DroneAcharya: From Battlefield Breakthroughs to Balance Sheet Blues – Is This Defence Drone Darling a Buy or a Trap?

Picture this: A swarm of 180 stealthy First-Person View (FPV) drones, zipping through high-altitude skirmishes, beaming real-time intel to Indian Army commanders – all built by a Pune-based startup that’s barely eight years old. Sounds like a scene from a Tom Clancy thriller, right? But it’s real, and it’s happening. DroneAcharya Aerial Innovations Ltd, India’s pioneering listed drone player, just clinched a ₹1.09 crore deal with the Ministry of Defence to supply these tactical beasts. Shares rocketed 15% on the news, hitting ₹60.3 intraday, as investors bet big on a defence tech renaissance.

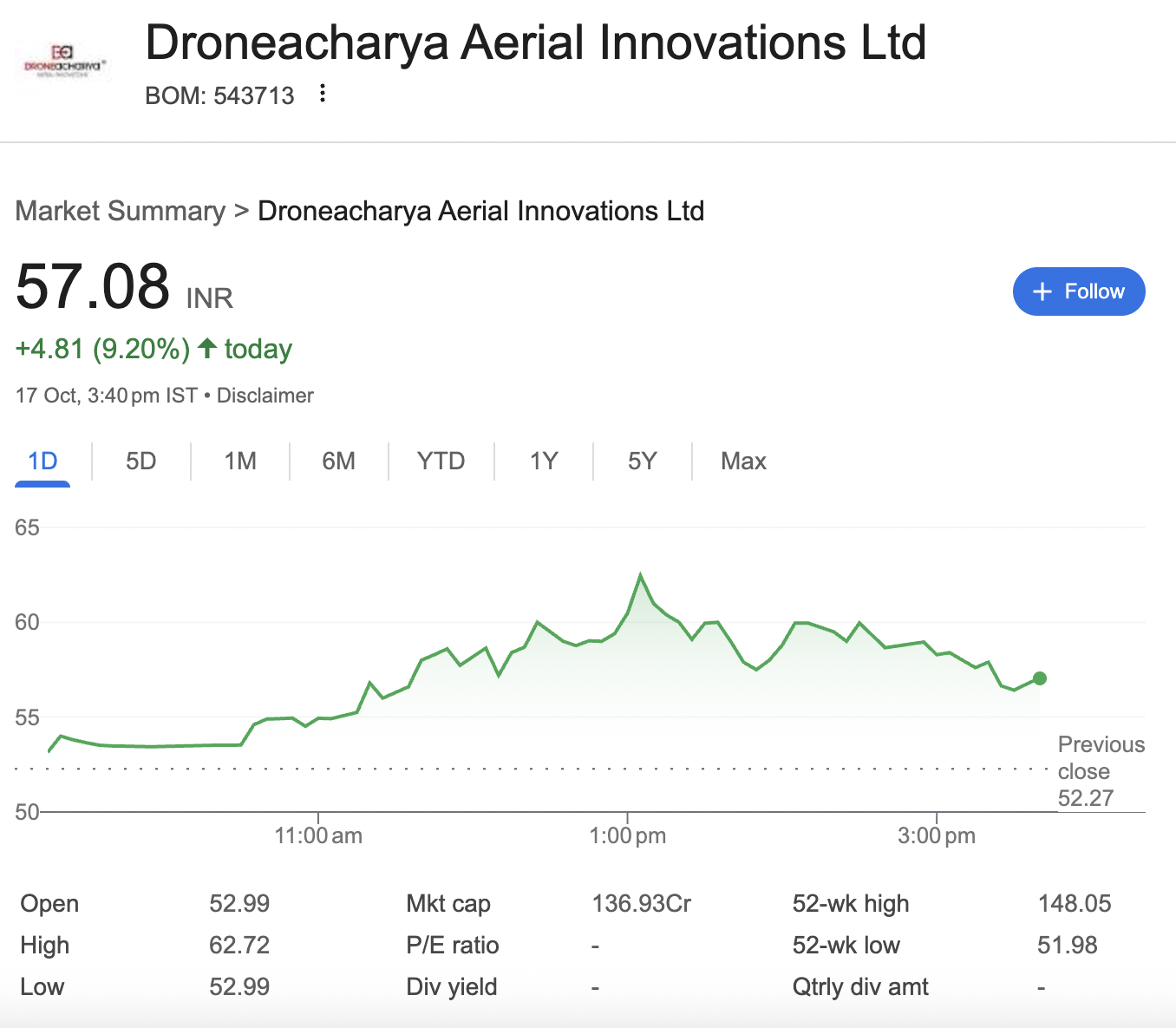

Yet, beneath the buzz, a nagging question lingers: Can this order – a mere 3% of last year’s revenue – pull DroneAcharya out of its financial nosedive? Or is it just another glint in a stock that’s shed 57% in the past year, trading at a bargain ₹59.70 with a market cap of ₹143 crore? As a research analyst dissecting BSE SME’s hidden gems, I’ve pored over filings, scoured order books, and crunched the numbers. Spoiler: The skies are clearing, but turbulence ahead demands a steady hand. Let’s unpack the flight path – from gritty defence wins to profitability pitfalls – and decide if this is your next multibagger or a ground-loop waiting to happen.

The Army’s Vote of Confidence: 180 Drones That Could Redefine DroneAcharya’s Destiny

In a move that’s got the defence corridors abuzz, DroneAcharya secured the FPV drone order on October 16, just as border tensions simmer. These aren’t your average quadcopters; FPV drones are precision-guided eyes in the sky, offering pilots an immersive cockpit view for surveillance, reconnaissance, and even kamikaze strikes. The contract mandates delivery in three tranches – 60 units by April 2026, another 60 by July, and the final batch by October – underscoring the Army’s urgency for homegrown tech amid global supply snarls.

