Geojit Financial: A 41% Crash is a Buying Opportunity or a Value Trap? Deep Dive.

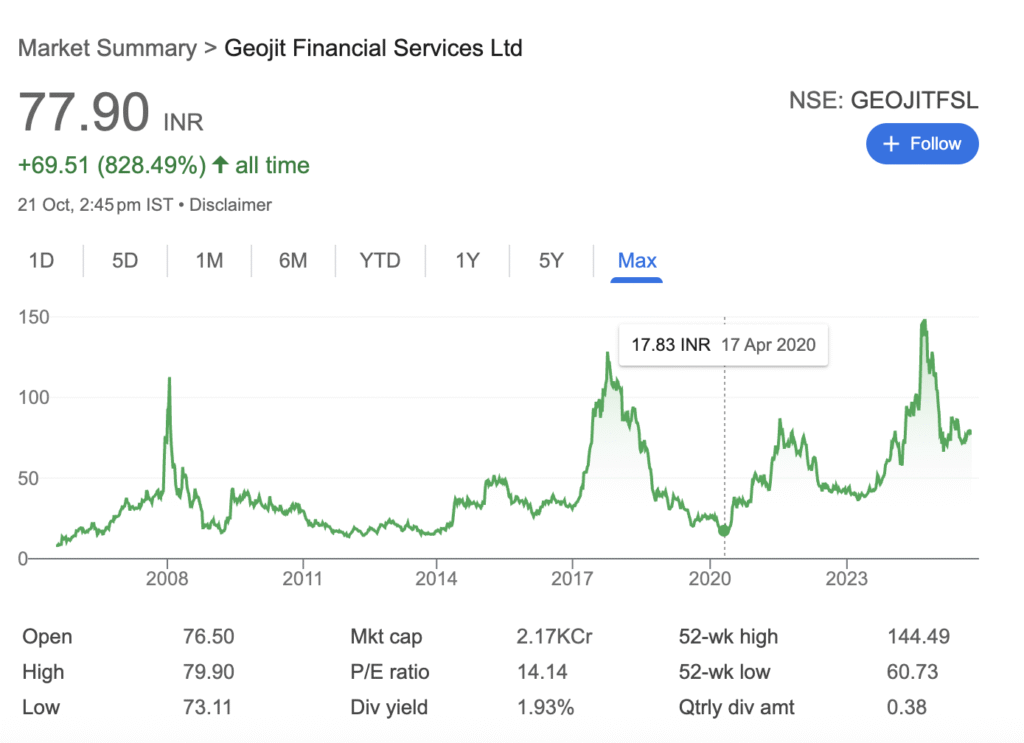

The blood is in the water. Geojit Financial Services (NSE: GEOJITFSL), a venerable name in Indian brokerage, has seen its stock plummet by approximately 41% over the past year, drastically underperforming the soaring broader markets. For investors, this presents a critical dilemma: is this a classic value investing opportunity to buy a solid company at a discount, or a falling knife signalling fundamental decay?

Our bottom-to-top investigation cuts through the noise to deliver a clear-eyed assessment. We dissect the financials, the growth drivers, and the stark realities to answer one burning question: Is Geojit a buy, sell, or hold?

1. The Financial Health Report Card: A Story of Two Tales

Beneath the surface-level panic lies a complex financial narrative. While the Profit & Loss statement shows visible scars, the balance sheet tells a story of remarkable resilience.

