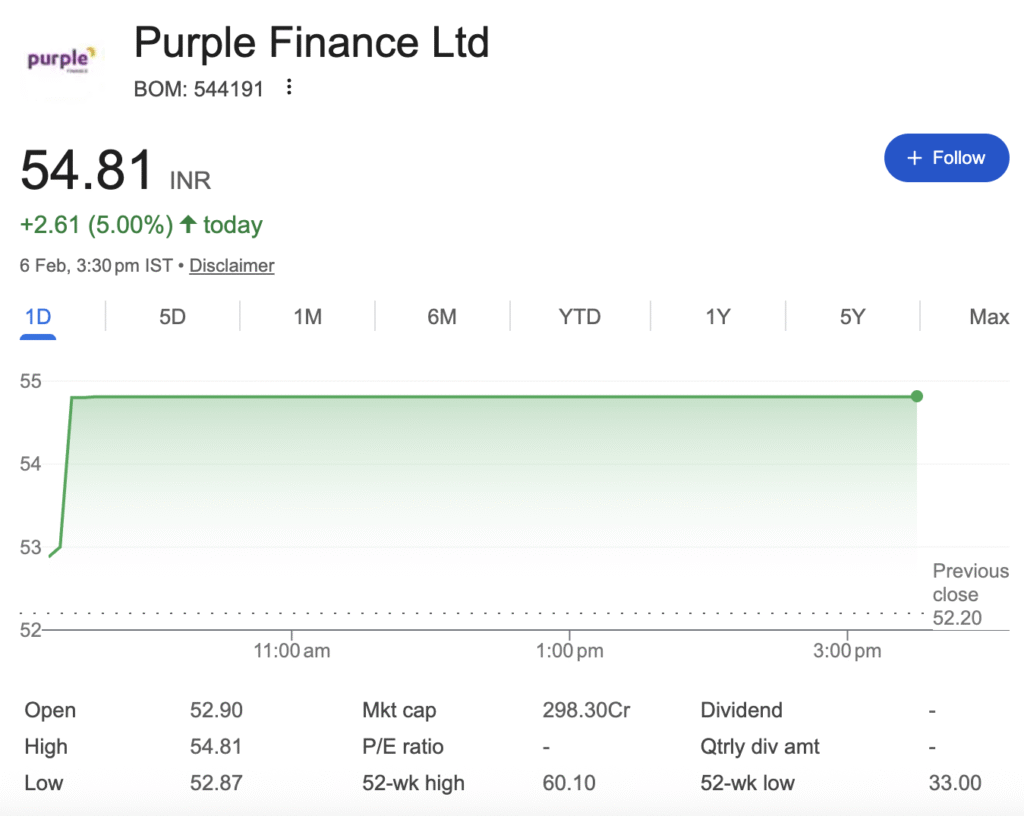

Purple Finance Soars 5% After Board Approves ₹69 Cr Equity Raise via Warrants – Is This 298 Cr Microcap NBFC Worth the Risk?

Mumbai, February 7, 2026 – In the bustling world of microcap stocks, Purple Finance Limited (BOM: 544191) is scripting a narrative that’s hard to ignore. The non-banking financial company (NBFC), which became publicly listed through a reverse merger just two years ago, has seen its stock surge 5% following the board’s approval to raise another ₹69.3 crore through equity warrants. This marks the fourth significant capital infusion in 16 months, painting a picture of a company in aggressive expansion mode. But beneath the surface of branch openings and soaring Assets Under Management (AUM) lies a critical question for investors: is this the groundwork for a future lending powerhouse, or a capital-intensive gamble in a notoriously tough sector?

The company’s ambition is clear. It targets a massive, underserved market: micro and small entrepreneurs in India’s tier II, III, and IV towns, offering secured business loans between ₹3-30 lakhs. By avoiding crowded metro markets, Purple Finance bets on a “high-tech, high-touch” model, promising loan decisions within five hours by blending digital processes with on-ground relationship managers.

