Blue Cloud Softech Soars 20% After Announcing $1 Billion AI Data Center Mega-Plan: AI Infrastructure Dream or Dilution Trap?

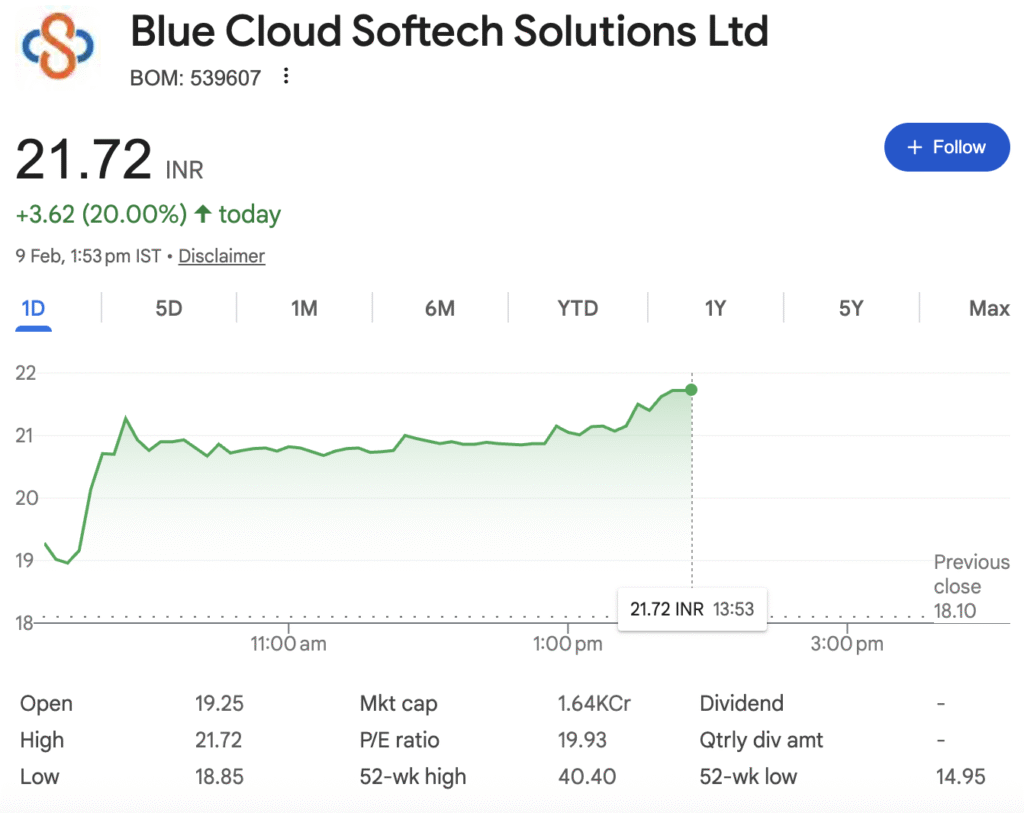

Hyderabad, February 9, 2026 – Shares of Blue Cloud Softech Solutions Ltd (BSE: 539607) skyrocketed 20% to hit the day’s upper circuit at ₹21.72 in afternoon trade, following a blockbuster announcement that has sent ripples through the tech and infrastructure sectors. The company has unveiled a strategic plan to invest up to US $1 Billion to build a next-generation, AI-powered data center business across India.

The Billion-Dollar Bet on India’s AI Future

In a regulatory filing to the BSE, the Hyderabad-based AI and cybersecurity solutions provider laid out a visionary roadmap. The capital will be deployed in phases to construct a nationwide platform of AI-native data centers, targeting a massive 800 MW of total capacity. This move positions Blue Cloud Softech to potentially become one of India’s largest and most technologically advanced digital infrastructure players.

“This long-term investment plan underscores our unwavering commitment to developing intelligent, sovereign, and future-ready digital infrastructure for India,” said Mrs. Janaki Yarlagadda, Chairman of the Company.

Beyond Real Estate: A Tech-First Infrastructure Model

The company’s strategy is a direct challenge to conventional data centers. Instead of being mere “power-and-space” landlords, Blue Cloud is betting on a deep-tech differentiator:

- AI-Ochestrated Operations: Using real-time AI for predictive maintenance, energy optimisation, and fault isolation to slash downtime.

- High-Density Compute: Supporting next-gen GPU/TPU racks with power densities of 80-120 kW—dwarfing the Indian industry average of 8-15 kW—catering directly to intensive AI and HPC workloads.

