Harshil Agrotech’s ₹113-Crore Order Bombshell: From Penny Stock ( ₹0.80) Peril to Agri Boom?

In the cutthroat world of BSE’s small-cap jungle, where fortunes flip faster than a Gujarat monsoon, Harshil Agrotech Ltd (BSE: 505336) just dropped a harvest-sized surprise. Barely 2 days ago—on September 26, to be precise—the 53-year-old Ahmedabad-based trader of grains and greens inked a ₹113-crore work order from an unrelated buyer, Heera Merchants. That’s wheat, potatoes, onions, hybrid tomatoes, fresh chillies, and a brinjal-capsicum cocktail, all to be delivered in 45 days via cold-chain logistics to Ahmedabad’s APMC hubs and warehouses. With 30% upfront payment and the rest on inspection, this isn’t pocket change—it’s a revenue rocket that could eclipse the company’s entire FY25 topline if executed flawlessly.

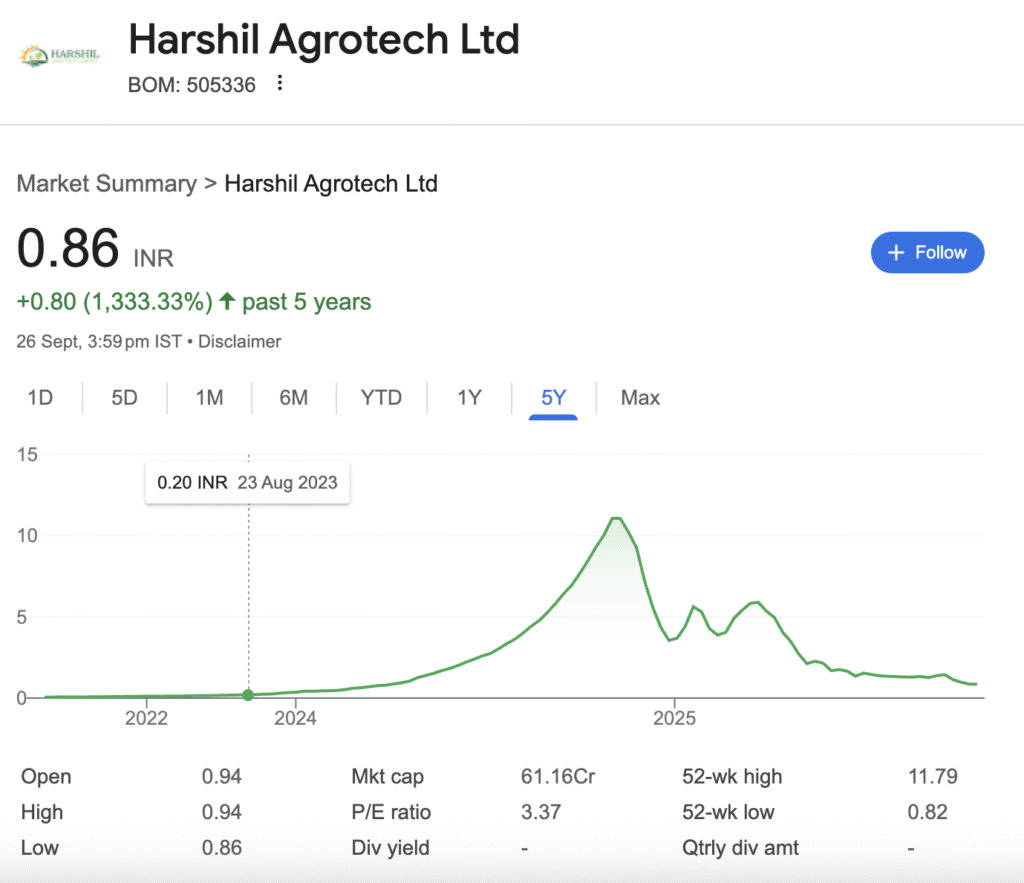

But here’s the curiosity kicker: Why now, and why has this stock, trading at a dirt-cheap 0.86 INR as of September 28 (3:30 PM IST), cratered 91.5% over the past year despite explosive sales growth? As a research analyst digging bottom-up—from dusty balance sheets to this fresh disclosure—I’ll unpack the finances, trace the wild price ride from 2023’s doldrums to December 2024’s dip, and weigh if this micro-cap (market cap: ₹61.16 crore) is a high-risk harvest or a hidden gem for bold investors.

