L&T Lands Major Riyadh Metro Contract, Bolstering Global Infrastructure Dominance

Indian multinational’s stock in focus after securing ultra-mega project in Saudi Arabia

MUMBAI, January 28, 2026 — Larsen & Toubro Limited (BSE: 500510, NSE: LT), India’s premier engineering and construction conglomerate, announced today that its Heavy Civil Infrastructure business has secured a major contract from the Royal Commission of Riyadh City for the extension of the Riyadh Metro.

The project, part of an ultra-mega consortium with global giants including Italy’s Webuild S.p.A, Saudi-based Nesma & Partners, France’s Alstom, and Spain’s IDOM, involves the design and turnkey construction of an 8.4 km metro line — featuring both elevated and underground sections — along with five new stations on the Red Line of the Riyadh Metro Network.

A Strategic Win in a Competitive Global Arena

This contract reinforces L&T’s formidable reputation in delivering large-scale, complex urban transit solutions worldwide. With a legacy spanning over eight decades, the $30 billion firm has repeatedly demonstrated its prowess in engineering, procurement, and construction (EPC) — a capability that continues to attract prestigious international clients.

In a filing to the BSE and NSE, the company highlighted the “major” classification of the project, which, according to its internal scale, refers to contracts valued between €5,000 crore and €10,000 crore. The win underscores L&T’s strategic focus on high-value international infrastructure projects, particularly in the Middle East, where it has steadily expanded its footprint.

Market Reaction and Stock Performance

While the official press release did not disclose the exact contract value, the classification as “major” signals a significant revenue boost for L&T’s Heavy Civil vertical. Investors often view such international mega-deals as positive catalysts for long-term growth, improving order book visibility and margin prospects.

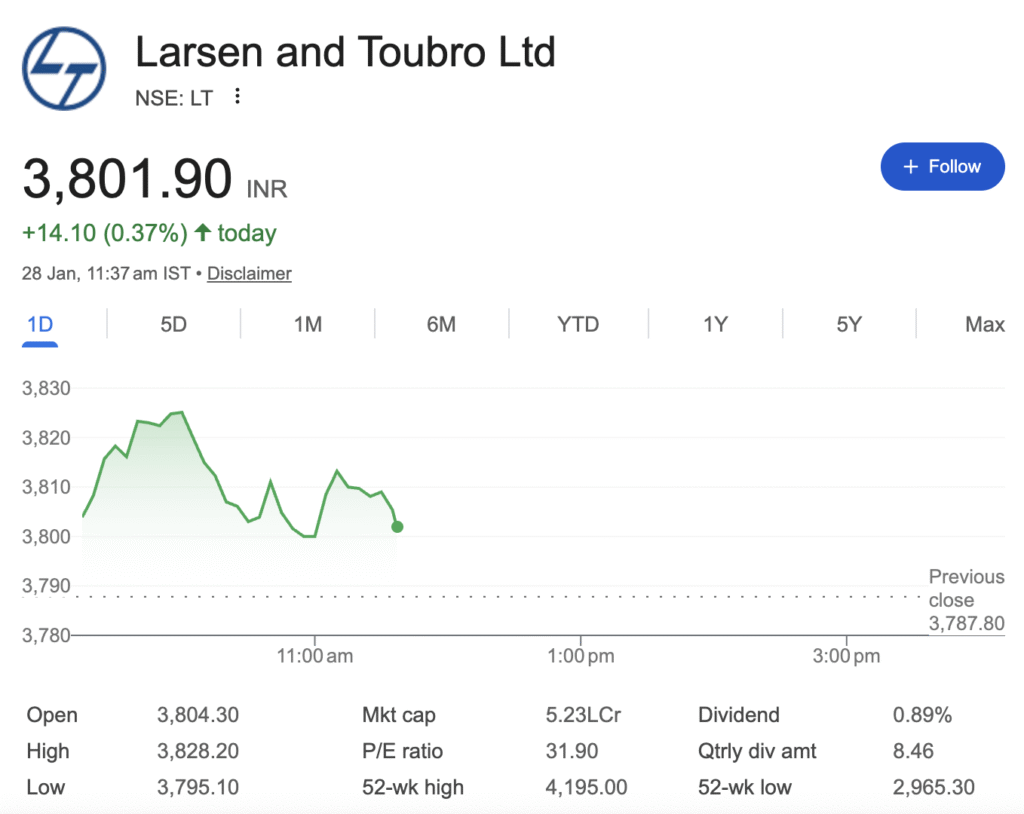

Early market data (see attached screenshot) suggests heightened trading activity, though detailed stock movement analysis will depend on forthcoming trading sessions. Given L&T’s role as a bellwether for India’s infrastructure sector, this contract win may also lift sentiment across related equities and the broader capital goods index.

What This Means for L&T

L&T’s latest achievement is more than just another contract — it’s a testament to its global competitiveness in an era where nations are aggressively investing in sustainable urban mobility. The Riyadh Metro extension aligns with Saudi Arabia’s Vision 2030, which aims to transform Riyadh into one of the world’s top ten city economies.

For L&T shareholders, the deal reaffirms the company’s growth trajectory beyond domestic markets and its ability to partner with world-class firms in complex consortium arrangements. It also highlights the effectiveness of L&T’s corporate branding and communications strategy, led by Sumeet Chatterjee, in building trusted client relationships globally.

Looking Ahead

As L&T continues to execute on such high-profile projects, analysts will watch for improved revenue diversification, robust margin delivery, and strengthened international branding. With India itself pushing massive investments in metro rail and urban infrastructure, L&T’s dual-engine approach — domestic leadership coupled with global expansion — appears strategically sound.

For now, the stock market and infrastructure enthusiasts alike will keep a close eye on how this major contract translates into financial performance in the coming quarters.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.