Concord Control Systems Soars 3.74% After Bagging Major ₹185 Cr Indian Railways Contract

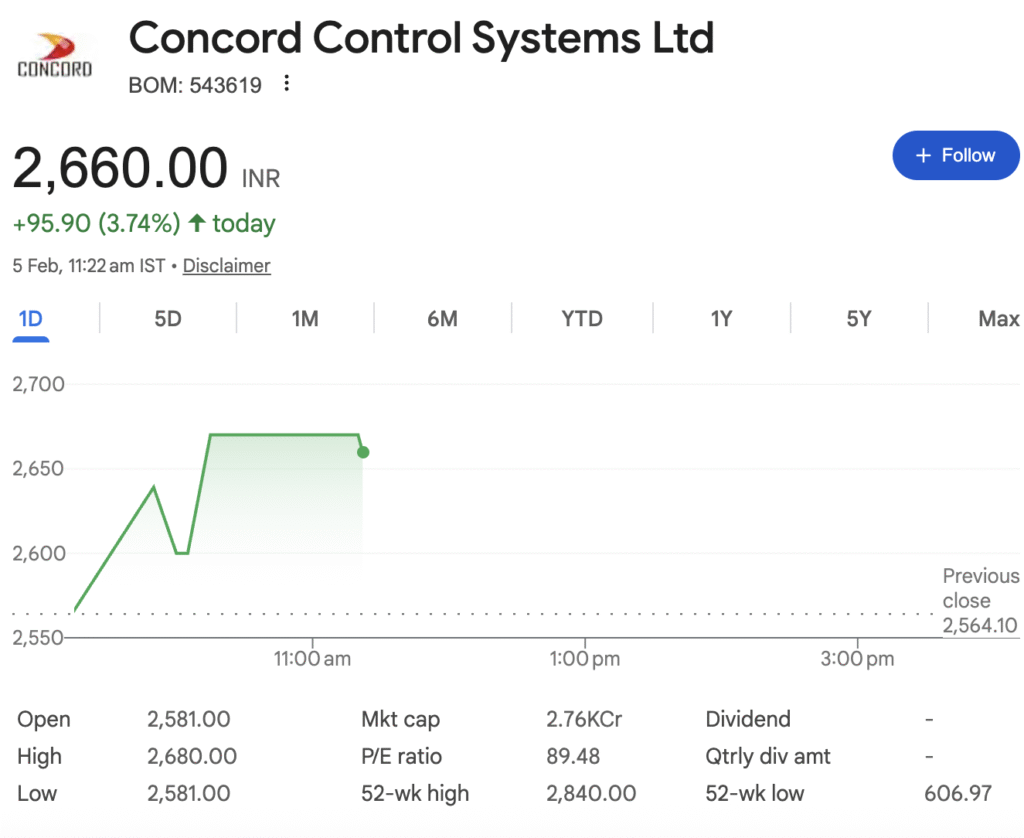

Concord Control Systems Ltd (BOM: 543619) witnessed a sharp surge of nearly 4% in early trading today, following the company’s announcement of a significant new order from Indian Railways.

The stock price jumped to an intraday high of ₹2,680, adding ₹95.90 to its value and breaching the ₹2,660 mark. This bullish momentum comes on the back of a major regulatory filing disclosed to the BSE.

The Catalytic Order: KAVACH 4.0

In an exchange filing dated February 5, 2025, Concord Control Systems Limited informed the markets that it has secured a substantial order worth ₹185.09 Crores through its associate company, Progota India Private Limited.

Key Details of the Contract:

- Awarding Entity: Indian Railways

- Nature of Order: Supply, installation, testing, and commissioning of On-board KAVACH 4.0 Loco equipment.

- Execution Timeline: The order is to be executed within 12 months.

- Transaction Type: The company clarified this is not a related party transaction and is conducted at arm’s length.

KAVACH, meaning “armor,” is the indigenously developed Train Collision Avoidance System (TCAS) for Indian Railways. An order for its next-generation 4.0 version represents a strategic and high-value technological contract in a critical national infrastructure sector.

Market Reaction & Financial Snapshot

The market’s response was immediate and positive. The stock, which opened at ₹2,581.00, quickly climbed, reflecting investor confidence in the order’s potential to boost future revenue and profitability.

At a Glance (as of 11:22 AM IST):

- Current Price: ₹2,660.00

- Day’s Gain: +95.90 (3.74%)

- Market Cap: Approx. ₹2,760 Crores

- 52-Week Range: ₹606.97 – ₹2,840.00

- P/E Ratio: 89.48

The company’s share price has seen a meteoric rise over the past year, trading significantly higher than its 52-week low of ₹606.97. The current Price-to-Earnings (P/E) ratio of 89.48 indicates high growth expectations are already priced in by the market.

Analyst Insights: Growth Trajectory vs. Valuation Concerns

“This order is a strong validation of Concord Control’s technological capabilities and its positioning within the railways’ modernization ecosystem,” commented a senior equity research analyst. “A near-₹200 crore order, executable within a year, provides excellent revenue visibility and could significantly impact FY26 financials.”

However, analysts also strike a note of caution. “While the order win is unequivocally positive, investors must be mindful of the elevated valuations,” the analyst added. “The stock trades at a steep P/E, implying flawless execution and sustained future order flow. Any delays in execution or a slowdown in order book accretion could lead to volatility.”

Looking Ahead

The successful execution of this KAVACH 4.0 order could pave the way for Concord Control Systems to secure more contracts from Indian Railways and other rail networks, both domestically and potentially internationally. It solidifies the company’s role in India’s push for transportation safety and automation.

Investors should note: The company has clarified that the order was awarded to its associate, Progota India Private Limited. While stated as an arm’s length transaction, such structures require monitoring for transparency and seamless value accretion to the listed entity.

The stock’s movement for the rest of the day and week will be closely watched as the market digests this news and evaluates its long-term impact on the company’s fundamentals.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.