Alldigi Tech’s Q3 Surge: Declares Dividend of ₹30/share, A Deep Dive Into Margins, Momentum, and Market Position

In a quarter marked by robust international traction and margin expansion, Alldigi Tech Limited (BSE: 532633, NSE: ALLDIGI), the Chennai-based digital payroll and BPM services leader, has delivered financial results that demand a closer look. The recently declared Q3 FY26 numbers aren’t just an improvement; they signal a potential structural shift in profitability and scale. For investors navigating the tech-services space, this stock presents a compelling narrative of transformation, backed by hard numbers. Let’s dissect whether the momentum is sustainable.

The Q3 FY26 Financial Snapshot: Where Precision Meets Performance

The headline figures are strong, but the devil—and the opportunity—lies in the details. Below is a granular breakdown of the consolidated performance that highlights the company’s operational leverage.

| Particulars (₹ Crore) | Q3 FY26 | Q3 FY25 | YoY Growth | Key Implication |

|---|---|---|---|---|

| Revenue from Operations | 152.7 | 139.5 | +9.5% | Steady top-line growth across verticals. |

| EBITDA | 45.9 | 32.4 | +41.7% | Core highlight: Profitability exploding faster than revenue. |

| EBITDA Margin (%) | 30.1% | 23.2% | +680 bps | Massive expansion indicates superior cost management and operating leverage. |

| Profit After Tax (PAT) | 20.8 | 19.9 | +4.5% | Growth muted due to a one-off ₹4.0 Cr expense from new labour code provisions (Gratuity & Leave). Adjusted PAT growth would be ~25%. |

| Operating Cash Flow (OCF) | 45.3 | 24.2 | +87.2% | Bullish signal: Cash generation has nearly doubled, showcasing earnings quality and financial health. |

| Annual Contract Value (ACV) Wins | 28.3 (T&D + BPM) | N/A | N/A | Strong new business momentum, fuelling future revenue pipeline. |

Segment-Wise Breakdown: The Twin-Engine Growth Model

Alldigi operates on two primary verticals: Tech & Digital (T&D – Payroll) and Business Process Management (BPM). The growth story is balanced.

| Segment | Q3 FY26 Revenue (₹ Cr) | YoY Growth | Margin Growth YoY | Investment Thesis Driver |

|---|---|---|---|---|

| Tech & Digital | 38.7 | +16.2% | +31.5% (to ₹16.7 Cr) | High-margin, scalable platform business. 10% YoY growth in employee records processed shows platform stickiness. |

| BPM | 114.0 | +7.4% | +56.3% (to ₹19.7 Cr) | International BPM revenue surged 13.8% YoY. Offshore leverage and healthcare vertical strength driving margins. |

| Key Metric | International Revenue Share | 67% of Total | De-risking Strategy: Heavy reliance on global markets (69 countries) insulates from domestic volatility. |

Company Overview

Alldigi Tech, formerly known as Allsec Technologies, is a global provider of business process solutions, operating primarily through two segments :

- Employee Experience Management (EEM/Tech & Digital): This is the company’s payroll and HR services arm, processing millions of payslips quarterly. It is considered a leading payroll services provider in India.

- Customer Experience Management (CEM/BPM): This segment offers customer lifecycle management, technical support, healthcare solutions, and back-office services.

The company serves a diverse client base, including Fortune 100 companies, from its delivery centers in India, the Philippines, and the United States, managing a significant volume of customer interactions daily. This global footprint provides a balanced revenue mix between domestic and international markets, a key factor in its growth strategy.

Industry & Sector Overview

Alldigi Tech operates within the expansive Indian IT and BPO services market, which is projected to grow at a CAGR of 12.3% to reach USD 214.8 billion by 2029. Key trends shaping the industry include:

- Strong Tailwinds: The primary driver is the escalating cost pressure for companies to maintain in-house IT systems, pushing them towards outsourcing. There’s also a rising adoption of application development outsourcing and transformative technologies like cloud computing, AI, and automation.

- Specific Growth in Payroll: The Indian payroll services market is being accelerated by a government-led digital compliance push, cloud adoption by SMEs, and the complexities introduced by new labour codes and the gig economy.

- Headwinds & Competition: The market is fragmented and competitive. Key challenges include data security concerns, effective client communication, and cost sensitivity among smaller businesses.

