Chemkart India Ltd: From Warehouse to Wealth – Can This Nutraceutical Stock Be Your Next Multi-Bagger?

When Chemkart India Ltd listed on the BSE SME platform in 2025, not many expected a supplier of amino acids and nutraceutical ingredients to turn into a high-margin, high-growth story. Today, the company is not only powering India’s booming ₹6.3 lakh crore health revolution but also eyeing global expansion with its greenfield manufacturing facility at JNPT SEZ.

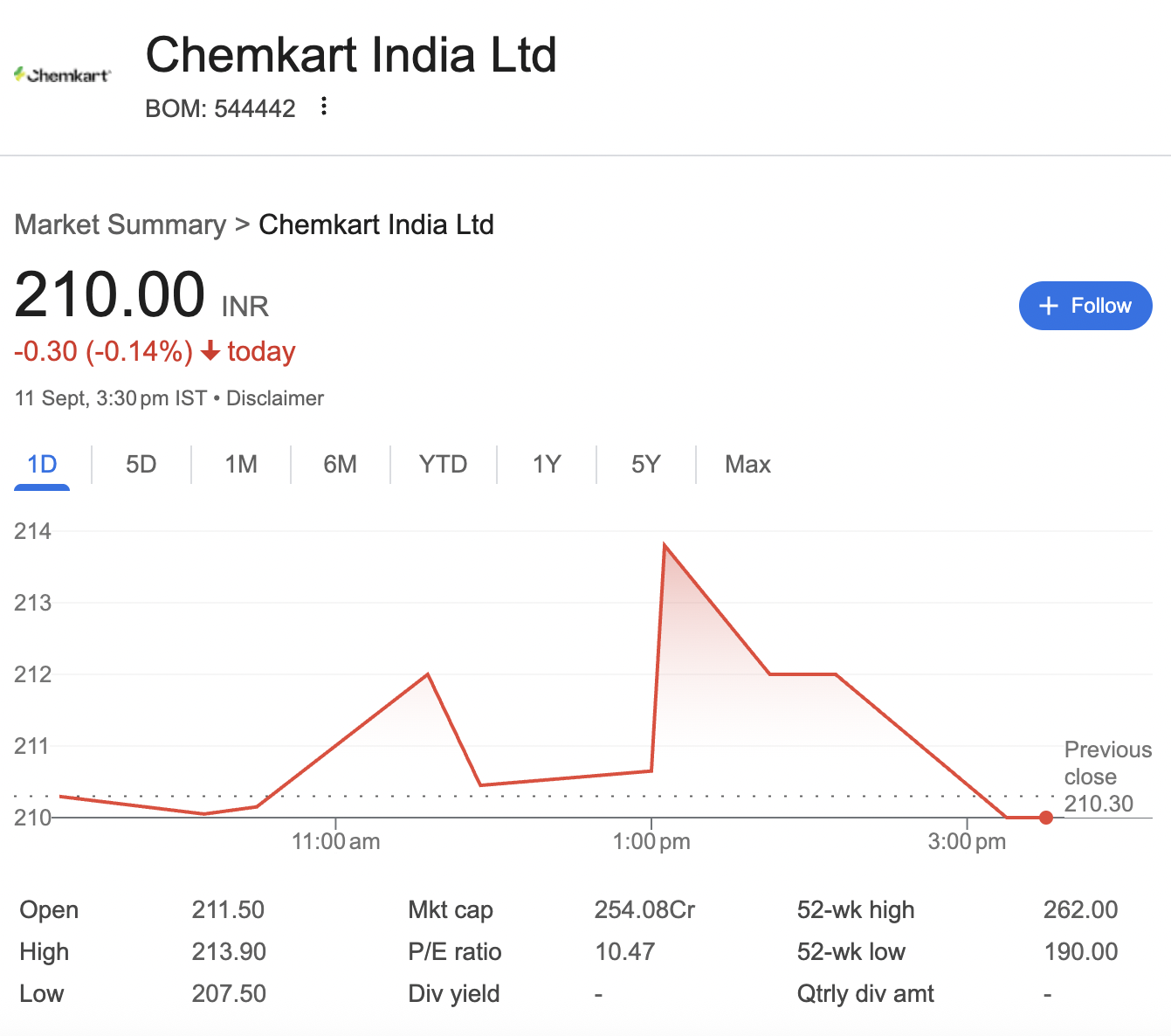

But the big question for investors is: Is Chemkart still a buy after its IPO dream run? Let’s decode.

📊 Chemkart at a Glance (FY25)

| Metric | FY23 | FY24 | FY25 | 3-Year CAGR |

|---|---|---|---|---|

| Revenue (₹ Lacs) | 13,138 | 13,203 | 20,328 | +24% |

| EBITDA (₹ Lacs) | 1,105 | 2,091 | 3,276 | +67% |

| PAT (₹ Lacs) | 766 | 1,452 | 2,426 | +64% |

| EBITDA Margin | 8.4% | 15.8% | 16.1% | Expanding |

| PAT Margin | 5.8% | 11.0% | 11.9% | Improving |

| ROE | 52.8% | 50.0% | 45.4% | Industry-beating |

| ROCE | 43.0% | 51.2% | 48.9% | Strong Efficiency |

| EPS (₹) | 15.28 | 25.54 | – | Rising Fast |

Source: Company Investor Presentation, Sept 2025

🏢 Company & IPO Story

- Founded: 2015 as a proprietorship, later incorporated in 2020.

- Business: B2B supplier of raw ingredients for nutritional, sports & health supplements.

- IPO & Listing: Listed on BSE SME Platform in 2025. IPO was well-received due to its high-growth nutraceutical theme. Post-listing, the stock gained traction as revenues and margins surged.

- Subsidiaries: Easy Raw Materials Pvt Ltd & Vinstar Biotech Pvt Ltd.

🚀 Growth Drivers

- Health Revolution: India’s nutraceutical market to touch $76B by 2033, growing at 10% CAGR.

- Global Expansion: New SEZ manufacturing unit (operational FY27) will enable exports, cutting costs and boosting margins.

- China+1 Strategy: Diversification into microencapsulation & liposomal delivery makes Chemkart a differentiated player.

- Strong Margins: EBITDA margins expanded to 16%, signalling pricing power.

⚖️ Risks to Watch

- Heavy dependence on the B2B supply chain.

- Execution risk in the upcoming greenfield facility.

- High working capital requirements (inventories + receivables).

💡 Analyst View – Should You Invest?

Chemkart has all the elements of a potential mid-cap multibagger –

✔️ Rising health awareness in India.

✔️ Strong financial growth with 3-year PAT CAGR of 64%.

✔️ Attractive return ratios (ROE ~45%, ROCE ~49%).

✔️ Global expansion potential with its SEZ facility.

However, it’s still a young listed company with SME liquidity risks. For long-term investors, especially those eyeing exposure to the booming nutraceutical sector, Chemkart India Ltd looks like a high-risk, high-reward bet.

📌 My Call: ACCUMULATE on dips for long-term wealth creation.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is solely for educational purposes, so please build your knowledge with us and use your strategy for investment.