The Price Rollercoaster: From 2023 Slump to 2024’s False Dawn and Fade

Harshil’s journey reads like a Bollywood plot twist. Incorporated in 1972 as Mirch Technologies (a dusty engineering play), it pivoted to agrotech trading in September 2023, rebranding amid a sector hungry for post-pandemic supply chain fixes. But the stock? A classic penny trap.

- 2023: The Awakening. Starting the year near 0.20 INR (its all-time low on August 23, 2023), shares stirred as FY23 revenue ticked up to ₹3.84 crore from ₹0.16 crore in FY22—a 2,300% surge on nascent agri trades. Net profit flipped to ₹0.54 crore from a ₹0.21 crore loss. Yet, liquidity was thin, volumes hovered under 1 lakh shares daily, and the stock meandered sideways, closing December 2023 around 0.25-0.30 INR. Investors yawned; no dividends, high debtors (267 days outstanding), and zero promoter holding (100% retail-owned) screamed “speculative sideshow.”

- Into 2024: Boom, Then Bust. The pivot paid off big. FY24 revenue exploded to ₹12.93 crore (236% YoY growth), with profit at ₹0.80 crore. Quarterly fireworks lit up: Q1 FY25 (June 2024) sales hit ₹11.37 crore (218% up), Q2 (September) ₹24.05 crore (737% surge), Q3 (December) ₹25.73 crore (714% jump). By mid-2024, the stock caught fire—peaking at 11.79 INR in what must’ve been a hype-fueled spike on name-change buzz and early results. But reality bit back. Thin free float, potential profit-booking, and broader small-cap jitters (Sensex small-caps down 20% in late 2024) triggered a freefall. By December 31, 2024, it had shed 85% from that high, closing near 1.50-2.00 INR amid Q3 profit warnings (a Q4 FY24 loss of ₹0.78 crore). Volumes spiked on bulk deals (e.g., 88.5 lakh shares at 1.09 INR in September 2025), but the stock bled to sub-1 INR levels—down 78% YoY by year-end.

What killed the momentum? Overhyped expectations met execution snags: Debtor days ballooned, no dividends despite profits, and a rights issue in March 2025 (20.32 crore shares at ₹2.43) diluted sentiment further. Result: A 52-week range of 0.20-11.79 INR, with September 2025 trading at 0.86-1.14 INR band—volatility incarnate.

Crunching the Numbers: A Financial Snapshot That Screams ‘Undervalued… Or Unstable?’

Bottom-up forensics reveal a company feasting on India’s ₹50-lakh-crore agri-trading pie, but with red flags waving like overripe tomatoes. Revenue has compounded at 150% CAGR since FY22, flipping chronic losses to ₹16 crore cumulative profits by mid-FY26. Yet, at a P/E of 3.37 (versus sector 15-20), it’s cheaper than Gujarat’s roadside chai. Market cap? A mere ₹61 crore—peanuts next to peers like Heritage Foods (₹3,000+ crore).

