M&B Engineering Bags ₹47.66 Crore Mega Order – A Stealth Multibagger in the Making?

In a significant development that underscores India’s accelerating infrastructure and industrial capex cycle, M&B Engineering Limited (BSE: 544470) has secured a substantial domestic order worth ₹47.66 Crores (plus GST) for the design, manufacturing, and supply of Pre-Engineered Buildings (PEB) and structural steel. The order, to be executed within approximately five months, includes an erection component awarded to its wholly-owned subsidiary, Phenix Building Solutions Private Limited. This announcement, made under SEBI Listing Regulations, has ignited interest in this small-cap engineering player. But beyond the headline number, does the financial foundation and growth narrative justify investor attention? We conduct a bottom-up analysis.

The Order in Context: A Game Changer?

The order size is monumental relative to the company’s scale. While the customer remains confidential, the “domestic entity” tag and the nature of work suggest involvement in logistics, warehousing, or industrial plant expansion—sectors booming under the PLI and infrastructure push. The 5-month execution timeline promises a swift conversion of this order into revenue, potentially significantly boosting FY2027 financials.

Financial Health: A Story of Accelerating Growth

M&B Engineering’s financial performance over the past few years has been nothing short of impressive. The company has successfully capitalized on India’s infrastructure and industrial boom, transitioning from steady performance to high-growth trajectory.

The Bottom Line: The financial statements reveal a company in its prime operational phase. The leap in profitability, coupled with stellar return ratios, suggests M&B is not just growing but becoming markedly more efficient and profitable.

The Growth Engine: A Record Order Book and Global Wins

The future outlook is powered by a formidable order pipeline. Recently, the company announced two significant wins:

- A ₹63.50 crore domestic order for PEB and structural steel, with an 8.5-month execution timeline.

- A $7.53 million (approx. ₹67.12 crore) export order from the United States, to be executed in just 3.5 months.

These fresh wins have propelled the company’s total order book to a robust ₹930.56 crore. This provides clear revenue visibility for the coming years and underscores its competitive strength in both domestic and international markets.

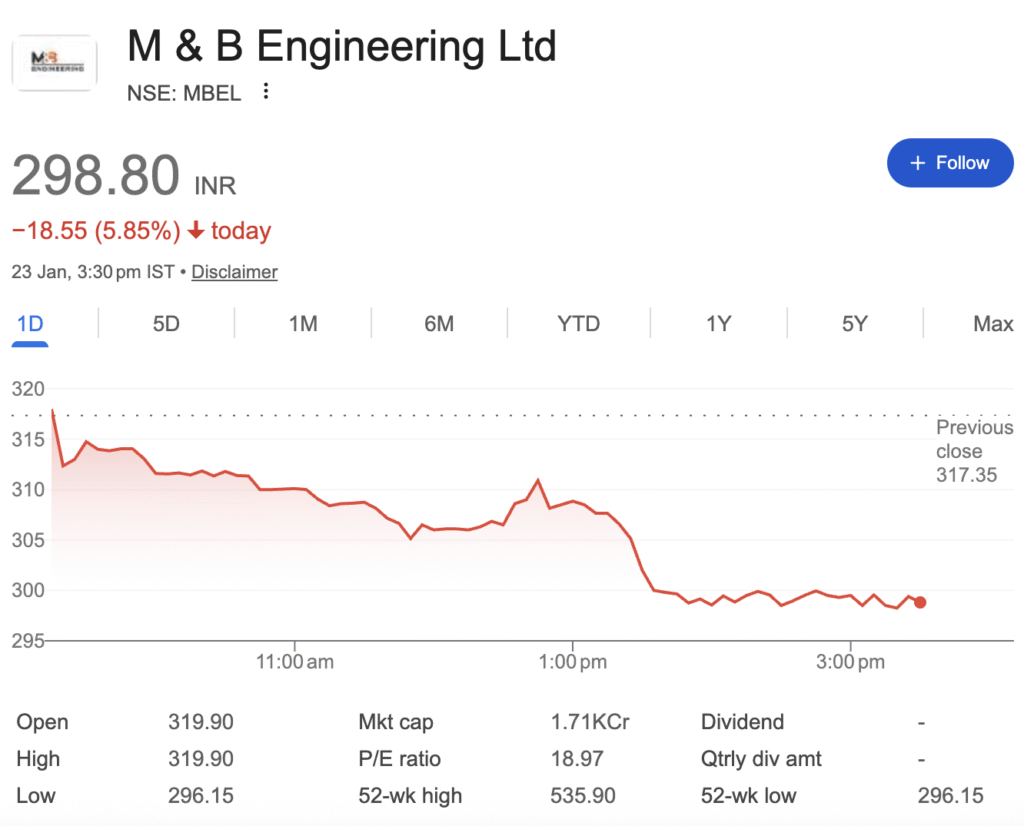

The Stock Price Conundrum: Decoding the Downtrend

Despite stellar fundamentals, MBEL’s share price has been under severe pressure. As of January 23, 2026, the stock is down 5.92% for the day at ₹298.55, hovering just above its 52-week low of ₹296.15.

Technical Analysis Perspective:

The chart structure is decidedly bearish in the short term.

- Trend: The stock is trading well below its key moving averages (50-day: ₹373.77, 100-day: ₹390.67), confirming a strong downtrend.

- Momentum: The Relative Strength Index (RSI) is at 29.76, approaching oversold territory but still in a “Strong Downtrend” phase.

- Key Levels: Immediate support is at the 52-week low of ~₹296. A break below could trigger further selling. Resistance is seen around the pivot point of ₹318 and the ₹333-₹341 zone.

This disconnect between stock price and business performance could be attributed to profit-booking after a strong multi-year run, broader market corrections, or sector-specific headwinds. It’s crucial to note that the company’s trading window is currently closed ahead of its Q3 FY26 results, which may have subdued liquidity.

Investment Verdict: High Potential with a Caveat

From a fundamental, bottom-up perspective, M&B Engineering is a compelling story. Its financial growth, high profitability, and strong order book make it a standout in the engineering and construction space.

For Investors:

- Aggressive/Long-Term Investors: The current price weakness could be viewed as a potential entry point for a long-term horizon. The company’s growth trajectory and visible earnings stream from its order book are powerful positives. Investors should look for signs of the downtrend exhaustion, such as a bullish reversal pattern or a hold above the ₹296 support.

- Conservative/Short-Term Investors: Exercise caution. The technical downtrend is strong. It may be prudent to wait for the stock price to show signs of consolidation or a definitive breakout above key moving averages (like the 50-day SMA) before considering an entry.

Key Risks to Monitor:

- Execution Risk: Timely execution of the large order book is critical.

- Margin Pressure: Any rise in raw material (steel) costs could impact margins.

- Market Sentiment: As a small to mid-cap stock, it remains vulnerable to broader market volatility.

Final Take: M&B Engineering Ltd. is fundamentally a company on a roll. For those who believe in its business model and can stomach short-term volatility, the current market pessimism may have created an attractive opportunity to invest in a high-quality growth story at a discounted price. However, aligning entries with improving technical signals would be a prudent strategy.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.