BHEL Secures Landmark ₹1,500 Crore Order from Hindalco, Stock Climbs Over 1%: Is India’s PSU Power Giant Gearing Up for a Fresh Growth Cycle?

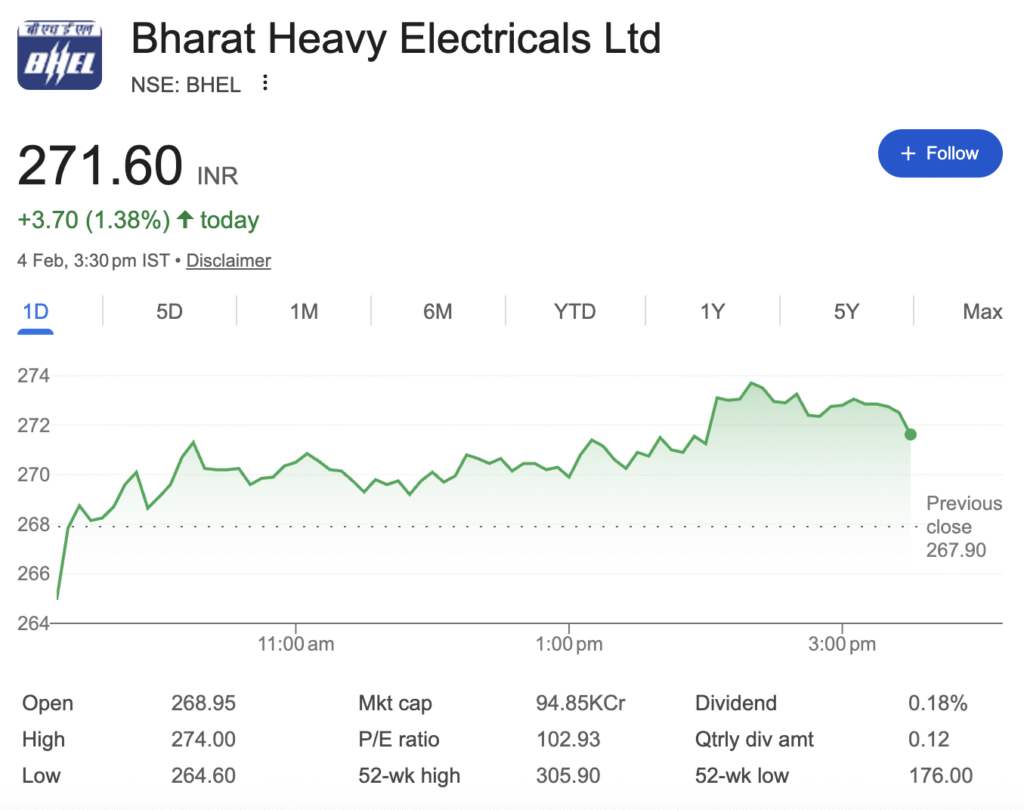

Mumbai, February 4, 2026 – In a significant boost to India’s capital goods and power sector, state-owned engineering giant Bharat Heavy Electricals Limited (BHEL) has secured a massive Letter of Intent (LOI) from Hindalco Industries Limited, marking one of the largest domestic orders for the company in recent quarters. The announcement sent BHEL’s shares upward, closing at ₹271.60 on the NSE, up 1.38% for the day.

The Deal at a Glance

BHEL has been entrusted with the design, engineering, manufacture, supply, installation, and commissioning of a 2 x 150 MW Boiler-Turbine-Generator (BTG) package for the Aditya Aluminium Expansion Project – Phase II in Lapanga, Sambalpur, Odisha. The order, valued between ₹1,200 to ₹1,500 crore (excluding GST), is entirely domestic and underscores the growing investment in India’s industrial and energy infrastructure.

The project timeline is set at 35 months for the first unit and 37 months for the second, commencing from the date of the LOI, which was issued on February 3, 2026.

Market Reaction and Analyst Views

The news broke during trading hours, reflecting immediately in BHEL’s stock performance. The scrip saw sustained buying interest, touching an intraday high of ₹274 before settling near the day’s peak. Market experts view this order as a strong positive signal for BHEL, which has been focusing on securing large engineering, procurement, and construction (EPC) contracts to strengthen its order book.

This win is the latest in a series of large order inflows that have swelled BHEL’s order book to ₹1.95 lakh crore as of FY25–26, providing multi‑year revenue visibility. For investors, the question is whether the stock, still trading about 11% below its 52‑week high of ₹305.85, is poised for a sustained re‑rating.

Financial Turnaround in Progress

After several years of stress, BHEL’s financials are showing green shoots:

- Q3 FY25‑26 revenue stood at ₹8,473 crore, with net profit of ₹382 crore – a 189.7% year‑on‑year jump.

- Operating margins have improved sequentially, aided by better execution and cost control.

- Debt levels have been stable, with the company focusing on working‑capital efficiency.

Nevertheless, the elevated P/E ratio (~120) reflects still‑low earnings; the key is whether the massive order book can convert into sustained profit growth.

3. Growth Catalysts

- Power‑Sector Expansion: India’s planned addition of 80‑100 GW of thermal capacity by 2030, along with hydro and nuclear projects, directly benefits BHEL.

- Diversification: BHEL is actively pursuing orders in railways (Vande Bharat sets, signalling), defence (artillery guns, naval systems), and clean‑energy equipment (green hydrogen, battery storage).

- Government Support: As a Maharatna PSU, BHEL is a key instrument of India’s “Make in India” and “Atmanirbhar Bharat” initiatives, often receiving nomination‑based orders in strategic sectors.

4. Risks to Monitor

- Execution Delays: Large projects often face land, environmental or logistical hurdles that can stretch timelines and squeeze margins.

- Competition: Private players (L&T, Thermax) and Chinese suppliers are aggressive in bidding.

- Debt & Working Capital: High receivables and inventory cycles can strain liquidity.

- Valuation: The current P/E is rich relative to historical averages; any earnings disappointment could trigger a correction.

🎯 Bottom Line

BHEL is no longer a struggling PSU; it is a turnaround story backed by a ₹1.95‑lakh‑crore order book and a improving profit trajectory. The Hindalco order is a fresh catalyst that underscores the company’s competitive strength in the power‑equipment space. While execution risks remain, the risk‑reward balance is tilted in favour of investors with a 2‑3 year horizon.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.