Here’s the fiscal deep-dive in crisp table form—sourced from BSE filings and audited results—for the investor eyeing specifics over fluff:

| Metric (₹ Crore, unless noted) | FY22 | FY23 | FY24 | FY25 (Est., based on Q1-Q3) | TTM (Sep 2025) | Notes |

|---|---|---|---|---|---|---|

| Revenue | 0.16 | 3.84 | 12.93 | 63.53 | 111.66 | 1,600% CAGR; Q3 FY26 at ₹25.73 (714% YoY) |

| Net Profit | -0.21 | 0.54 | 0.80 | 10.50 (proj.) | 16.00 | Breakeven to black; Q1 FY26 profit ₹6.53 (626% YoY) |

| EPS (₹) | -0.03 | 0.07 | 0.10 | 1.32 | 2.00 | Diluted post-rights issue |

| Total Assets | 2.50 | 3.98 | 22.58 | 45.00 (est.) | – | Debt-free; cash flow ops +₹8 Cr TTM |

| Debt/Equity | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | Zero leverage—rare in agri |

| ROE (%) | -8.4 | 13.6 | 3.5 | 23.4 (proj.) | 26.1 | Improving on scale |

| Debtor Days | 150 | 200 | 267 | 280 (est.) | 267 | Red flag: Collections lag sales |

| P/E Ratio | N/A | 3.57 | 10.00 | 3.37 | 3.37 | Dirt-cheap; sector avg 18x |

Sources: BSE filings, Screener.in, Moneycontrol. FY25 est. aggregates Q1-Q3 actuals (₹111 Cr rev) + flat Q4; projections conservative at 10% margins.

The tale? Hyper-growth from a low base—trading staples like wheat (India’s ₹2-lakh-crore staple) amid farm-to-fork supply crunches. But debtor drag (₹30 Cr outstanding) hints at execution risks, and zero dividends signal reinvestment over payouts.

The ₹113-Crore Catalyst: Speedrun to Scale in Just Seven Days?

Timing is everything in agri, where harvests rot if delayed. This Heera order—disclosed September 26, barely a week before today’s date—feels like a deliberate demo of Harshil’s pivot prowess. Valued pre-tax at ₹113 Cr (taxes extra), it’s for “operationally significant” supplies: 45-day tranche deliveries, 30% advance in 7 days, FSSAI-compliant quality checks, and Ahmedabad jurisdiction for disputes. No related-party ties, no promoter skin in the game—just pure, arm’s-length upside.

From an investor lens: This dwarfs FY25’s ₹63 Cr revenue, potentially juicing Q3/Q4 FY26 topline by 100-150% if fully realized. With cold-chain mandates and RTGS payments, margins could hit 12-15% (vs. current 10%). But risks lurk—liquidated damages for delays, rejection windows, and market volatility (onion prices swung 50% in 2025). Still, it’s a “within one week” masterstroke, signaling network strength in Gujarat’s APMC ecosystem. Expect board updates on execution; a September 23 meeting hinted at fundraising (QIP/preferential) to fuel this.

Investor Verdict: Dip-Buy Dare or Dead-End Drift?

Harshil Agrotech isn’t for the faint-hearted—it’s a 100% retail-owned wildcard in a sector where 70% of India’s ₹10-lakh-crore agri output rots pre-market. The bull case? Explosive scale (revenue 1,600% in three years), debt-free balance sheet, and this ₹113 Cr order as a near-term nitro boost. At 0.86 INR, it’s trading at 0.5x FY26 est. sales— a steal if execution clicks, potentially rerating to 3-5 INR (3-5x upside) on order fulfillment.

The bear traps? Chronic illiquidity (daily volumes <5 lakh shares), debtor overhang risking cash crunches, and promoter vacuum (0% stake) breeding governance whispers. Broader headwinds—erratic monsoons, 10% agri-GDP drag from El Niño echoes—could spoil the party.

Bottom line: Accumulate on dips below 0.80 INR for aggressive portfolios (5-10% allocation max). It’s a high-conviction bet on India’s agri-revival, but only if you’re in for the long haul—think 12-18 months to harvest returns. Conservative souls? Steer clear; stick to blue-chips. Harshil’s story? From seed to feast, but one bad tranche could wilt it all.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.