- Sovereign-by-Design: Building fully isolated, jurisdiction-bound data environments with “zero-trust” cybersecurity, specifically for defence, space, and strategic government institutions.

- Sustainable Tech: Implementing liquid immersion cooling and AI-managed thermal systems to achieve industry-leading power efficiency.

Market Scope: From Flipkart’s Festive Sales to DRDO’s Labs

The target market outlined in the release is exceptionally broad and strategically layered:

- Enterprise & E-commerce: Scalable cloud and AI infrastructure for large corporates, MSMEs, and to handle peak traffic for major e-commerce platforms.

- Sovereign & Strategic: Air-gapped, secure facilities for Defence R&D, Indian Space Research, and strategic Public Sector Undertakings (PSUs).

- Research & Academia: High-Performance Computing (HPC) environments for national AI research centres, universities, and semiconductor design.

Financial Health Snapshot: Explosive Growth from a Tiny Base

A bottom-up analysis reveals a company on a stellar growth trajectory in its core business, but from a very small base, which magnifies the risk of the new venture.

The Growth Story:

The company’s financials show a period of hyper-growth. Its asset base ballooned from ₹13.79 crore in March 2023 to ₹232.12 crore in March 2025. Profitability metrics are outstanding, with a Return on Equity (ROE) of 44.5% and a Return on Capital Employed (ROCE) of 37.1%, indicating highly efficient use of capital.

Key Financial Metrics Analysis:

The Funding Conundrum:

With a market cap of ~₹1,600 Cr, the $1B plan cannot be funded internally. Success hinges on the company’s ability to secure strategic equity partnerships, substantial debt financing based on anchor tenant commitments, and potential government subsidies.

Valuation and Market Performance: A Story of Two Extremes

The market’s reaction to the news was violently positive, with the stock hitting a 20% upper circuit at ₹21.72. However, this masks significant volatility and a stretched valuation.

- Recent Performance: While the stock jumped 17-20% on the announcement, it is still down ~47% over the past year from its 52-week high of ₹40.40. It has been a long-term multi-bagger, delivering 328% returns over 5 years.

- Current Valuation: The stock trades at a demanding P/E ratio of 30.9. Analysis from MarketsMOJO notes the valuation has shifted from “fair” to “expensive,” with a P/E of 28.55 and a high price-to-book value, suggesting much of the near-term growth is already priced in.

- Lack of Analyst Coverage: Notably, the company has no analyst coverage for earnings projections, which is rare and adds to the uncertainty in modeling its future.

Investment Thesis: Bull vs. Bear

The Bull Case (Reasons to Invest):

- First-Mover in a Strategic Niche: Capturing the “sovereign AI cloud” segment for defense and space could create a defensible, high-margin moat.

- Proven Execution in Core Business: Exceptional ROE/ROCE and profit growth demonstrate strong management capability.

- Structural Tailwinds: Perfect alignment with India’s national AI, semiconductor, and digital sovereignty initiatives.

- High-Reward Potential: Successful execution of even a part of the plan could lead to a complete re-rating and multi-bagger returns from current levels.

The Bear Case (Risks to Consider):

- Execution Risk of Colossal Scale: The company is leaping from IT services to mega-infrastructure, a different business with massive complexity.

- Funding Risk: The $1B plan is 5x its market cap. Unclear funding could lead to heavy shareholder dilution or unsustainable debt.

- Valuation Risk: At ~31 P/E, the stock is expensive, leaving little margin for error.

- Fierce Competition: It will compete with deep-pocketed giants (Adani, Reliance, Tata) and established global data center operators.

Verdict and Investor Guidance

Should you invest in Blue Cloud Softech?

Blue Cloud Softech is no longer just a stock; it is a high-risk call option on India’s sovereign AI infrastructure dream. The 20% surge celebrates the promise, but the coming quarters will test the reality.

- For Aggressive, High-Risk Portfolios: A small, tactical allocation could be justified. The upside is substantial if the company secures anchor tenants and funding. Monitor closely for announcements on strategic partnerships, land acquisition, and government contracts.

- For Conservative and Most Investors: Exercise extreme caution or avoid. The risk profile is extreme. The stock is likely to be highly volatile. Prudent investors should wait for concrete evidence of the plan’s feasibility—specifically, financial closure for Phase 1 and binding contracts with large clients.

Bottom Line: The ambition is breathtaking, and the growth story compelling, but the valuation is rich and the execution mountain is enormous. Investors must have a high-risk appetite and a long-term horizon to consider this bet.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy. Investors are advised to conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.