTech) and supervisory (SupTech) solutions.

- Diverse Portfolio: IRIS offers a suite of products across SupTech, RegTech, TaxTech, and DataTech, serving regulators, banks, and corporates across India, the Middle East, Africa, and beyond.

- Operational Efficiency: The company has significantly improved its working capital cycle, reducing requirements from 42.4 days to 13.0 days, freeing up cash for growth.

Risks and Considerations:

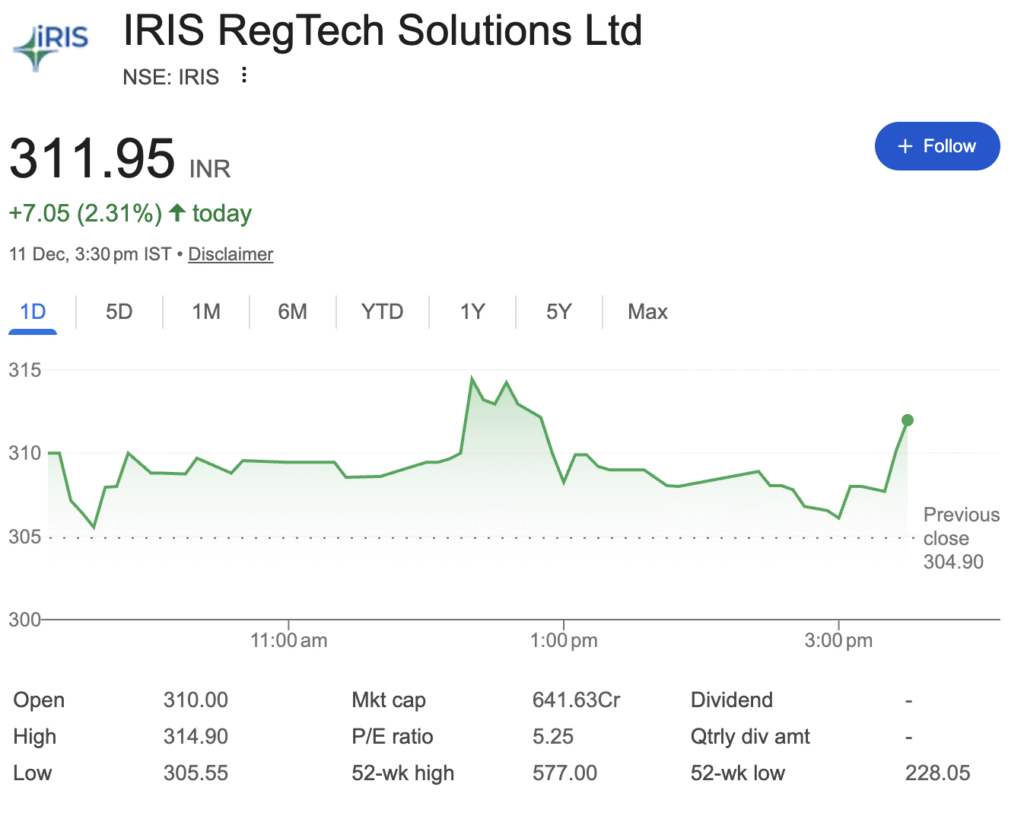

- Premium Valuation: The high P/E ratio suggests expectations are already elevated. Any slowdown in growth could pressure the stock price.

- Promoter Holding: Promoter holding is noted to be relatively low at 34.6% and has decreased over the last three years.

- Market Volatility: As a smaller player (market cap ~₹634 Cr), the stock can experience higher volatility, as evidenced by its 52-week range of ₹228.05 to ₹577.00.

Conclusion: A High-Growth RegTech Specialist

IRIS RegTech Solutions presents a compelling profile of a company capitalizing on a high-growth niche. Its financials show a remarkable trajectory of scaling revenue and exploding profitability, supported by a rock-solid, debt-free balance sheet.

The recent international contract extension and strategic rebranding reinforce its focused market positioning. However, the investment proposition is a classic case of “growth at a price.” The stock’s rich valuation already bakes in significant future success, making it more sensitive to any execution missteps or shifts in market sentiment.

For investors, the key will be monitoring the company’s ability to consistently win large international contracts, further improve margins, and justify its premium valuation with sustained earnings growth. The recent news is a positive step in that narrative.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice., We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.