Shree Ganesh Remedies: A Deep Dive into a Growth Story Under Siege

Ankleshwar-based specialty chemical player Shree Ganesh Remedies Ltd (SGRL) finds itself at a critical juncture. The company’s recently announced Q3 FY26 results reveal a business grappling with severe headwinds, yet its management continues to chart an ambitious course for future expansion. For investors, the story presents a stark dichotomy: a troubling present of declining sales and profits versus a promising future built on new facilities and high-margin contracts. This analysis delves into the numbers, the narrative, and the valuation to answer the pivotal question: Is this a fallen angel poised for a rebound, or a value trap?

The Unvarnished Truth: A Quarter of Steep Decline

The third quarter of FY26 was unambiguously weak for SGRL. The financials show a company battling external challenges and possibly some internal execution issues, with key metrics painting a concerning picture of deceleration.

Table 1: Quarterly Performance Snapshot (Consolidated, ₹ in Crores)

A few critical insights emerge:

- Revenue Collapse: The 30% quarter-on-quarter plunge in sales is the steepest in recent memory, indicating significant client-side issues or order delays. The management has cited shipment deferrals and a challenging European demand environment as primary causes.

- Profit Erosion: The fall in net profit (-43% YoY) is even steeper than the revenue decline, highlighting pressure on the bottom line. This is exacerbated by a more than doubling of finance costs year-on-year.

- A Silver Lining in Margins? Interestingly, the operating margin held steady and even improved slightly year-on-year. This suggests some success in cost control or a favourable product mix, but it was insufficient to offset the sheer volume decline.

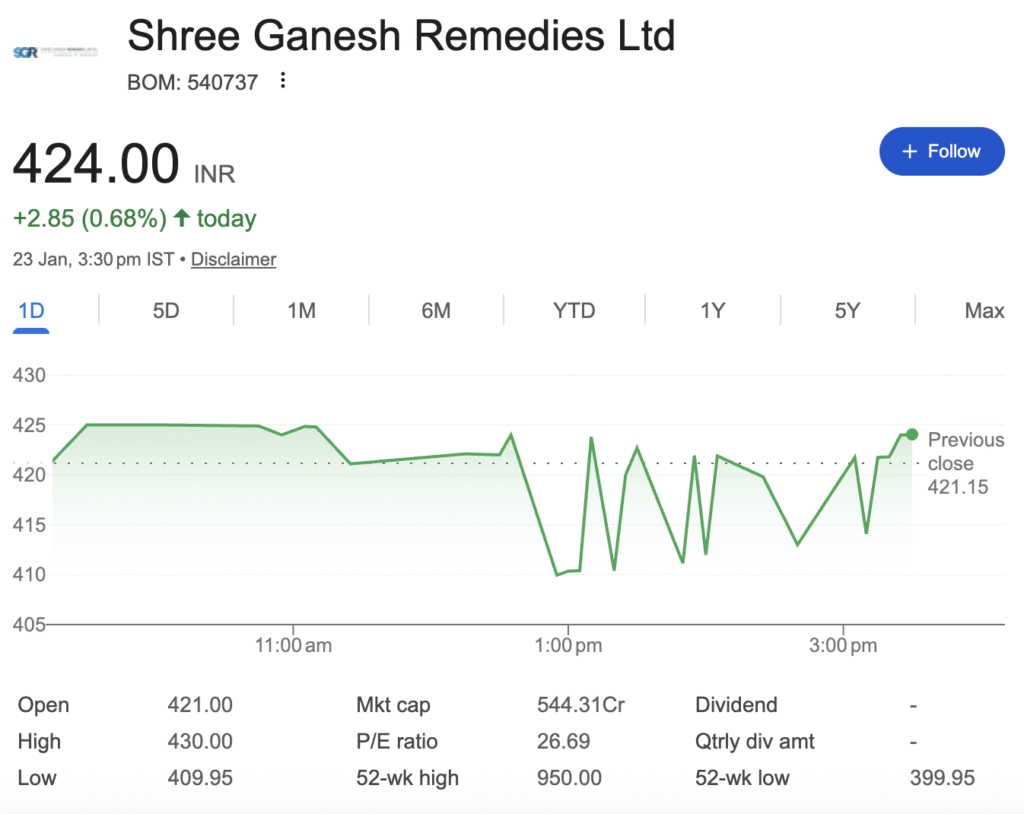

The Bigger Picture: From Market Darling to Underperformer

The Q3 woes are not an isolated incident but part of a broader trend. The company’s stock, trading around ₹423, has shed a staggering 38% of its value over the past year. This dramatically underperforms both the broader pharmaceutical sector and the overall market.

Key metrics of capital efficiency, once a strength, are also flashing warning signs. The company’s Return on Equity (ROE) has deteriorated from a healthy historical average of ~20% to around 13%, while Return on Capital Employed (ROCE) has fallen from ~22% to about 17%. This indicates the company is generating less profit from each rupee of capital invested by shareholders and the business itself.

The Management’s Gambit: Betting the Future on Block 7 and CRAMS

Despite the bleak present, Shree Ganesh Remedies is not standing still. Management commentary and corporate updates point to a significant transformation underway, pivoting from traditional intermediates to a more specialized model.

The Growth Pipeline:

- Block 7 Expansion in Dahej: This is the cornerstone of the future strategy. The new facility, expected to be commissioned in H1FY27, is dedicated to low-volume, high-margin specialty chemicals, aiming to move the company up the value chain.

- CRAMS (Contract Research and Manufacturing Services): The company is actively building a pipeline of CRAMS projects, particularly with a key Japanese client. These projects typically command premium margins (35-40% initially) and provide stable, long-term revenue streams.

- Backward Integration: Plans to vertically integrate 40% of its product portfolio aim to secure supply chains and improve cost efficiency over the long term.

Table 2: The Future Outlook – Projections vs. Present Reality

Valuation Verdict: The Premium Price of Promise

Here lies the core dilemma for investors. The company’s fundamentals are currently weak, yet its stock trades at a significant premium based on future expectations.

A detailed intrinsic value analysis suggests a stark overvaluation. According to modeling based on historical EV/EBITDA, EV/Sales, and Price/Sales ratios, the estimated median fair value for SGRL is approximately ₹83.71. Compared to the current market price of ₹423.05, this implies the stock is trading at a premium of over 400% to its calculated intrinsic value.

Other valuation multiples tell a similar story:

These multiples are at the higher end of the spectrum for pharmaceutical intermediates companies, especially for one experiencing a pronounced downturn. The market is, unequivocally, pricing in a successful and timely execution of the future growth plans.

Investment Thesis: High Risk, High Reward?

The Bull Case (Reasons to Consider):

- Transformational Expansion: The Block 7 facility could be a game-changer, enabling entry into lucrative chemical niches.

- CRAMS Potential: Success in this segment would mean better visibility, stability, and profitability.

- Strong Balance Sheet: The company maintains a low debt profile (Debt/Equity of ~0.26), giving it financial flexibility to fund its expansion.

The Bear Case (Significant Risks):

- Execution Risk: The entire investment thesis hinges on the successful and on-schedule commissioning of Block 7 and conversion of the CRAMS pipeline. Any delay or cost overrun would be severely punished.

- Extended Downturn: European market weakness and competitive pressures may persist longer than expected, further damaging near-term earnings.

- Extreme Valuation: The current price leaves almost no room for error. It discounts years of perfect future growth.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.