Brahmaputra Infrastructure Stock Soars 10% After Bagging ₹46.6 Crore Railway Contract

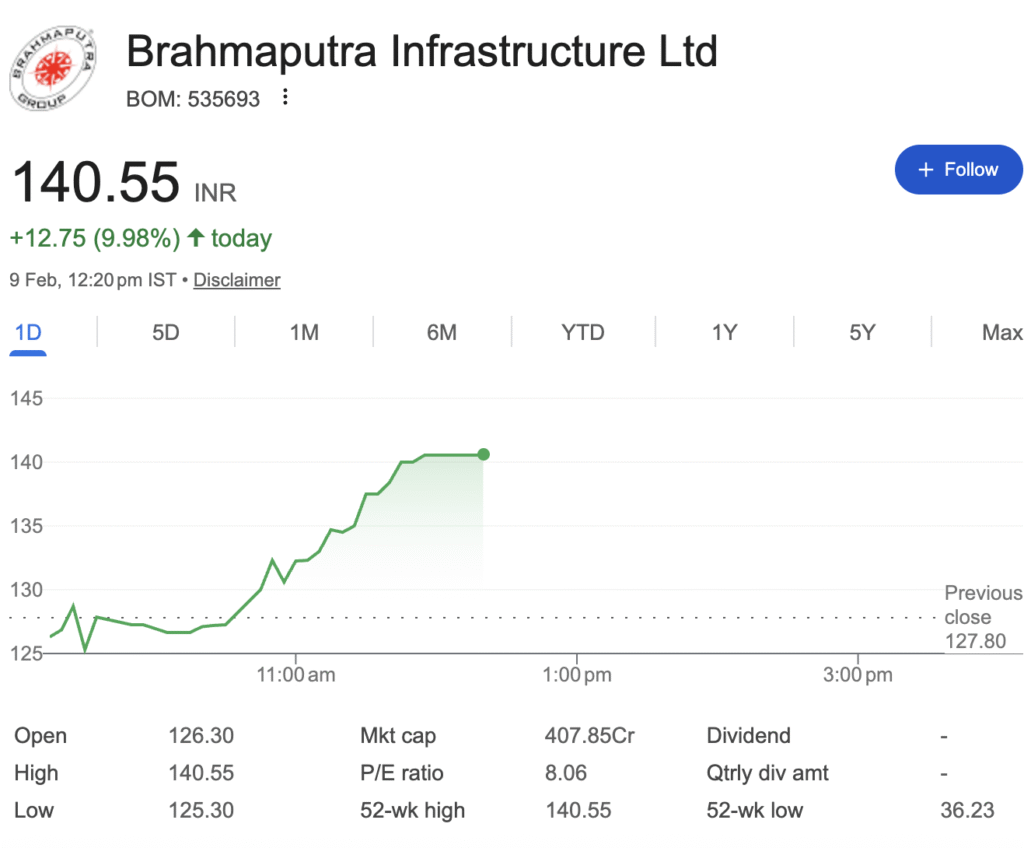

A quiet revolution is unfolding in the small-cap infrastructure space. Brahmaputra Infrastructure Limited (BSE: 535693), once a relatively obscure player, has seen its stock price rocket by over 146% in the past year and surge nearly 10% today alone. This staggering run, catapulting the stock from a 52-week low of ₹36.23 to a high of ₹140.55, demands more than a passing glance. Is this a speculative bubble or the beginning of a fundamental re-rating story? Our bottom-to-top analysis separates the signal from the noise.

The Spark: A Flurry of Strategic Wins

The immediate catalyst for today’s surge is a Letter of Award (LoA) worth ₹46.62 crore from the Northeast Frontier Railway to construct a Road Over Bridge. This is not an isolated event but part of a powerful, consistent narrative.

In a remarkable display of business development momentum, the company has secured over ₹290 crore in new orders in just the first five weeks of 2026. This spree includes a ₹113.54 crore contract for a new Legislature Complex in Jammu and a ₹62.03 crore joint venture project for riverbank protection in Assam. These wins, predominantly from government bodies, signal robust demand and execution capability in critical infrastructure segments.

Decoding the Financial Metamorphosis

While new orders fuel future growth, the stock’s vertiginous rise is fundamentally anchored in a dramatic financial turnaround. The following table distills the key metrics that reveal a company in the midst of a powerful transformation.

The Bull vs. Bear Thesis: A Balanced Perspective

The Bull Case: Why the Rally Could Have Legs

- Government Capex Tailwind: The company is a direct beneficiary of India’s massive infrastructure push, particularly in the Northeast, winning contracts from railways, PWD, and water resources. The order book is swelling, providing multi-year revenue visibility.

- Deep Undervaluation: Even after the massive run-up, the single-digit P/E ratio suggests the market is skeptical about sustainability. If the company delivers consistent quarterly earnings, a significant valuation re-rating is inevitable.

- Operational Excellence: The stellar net profit margin indicates not just top-line growth but quality earnings, a crucial differentiator in the low-margin construction world.

The Bear Case: Risks Lurking Beneath the Surface

- Execution is Key: Infrastructure is fraught with risks—cost overruns, delays, and commodity price volatility. The credit risk profile, while improving, remains elevated (B2 rating), and any project slippage could hurt sentiment.

- Small-Cap Volatility: With a market cap of ~₹407 crore, this is not a stock for the faint-hearted. It exhibits higher volatility and lower liquidity compared to large-caps.

- Limited Institutional Coverage: The stock has zero analyst coverage. This means the investment thesis relies heavily on investor due diligence and company disclosures, increasing the risk of information asymmetry.

The Analyst’s Verdict: A High-Potential, High-Vigilance Play

Brahmaputra Infrastructure presents a classic high-risk, high-reward proposition.

- For the Aggressive Investor: This is a compelling story of a turnaround play catching a structural growth wave. The combination of a strong order pipeline, exploding profitability, and a deeply discounted valuation creates a potent mix. It warrants a speculative allocation in a high-risk portfolio, with the understanding that volatility will be a constant companion.

- For the Conservative Investor: Steer clear. The lack of long-term earnings visibility, small-cap risks, and sector-specific headwinds make it unsuitable for a conservative portfolio focused on capital preservation and steady dividends.

The Final Word: Brahmaputra Infrastructure is no longer flying under the radar. It has demonstrated an exceptional ability to win contracts and convert them into profits. The next critical phase is consistent execution and balance sheet strengthening. Investors betting on this story are ultimately betting on India’s infrastructure dream and this company’s niche execution prowess within it. The easy money from the initial turnaround may have been made; the future returns will depend entirely on delivered results.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy. Investors are advised to conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.