Financial Performance Analysis (Last 5 Years)

The following table summarises Alldigi Tech’s consolidated financial trajectory, highlighting a consistent growth story.

| Fiscal Year | Revenue (₹ Cr) | EBITDA (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | OPM % |

|---|---|---|---|---|---|

| FY 2021 | 277 | 66 | 35 | 23.05 | 24% |

| FY 2022 | 317 | 80 | 36 | 23.39 | 25% |

| FY 2023 | 390 | 89 | 49 | 32.06 | 23% |

| FY 2024 | 469 | 116 | 64 | 42.00 | 25% |

| FY 2025 | 546 | 130 | 83 | 54.66 | 24% |

| CAGR (FY21-FY25) | ~18.5% | ~18.5% | ~24% | ~24% | – |

Source: Compiled from annual data

Note: OPM stands for Operating Profit Margin.

Key Financial Insights:

- Consistent Growth: The company has demonstrated strong and steady growth across all major parameters over the past five years.

- Margin Stability: Operating margins have been stable in the 23-25% range, indicating efficient cost management alongside expansion .

- Profitability Acceleration: Net profit and EPS have grown at a faster rate than revenue, showcasing operating leverage and improved bottom-line efficiency.

- Recent Performance (Q3 FY26): The company reported a strong quarter with revenue of ₹139.5 Cr (up 16.4% YoY) and net profit surging 76.9% YoY to ₹19.92 Cr, with Diluted EPS at ₹13.07.

Balance Sheet & Debt Analysis

Alldigi Tech maintains a robust balance sheet, which is a significant strength.

- Debt Position: The company has a negligible Debt-to-Equity ratio, classified as 0% in recent analyses, indicating it is virtually debt-free. This eliminates interest rate risk and provides financial flexibility.

- Strong Profitability Metrics: High and improving Return on Equity (ROE: 27.3%) and Return on Capital Employed (ROCE: 31.4%) reflect exceptional efficiency in using shareholder and company capital to generate profits.

- Working Capital Management: The company has shown improvement here, with working capital requirements reducing significantly from 19.1 days to 12.3 days, indicating better cash conversion efficiency .

Key Positives & Strengths

- Niche Market Leadership: A recognised leader in the Indian payroll outsourcing space, a segment with strong growth tailwinds .

- Exceptional Financial Health: Debt-free status coupled with high ROE/ROCE makes the company financially resilient and efficient .

- Global Delivery Model: Presence in India, the Philippines, and the US allows for nearshore and offshore service delivery, catering to a global clientele.

- Stable & High Dividend: A consistent dividend policy with a high payout ratio (84%) and a yield near 3.7% is attractive to income-seeking investors.

- Strong Recent Performance: The impressive profit and EPS growth in the latest quarter suggests positive business momentum.

Key Risks & Concerns

- Sector Competition: The IT-BPM and payroll markets are highly competitive and fragmented, with pressure on pricing and a constant need for innovation.

- Client Concentration & Macro Dependence: Performance is linked to clients’ outsourcing budgets, which can be impacted by global economic slowdowns.

- Regulatory Changes: The business is subject to data privacy laws (like India’s DPDP Act), labour regulations, and compliance norms across different geographies.

- Execution in Growth: Sustaining high growth rates and margin levels as the company scales further will be a key challenge.

Recent News & Management Commentary

- The Q3 FY26 results highlighted robust growth, particularly in net profit.

- The Board declared an interim dividend of ₹30 per equity share for FY26, reflecting confidence in cash flows.

- Management commentary in press releases has emphasised growth in international revenues and the successful transition of clients to new digital platforms.