The Bull Case: Tapping a Goldmine Others Fear

Purple Finance’s strategy is a study in contrarian focus. While larger lenders crowd metropolitan markets, Purple has carved a niche in Tier II, III, and IV towns, serving micro-entrepreneurs with annual turnovers under ₹40 lakh. Its offering is a single, streamlined product: secured business loans against property, with an average ticket size of ₹6-7 lakh, significantly lower than traditional housing finance companies.

The “High-Tech, High-Touch” Model: The company leverages a hybrid model combining digital efficiency with local intelligence. Its proprietary technology platform promises loan decisions within five hours using video-based income assessments and Aadhaar-based verification, while a network of relationship managers provides on-ground validation. This focus has yielded exceptional asset quality, with Gross Non-Performing Assets (NPAs) reportedly below 1%, a remarkable feat in this segment.

Explosive Growth Trajectory: The operational metrics reveal a company scaling at breakneck speed, fueled by capital.

- Assets Under Management (AUM): Tripled to ₹163 crore by September 2025 and reported at ~₹210 crore in January 2026.

- Branch Network: Expanded to 45 branches across multiple states.

- Capital Raises: Has raised nearly ₹192 crore in phases since October 2024 to fuel this expansion.

The ambition is clear. Founder and Executive Chairman Amitabh Chaturvedi, a veteran with over three decades in banking, has set a target of ₹500 crore AUM by FY2027 and envisions transforming Purple Finance into a Small Finance Bank (SFB) by 2028. This long-term vision of building a lasting institution in a market with an estimated ₹85 trillion MSME credit gap forms the core of the bullish thesis.

The Bear Case: A Foundation Built on Red Ink

However, a deep dive into the financial statements reveals significant causes for concern. The company is, by all standard profitability measures, deeply loss-making.

Persistent Financial Losses and Poor Returns:

High Costs and Stretched Valuation: The company’s cost structure is alarming. In the year ending March 2025, it spent 146.5% of its operating revenues on employee costs and 38.94% on interest expenses. Furthermore, the stock trades at 3.84 times its book value, a premium valuation that is difficult to justify for a company that is not profitable. This combination led MarketsMojo to assign a ‘Sell’ rating, citing “below average quality” and “risky valuation”.

The Funding Conundrum and Reverse Merger Intrigue

Purple Finance’s path to the public markets was unconventional. It achieved listing not through a traditional IPO but via a reverse merger with Canopy Finance Limited in March 2024. While this route offered speed and cost benefits, it often carries a stigma of bypassing rigorous public scrutiny. The company’s lifecycle since has been defined by a constant need for capital, raising funds through rights issues and warrants to feed its growth. This raises the risk of continued dilution for existing shareholders.

Investment Verdict: A High-Risk Speculation, Not for the Faint-Hearted

Purple Finance presents a classic high-risk, high-potential microcap dilemma.

Who Might Consider It? Only investors with a very high-risk appetite, a long-term horizon of 5+ years, and the mindset that this is a venture-capital-style bet on execution. It should be, at most, a satellite holding in a well-diversified portfolio. The belief must be that the company’s focused model will achieve operational leverage, turning its massive revenue growth into sustained profitability as the loan book matures.

Who Should Avoid It? Conservative investors, those seeking dividends or stable returns, and anyone uncomfortable with financial losses and dilution. The lack of analyst coverage and a proven multi-year profit track record means investors are largely on their own.

The Bottom Line

Purple Finance is attempting to build a formidable lending institution in one of India’s most promising yet challenging markets. The ambition is grand, the target market vast, and the early operational metrics on growth and asset quality are impressive. However, the financial foundations are currently weak, shrouded in red ink and reliant on continuous capital infusion.

For now, the scales tip towards caution. The company must demonstrate a clear and rapid path to profitability, moving beyond top-line growth to deliver bottom-line results. Until then, for most investors, it may be prudent to watch this ambitious story unfold from the sidelines, waiting for the financials to convincingly catch up with the narrative.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy. Investors are advised to conduct their own independent research and consult with a qualified financial advisor before making any investment decisions.