AXISCADES Surges 5% on Major U.S. Contract Wins Worth $1.4 Million: Is This High-Flyer Still a Buy?

Mumbai, February 4, 2026 – AXISCADES Technologies Limited (NSE: AXISCADES, BSE: 532395) witnessed a sharp uptick in its share price on Wednesday, climbing nearly 5% after the company announced that its subsidiary, Mistral Solutions Private Limited, has secured significant international contracts from two U.S.-based firms.

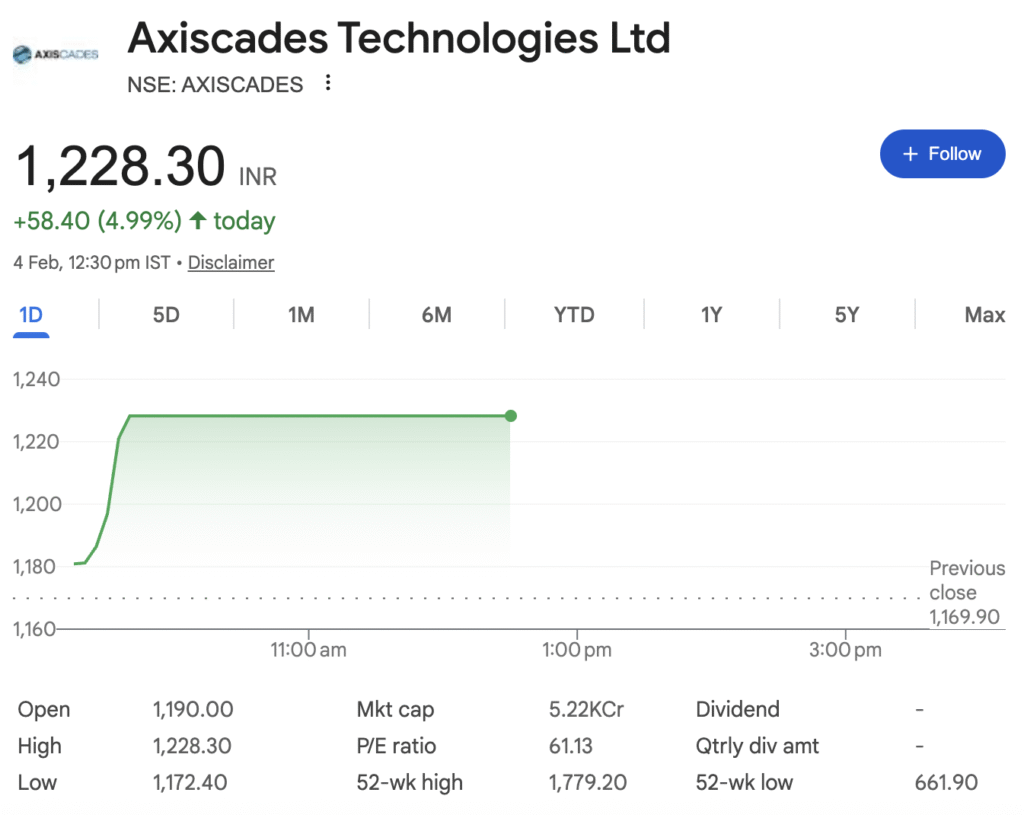

The stock is at ₹1,228.30, up ₹58.40 (+4.99%), reflecting strong investor confidence following the regulatory disclosure.

The Deal: Global Recognition for Indian Engineering

In a filing to the stock exchanges, AXISCADES disclosed that Mistral Solutions has been awarded design, development, and production contracts by Axon Enterprise Inc. and Stratacache Inc., both prominent technology entities based in the United States.

The contracts, categorized as “Development and Production” in nature, are valued at approximately USD 1.4 million (around ₹11.7 crore) and are slated for execution over a period exceeding one year.

Why This Matters

- International Validation: The awards from established U.S. corporations underscore the global competitiveness and technical prowess of AXISCADES’ engineering and design capabilities, particularly in the aerospace, defense, and advanced technology sectors where the group has a strong footprint.

- Revenue Visibility: A multi-year contract provides clear revenue visibility and contributes to the order book stability of the company’s subsidiary, potentially leading to improved financial performance in the coming quarters.