This isn’t DroneAcharya’s first tango with the khaki. Back in July, they bagged a ₹99.67 lakh gig for an advanced Drone Lab setup for combat engineers, complete with high-performance UAV systems. Add in high-altitude trials of FPV and fibre-optic kamikaze drones with the Army, and it’s clear: Pune’s drone wizard is embedding itself in India’s $25,000 crore defence modernisation push. “This validates our manufacturing muscle,” says a company statement, hinting at phased indigenisation under ‘Make in India’.

For investors, it’s catnip. Social Media lit up with traders hailing it as a “strategic pivot” from training gigs to hardware-heavy hitting. But here’s the curiosity kicker: At ₹6,067 per drone (total ₹1.09 crore / 180), is this a loss-leader for bigger bites? Defence orders often snowball – think IdeaForge’s Heron-like trajectory post-Army nods. DroneAcharya’s export play (84% of FY25 revenue) could turbocharge if Uncle Sam or allies follow suit.

Financials Under the Microscope: Revenue Rockets, But Losses Linger Like Engine Smoke

Bottom-up research reveals a tale of two timelines. Founded in 2017 as a DGCA-certified training hub, DroneAcharya pivoted to full-stack solutions – training, manufacturing, mapping, and now defence – riding India’s drone boom. The sector’s exploding: From ₹14,000 crore in 2025 to a projected ₹40,000 crore by 2030, per JM Financial, with an 80% CAGR. DroneAcharya’s slice? A nimble 0.1-0.2%, but growing fangs.

Yet, FY25’s audited results (approved September 27) paint a stark picture: Revenue climbed 6% to ₹36.7 crore on export surges and domestic projects like a 350-km Bengaluru LiDAR mapping. But H2 tanked 47% to ₹7.62 crore, hammered by one-offs and capex burns. The real gut-punch? A ₹13.45 crore net loss – widened from ₹5.2 crore prior – thanks to R&D spends on space tech (reusable rockets, CubeSats) and a low interest coverage ratio screaming leverage risks.

Promoters hold a modest 28.2%, with FIIs circling (BofA scooped a stake in 2023). Cash burn eased – investing activities dropped 95% YoY to ₹1.54 crore – but employee costs gnaw 15% of ops revenue. Valuation? P/B at 2.51x (vs. peers’ 5.85x) screams undervalued, but negative earnings make P/E a non-starter.

For a scroll-stopping snapshot, here’s the fiscal heartbeat:

| Key Metric | FY25 (₹ Cr) | FY24 (₹ Cr) | YoY Change | Investor Takeaway |

|---|---|---|---|---|

| Revenue | 36.7 | 34.5 | +6% | Steady climb, but H2 dip flags execution hiccups. Exports (84%) are the jet fuel. |

| EBITDA | -8.2 | -3.1 | -165% | Margin erosion from R&D; needs 20%+ ops leverage for breakeven. |

| Net Profit/Loss | -13.45 | -5.2 | -159% | Losses ballooned on capex; Q1 FY26 profit of ₹1.51 Cr hints at inflection? |

| Cash from Ops | 2.1 | 4.8 | -56% | Liquidity squeeze; ₹1.54 Cr investing drop aids, but debt coverage thin. |

| Market Cap / P/B | 143 / 2.51x | 335 / 5.2x | -57% | Dirt-cheap vs. peers (Zen Tech at 8x); 52-wk low ₹58 tests floor. |

| Order Book (Recent) | 1.09 (Army) + 0.997 (Lab) | N/A | +100% QoQ | Defence pipeline ~3% of rev; scalability key to 50% topline jump. |

Source: Company filings, BSE data as of Oct 18, 2025. Consolidated figures unless standalone noted.

Future Skies: Tailwinds Galore, But Will the Engines Ignite?

Zoom out, and the runway looks endless. India’s drone policy – liberalised airspace, PLI schemes worth ₹120 crore – is catapaulting startups like DroneAcharya into the big leagues. Mergers on the horizon (they eyed AITMC Ventures for a mainboard leap) and global tie-ups (MoU with R V Connex) scream ambition. Add SEBI’s nod for SME-to-mainboard migration, and valuations could double on listing.

From an investor’s lens: Bull case? Defence orders cascade to ₹100+ crore pipeline by FY27, flipping losses to 10% PAT margins as scale kicks in. Bear case? If H2 slumps persist, or regulatory probes (ongoing SEBI enquiry) bite, it’s back to training-treadmill days. Social Media chatter’s bullish – “Infosys of drones!” quips one trader – but volatility’s a beast (beta 1.8).

Verdict: Invest? A Calculated Yes – But Strap In for the Ride

As your analyst’s crystal ball: Buy DroneAcharya for the long haul if you’re a defence devotee with a 2-3 year horizon. At sub-₹60, it’s a speculative steal – target ₹120 (2x upside) on order execution and sector tailwinds. Allocate 2-5% portfolio; diversify with peers like IdeaForge or Paras Defence. But skip if you’re risk-averse; losses and low promoter skin (28%) scream caution.

The Army’s 180-drone nod isn’t just ink on paper – it’s a battle cry for DroneAcharya’s resurgence. In a world where drones rewrite warfare, this underdog could soar. Question is: Are you piloting the cockpit, or watching from the tarmac?

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.