BLS E-Services Acquires Atyati Technologies in ₹154 Crore Deal, Shares Jump

In a move that signals a significant strategic realignment, BLS E-Services Ltd (NSE: BLSE) has fired a warning shot across the bow of the financial inclusion space. At a board meeting that concluded at noon today, the company greenlit the 100% acquisition of Bengaluru-based fintech Atyati Technologies for a cool ₹154 crore in cash.

Simultaneously, the board has proposed a drastic change in how it utilizes its IPO proceeds, kicking off a process that will culminate in an EGM on March 16. This isn’t just a routine acquisition; it is a capital allocation event that will define the company’s trajectory for the next decade.

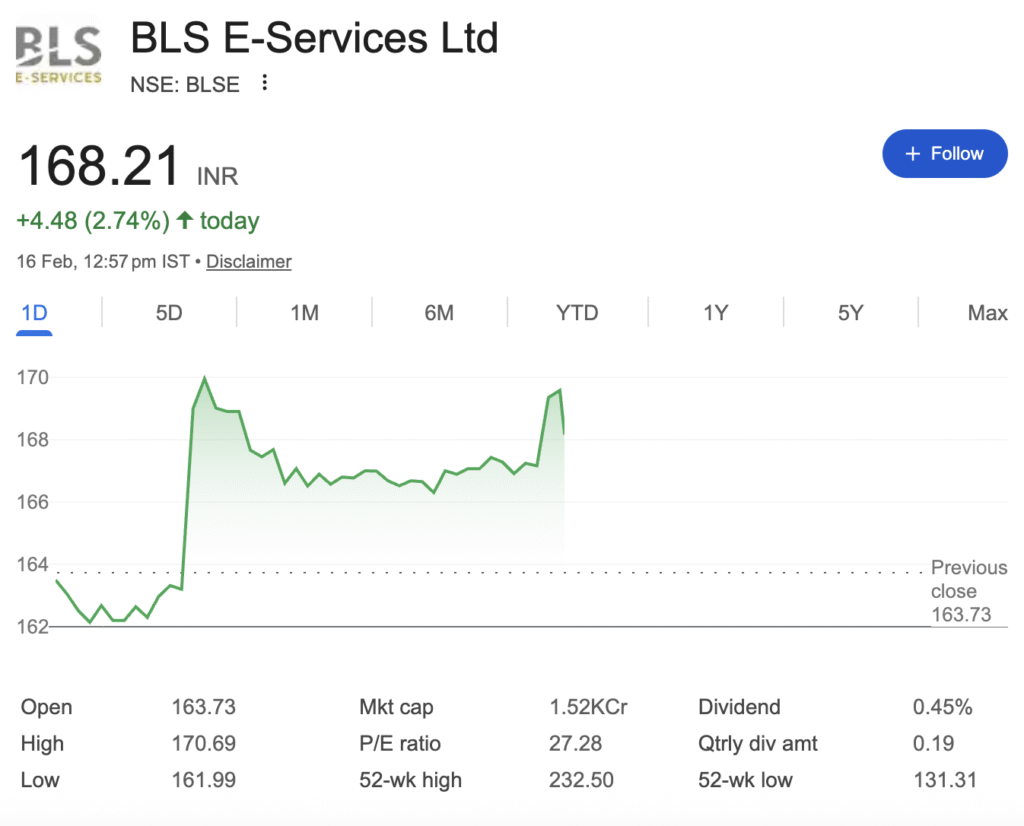

With the stock trading at ₹167.14, up 2.08% on the day, we dive deep into the balance sheet, the deal math, and the grassroots reality to answer the only question that matters: Should we buy, hold, or get out of the way?

The Deal Tape: What BLS is Actually Buying

Before looking at the valuation, let’s strip down the target. Atyati Technologies isn’t a small kirana store aggregator; it’s a serious operational giant with deep tech roots.

Snapshot of Atyati Technologies Pvt. Ltd.

| Metric | Value (FY25) |

|---|---|

| Revenue from Operations | ₹395.6 Crore |

| Paid-up Capital | ₹11.42 Crore |

| Founded | 2006 |

| Geographic Reach | 1 Lakh+ Villages |

| Core Business | BC Services, Micro-Lending, Tech Solutions |

Source: Company Exchange Filings

The Strategic Logic

At first glance, this looks like a consolidation play. BLS is already a giant in the Business Correspondent (BC) space. However, the devil is in the details—and the price.

- The “Micro-Lending” Edge: Atyati brings a significant micro-lending portfolio to the table. For BLS, which currently generates revenue primarily through assisted e-services and transaction flows, adding a direct lending book (even if off-balance sheet) diversifies the revenue stream from pure fee-based income to high-margin financial intermediation.