- Non-Related Party Transaction: The company clarified that the contracts do not constitute a related party transaction and are conducted on an arm’s length basis, ensuring transparency and fair market value.

Company Snapshot: The Engineering Solutions Specialist

AXISCADES is a Bangalore-based technology solutions company with a global footprint across the US, Europe, and Asia-Pacific. It operates as a critical partner in high-stakes engineering, offering product design, development, and lifecycle management services. Its expertise spans embedded electronics, avionics, drone systems, and AI-enabled solutions for the aerospace, defense, automotive, and semiconductor industries.

Financial Health & Valuation: A Story of Two Narratives

A deep dive into the company’s financials reveals robust growth but at a premium price. The table below summarizes key metrics for investor assessment:

While the growth metrics are compelling, the valuation presents a stark contrast. AXISCADES is currently trading at a Price-to-Earnings (P/E) multiple of approximately 59x. This is nearly double the median industry P/E of 32.09x for top IT software peers and far above its own 5-year median P/E in the low 20s.

Analysts at Smart Investing estimate the stock’s intrinsic value may be closer to ₹334.76, based on historical valuation models, suggesting the current price carries a substantial premium.

Growth Prospects & Market Position

The company’s future hinges on capitalizing on global trends in defense modernization, aerospace innovation, and smart automotive technologies. The latest $1.4 million contract from U.S. firms like Axon Enterprise validates its ability to compete internationally. Analysts note its offerings in AI for robotics and autonomous systems position it well for future growth.

The Technical Conundrum: Bullish Momentum vs. Bearish Warnings

The stock chart is sending mixed signals:

- The Bull Case: The stock recently hit its upper circuit limit on strong buying pressure, rebounding from a short-term downtrend and showcasing solid momentum. Its long-term performance is undeniable, with returns of over 2,100% in the past five years, massively outperforming the Sensex.

- The Bear Case: A critical technical red flag has emerged. The stock has formed a “Death Cross,” where its 50-day moving average has fallen below its 200-day moving average. This is traditionally viewed as a signal for a potential shift to a medium-term bearish trend. The stock is also trading below all its key moving averages (20, 50, 100, 200-day), indicating prevailing weakness.

Investment Verdict: High Risk, High Reward?

From a research analyst’s perspective, AXISCADES presents a classic high-risk, high-reward proposition.

Arguments FOR Investment:

- Demonstrated Growth Engine: A proven track record of strong profit growth (21.3% 5-yr CAGR) and revenue expansion.

- Solid Financial Foundation: A clean balance sheet with low debt and good return metrics.

- Operating in “Sweet Spot” Sectors: Core expertise aligns with high-growth, government-prioritized sectors like defense and aerospace.

- Global Contract Wins: Demonstrated ability to secure international business, as evidenced by the recent announcement.

Arguments FOR Caution:

- Extreme Valuation Risk: Trading at a P/E ~59x, which prices in near-perfect execution for years to come. Any earnings disappointment could lead to a sharp correction.

- Key Technical Deterioration: The formation of the “Death Cross” and position below all key moving averages suggest the powerful uptrend may be exhausted.

- Low Forward Visibility: The lack of analyst coverage and forecasts makes future growth difficult to gauge, increasing uncertainty.

- Promoter Stake Reduction: Promoter holdings have decreased by over 8% in the last three years, which can sometimes be a sentiment indicator.

The Bottom Line

AXISCADES is a fundamentally strong company operating in attractive sectors. However, for new money entering at current levels, the risk-reward ratio appears unfavourable.

The market has rewarded AXISCADES handsomely for its past performance. The coming quarters will determine if it can grow into its premium valuation and justify investor faith for the next leg of its journey.

Analyst Outlook

Market observers view this contract win as a positive step in AXISCADES’ strategy to deepen its international client relationships. “Securing work from firms like Axon and Stratacache is a testament to the quality and scalability of India’s engineering services,” commented a sector analyst. “It not only adds to the top line but also enhances the company’s profile for future global tenders.”

Looking Ahead

Investors will now monitor the execution of these contracts and their contribution to AXISCADES’ consolidated earnings. The company’s ability to leverage this success into larger follow-on orders will be a key factor in sustaining the current positive market momentum.

For now, the streets of Dalal Street are buzzing as AXISCADES demonstrates that strategic subsidiaries and focused capabilities can open lucrative doors in the international marketplace.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.