Table: The Financial Duality – P&L Pain vs. Balance Sheet Strength

| Metric | FY 2023 | FY 2024 | FY 2025 (Est.) | The Verdict |

|---|---|---|---|---|

| Revenue (₹ Cr.) | 438.81 | 614.13 | 749.00 | Strong Growth Trajectory |

| Net Profit (₹ Cr.) | 97.18 | 144.85 | 172.00 | Healthy Expansion |

| Q2 FY26 PAT (YoY Change) | – | – | -38.71% | 🚨 Major Red Flag |

| Debt-to-Equity Ratio | 0.11 | 0.42 | 0.10 | 🏆 Superb, Near-Zero Debt |

| Return on Equity (ROE) | 17% | 17% | 17% | 👍 Best-in-Class Consistency |

| Current Ratio | 1.92 | 1.52 | 6.12 | 💧 Exceptional Liquidity Cushion |

The Bottom Line: The company is fundamentally strong with a fortress-like balance sheet. The recent profit crash is a severe, but potentially temporary, earnings shock, not a balance sheet crisis.

2. The Growth Engine: Recurring Revenue Quietly Booming

While the market obsesses over quarterly brokerage income, a silent revolution is underway. Geojit has successfully pivoted to building predictable, high-quality revenue streams.

Table: The “Hidden” Growth: Recurring Revenue Assets (As of Sept 2025)

| Asset Class | Size (₹ Crore) | YoY Growth | Strategic Implication |

|---|---|---|---|

| Total Customer Assets | 1,09,947 | (Slight Decline from Jun ’25) | Massive Scale |

| Mutual Fund AUM | 15,800 | +6% | Steady, Predictable Fees |

| PMS AUM | 1,301 | +10% | High-Margin Business |

| SIP Book Value | 114 | +20% | Powerful Future Revenue Visibility |

The Bottom Line: The headline “Customer Assets” figure is masking robust growth in the right places. The 20% surge in the SIP book is a particularly powerful leading indicator of future stability.

3. Valuation & Peer Comparison: Deep Value or Value Trap?

This is where the investment thesis gets compelling. The brutal price correction has thrown Geojit into deep value territory.

Table: Is Geojit Dirt Cheap? Valuation Showdown

| Valuation Multiplier | Geojit Financial | Typical Industry Peer | Analysis |

|---|---|---|---|

| P/E Ratio (TTM) | 14.69 | 20-25 | Trading at a ~30% Discount |

| Price-to-Book (P/B) | 1.90 | 2.5-3.0 | Asset Backing Provides Safety |

| Dividend Yield | 1.93% | ~1.0-1.5% | You Get Paid to Wait |

The Bottom Line: The numbers scream “undervalued.” The critical question is whether the market is wrong or if it’s pricing in a further earnings decline.

4. The Final Verdict: To Invest or Not?

After a granular analysis, our recommendation is nuanced and time-horizon specific.

The Bull Case (Why it’s a BUY):

- Fortress Balance Sheet: With a Debt/Equity of 0.10, it can survive any market storm.

- Valuation Margin of Safety: A P/E of 14.7 for a company with a 17% ROE is statistically cheap.

- Recurring Revenue Shift: The growing AUM in MF and PMS insulates it from pure brokerage volatility.

- Strategic Presence: Deep roots in Tier II/III cities position it perfectly for India’s next investment wave.

The Bear Case (Why it’s a SELL/AVOID):

- Earnings Collapse: A near-40% drop in PAT cannot be ignored; it may indicate deeper operational issues.

- Brokerage Saturation: Intense competition from discount brokers continues to squeeze core business margins.

- Low Institutional Interest: Lack of analyst coverage creates a liquidity and visibility problem.

Your Investment Strategy:

| Your Profile | Our Recommendation | Rationale |

|---|---|---|

| Short-Term Trader (0-12 months) | AVOID / HOLD | Lack of immediate catalysts and earnings uncertainty could lead to sideways movement. |

| Long-Term Investor (3-5 Years) | ACCUMULATE | Buy in staggered amounts. Use market panic to build a position below ₹80. The long-term fundamentals and valuation are in your favor. |

Final Word: Geojit is not a quick-get-rich stock. It is a classic, fundamentally sound company facing a cyclical downturn. For investors with patience and a stomach for volatility, the current price offers a compelling entry point into a well-managed business with a strong legacy and a realistic path to recovery. The 41% crash has likely created more opportunity than peril.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.