- Tech Synergy: Atyati has a robust tech stack for last-mile connectivity. BLS has been aggressively investing in AI-led analytics; integrating Atyati’s backend could accelerate the “BLS Sewa” platform vision.

The Financial Health Check: A Blow-Out Q3

To understand if BLS can digest this acquisition, we must look at the state of its own finances. The recently concluded December quarter (Q3 FY26) was a blockbuster in terms of topline, but margins tell a nuanced story.

BLS E-Services: Quarterly Performance

| Metric | Q3 FY26 | Q3 FY25 | YoY Change |

|---|---|---|---|

| Revenue from Ops | ₹280.7 Cr | ₹133.1 Cr | ▲ +119.9% |

| Total Income | ₹286.7 Cr | ₹133.1 Cr | ▲ +115.5% |

| EBITDA | ₹22.7 Cr | N/A | ▲ +7.0% |

| PAT (Profit After Tax) | ₹15.2 Cr | ₹14.0 Cr | ▲ +8.7% |

| BC GTV | ₹27,000 Cr | ₹21,000 Cr | ▲ +28.5% |

| Loan Leads Generated | ₹9,700 Cr | ₹2,900 Cr | ▲ +234% |

Source: BW Businessworld, Company Data

The Analyst’s Take on the Numbers:

The top-line growth (119%) is staggering, driven by the consolidation of Aadifidelis and organic network expansion. However, the profit growth (8.7%) is lagging significantly behind revenue growth.

Why? Margin Compression.

- Gross margins have been sliding. Looking at the trailing twelve months (TTM), margins have compressed from the high teens to single digits.

- The company is spending heavily to acquire reach. They now operate over 1,51,000 touchpoints. This asset-heavy expansion is eating into bottom-line gains in the short term.

The Balance Sheet Fortress

Despite operational pressures, the financial foundation remains rock-solid.

Key Financial Metrics (as of February 2026)

| Metric | Value |

|---|---|

| Market Capitalization | ₹1,508 – 1,522 Cr |

| P/E Ratio (TTM) | 26.95x – 27.21x |

| Industry P/E | 27.21x – 29.77x |

| P/B Ratio | 2.9x – 3.23x |

| Debt-to-Equity | 0 (Zero long-term debt) |

| Return on Equity | 11.17% – 12.9% |

| Return on Capital Employed | 44.82% (latest) |

| Book Value per Share | ₹53.13 – ₹57.2 |

| EPS (TTM) | ₹6.2 – ₹6.47 |

The zero-debt balance sheet with ₹185.32 crore of unutilized IPO proceeds provides extraordinary flexibility. Operating cash flow of ₹67 crore in FY25 (up from ₹19 crore in FY24) confirms the underlying business generates real money.

The EGM Twist: Shareholders Get a Vote

On March 16, 2026, shareholders will vote on a “Change and Variation in the Objects of Utilisation of the IPO Proceeds” . Translation: the money raised for Technology Upgrades and Organic Expansion is now funding the Atyati acquisition.

This is standard corporate practice—but it signals that management sees buying existing infrastructure as superior to building it. The ₹185.32 crore war chest gives them firepower, but investors must decide whether this capital allocation choice optimizes long-term returns.

Valuation: Fair Price or Bubble?

Fair Value Estimates

| Source | Fair Value | Date |

|---|---|---|

| Simply Wall St (DCF) | ₹153 | January 2026 |

| Current Market Price | ₹167.14 | February 16, 2026 |

| 52-Week Range | ₹131.31 – ₹232.50 |

The stock trades at 26.95x earnings—almost exactly in line with the industry average of 27.21x . This is a dramatic compression from its peak P/E of 72.10x in April 2024 . The market has already priced in significant margin pressure.

The Verdict: Buy, Hold, or Exit?

The Bull Case:

- Scale advantages—1.51 lakh touchpoints plus Atyati’s 1 lakh villages creates India’s largest financial inclusion network

- Loan leads exploded—₹9,700 crore in Q3 FY26, up 234% YoY . Conversion even at 1% would transform earnings

- Zero debt provides acquisition firepower and downside protection

- ROCE of 44.82% confirms capital efficiency despite margin pressures

The Bear Case:

- Margins are melting—5.94% operating margin cannot sustain premium valuation

- Acquisition target plateaued—Atyati’s FY25 revenue growth was just 1.5%

- IPO objective change signals original organic growth plan wasn’t viable

- Integration risk—digesting Aadifidelis while adding Atyati stretches management bandwidth

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Investors are advised to conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.