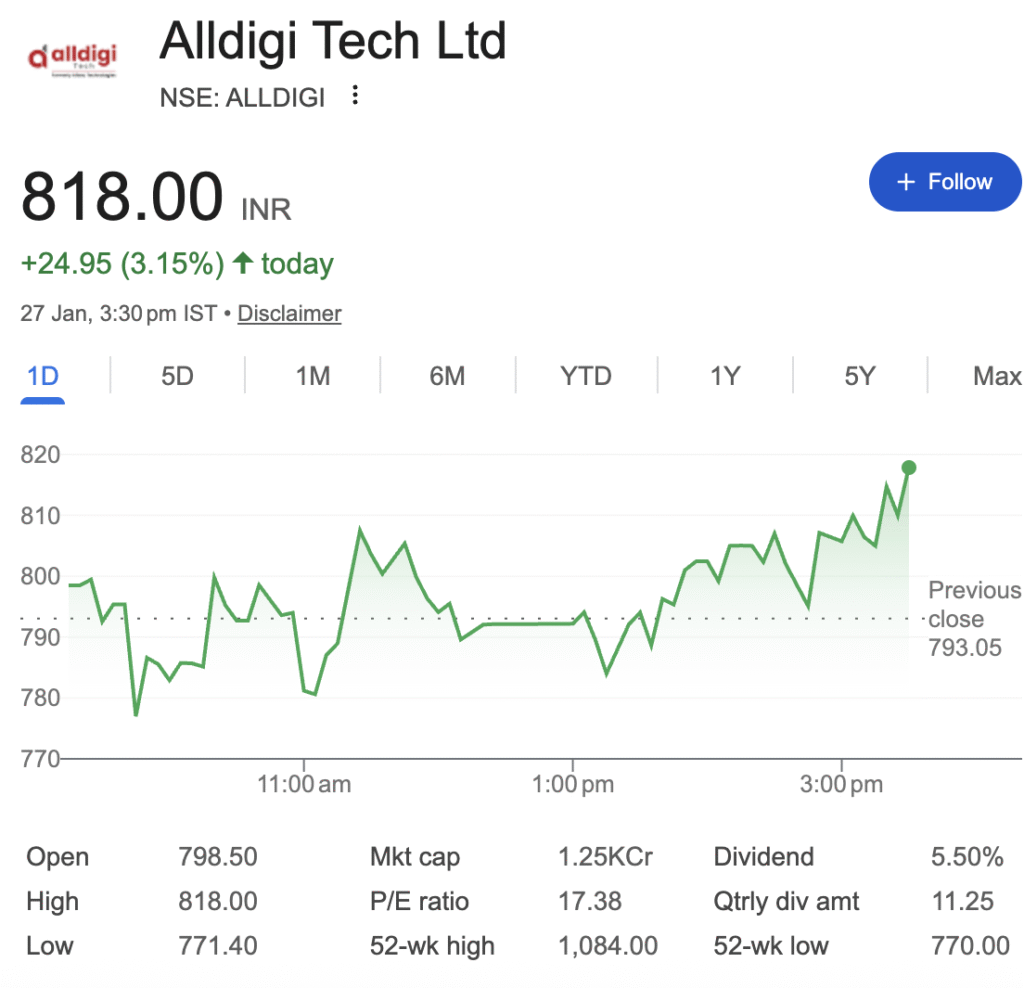

Valuation Snapshot

- Current P/E: At 16.2, the company’s P/E ratio is lower than its historical highs, potentially reflecting market caution or broader sector valuation adjustments.

- Peer Comparison: While a direct like-for-like peer set is complex due to its niche, its valuation can be compared to mid-tier IT services and BPM companies. Its high ROE/ROCE and debt-free status could justify a premium to some peers.

- Price Context: The current price is roughly midway in its 52-week range, having retreated from its high of ₹1,084.

Long-Term Outlook

Alldigi Tech’s long-term prospects are tied to its ability to leverage key growth triggers:

- The structural shift towards the outsourcing of payroll and complex BPM processes driven by digitalisation.

- Expanding its platform-based Tech & Digital services to capture more value in the HR tech stack.

- Deepening relationships with existing global clients and mining accounts for more business.

The sustainability of its high earnings growth will depend on winning large contracts, maintaining operational discipline to protect margins, and navigating the competitive landscape effectively. The company’s alignment with the broader positive sector outlook for IT-BPM and digital transformation in India is a favourable macro factor .

Summary

Alldigi Tech Limited presents a profile of a financially strong, debt-free company operating in a growing sector. It has demonstrated a consistent track record of revenue and profit growth, high capital efficiency (ROE/ROCE), and a shareholder-friendly dividend policy. Its position in the niche payroll outsourcing market is a distinct strength. However, it operates in a competitive and fragmented industry where execution and adaptation to technological changes are critical. The stock’s current valuation reflects both its strong fundamentals and the broader market environment. Investors should weigh its robust financial health and market position against the sector-wide challenges and execution risks involved in sustaining its growth trajectory.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.