Make in India’s defence and shipbuilding giant lands record order: Is Swan Defence stock ready to sail?

In a landmark win for India’s private shipbuilding and defence sector, Swan Defence and Heavy Industries Limited (BSE: 533107, NSE: SWANDEF) – formerly Reliance Naval and Engineering – has secured the nation’s first-ever chemical tanker export order, a whopping $227 million (~₹2,080 crore) contract from Norway’s Rederiet Stenersen AS. The order is for six sophisticated IMO Type II chemical tankers, with an option for six more, catapulting the debt-laden but strategically vital firm back into the limelight.

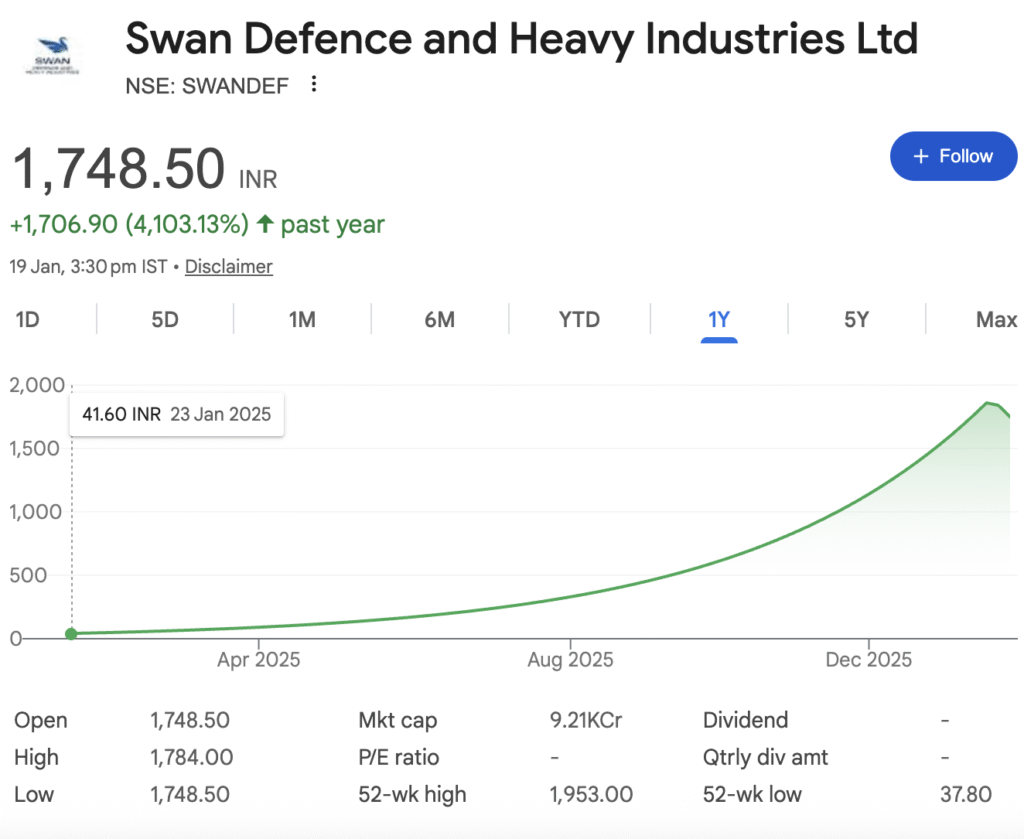

The stock, predictably, has been on a rollercoaster. From a 52-week low of ₹8.25, SWANDEF surged over 400% in the past year, touching ₹45.90 recently, before experiencing profit-booking. The announcement triggered another upper circuit, highlighting extreme speculative interest alongside genuine fundamental re-rating potential.

1️⃣ Stock Snapshot (Quick Facts)

Data as of January 23, 2026; based on latest available filings.

2️⃣ Company Overview

Swan Defence and Heavy Industries Ltd (SDHI), historically known as Reliance Naval and Engineering, operates India’s largest integrated shipbuilding and heavy engineering facility at Pipavav, Gujarat. Its business model is anchored in two core segments: naval & defence shipbuilding and commercial shipbuilding & repair. The company possesses one of the world’s largest dry docks, enabling it to construct and refit large vessels.

For years, the company’s revenue sources were minimal, with operations stalled due to its Corporate Insolvency Resolution Process (CIRP), which concluded in early 2023. The recent $227 million (approx. ₹1,880 crore) contract to build six advanced chemical tankers for Norway’s Rederiet Stenersen AS marks a pivotal shift, representing its first major commercial export order and signalling a restart of its core shipbuilding activity. This order provides a clear international exposure vector, while its long-term strategy remains aligned with domestic defence procurement.

3️⃣ Industry & Sector Overview

India’s shipbuilding industry is at an inflection point, contributing less than 1% to the global market but backed by an ambitious national vision. The government’s Maritime India Vision 2030 and Amrit Kaal Vision 2047 aim to position India among the top five shipbuilding nations. A cornerstone of this push is a $5.4 billion (₹45,000 crore) subsidy and infrastructure program approved in 2025, including direct financial assistance (15-25% of contract value) and low-interest financing through a Maritime Development Fund.

Key Tailwinds:

- Policy Support: Strong government push for self-reliance (‘Atmanirbhar Bharat’) in defence and strategic sectors.

- Global Supply Chain Shift: Geopolitical dynamics and congestion at East Asian shipyards are prompting global clients to seek alternative, reliable partners.

- Niche Specialisation: Indian yards are focusing on high-value, specialised vessels like chemical tankers, offshore support vessels, and naval craft, where SDHI’s new order is a prime example.

- Green Shipping Transition: Global demand for LNG-ready and hybrid propulsion vessels (like those in SDHI’s new order) is rising.

Key Headwinds & Competition:

- Dominant Asian Players: Competition is intense against China (~61% global share), South Korea, and Japan, which benefit from scale, advanced technology, and established supply chains.

- High Capital Costs & Imports: Indian shipyards face higher financing costs and dependence on imported machinery and materials.

- Productivity Gap: Productivity levels in India generally lag behind leading Asian shipyards.

4️⃣ Financial Performance Analysis (Last 5 Years)

The company’s financial history is bifurcated into a period of severe stress leading to insolvency and a recent phase of restructuring and revival. The data reflects the operational shutdown and the clean-up of the balance sheet post-CIRP.

Table 1: Key Financial Metrics (Consolidated, in ₹ Crores)

Analysis: The financials show negligible revenue and sustained operating losses from FY2021 to FY2025, a direct result of the insolvency process and halted operations. The Operating Profit Margin (OPM) has been deeply negative. The recent traction is visible in the Trailing Twelve Months (TTM) revenue of ₹46 crores, which, while still small, indicates the restart of repair and refit activities. The landmark $227 million order, though not yet reflected in these statements, is set to dramatically alter the revenue trajectory starting from FY2027.

5️⃣ Balance Sheet & Debt Analysis

The completion of the Corporate Insolvency Resolution Process (CIRP) has been the most critical event for the balance sheet. The company underwent a significant debt restructuring, which has dramatically reduced its debt burden.

- Debt Reduction: Post-CIRP, the company’s debt has been reduced to manageable levels. Recent filings show a marked decline in finance costs, from over ₹1,400 crores annually in FY20-FY23 to just ₹10 crores in the last twelve months. This is a fundamental positive change.

- Interest Coverage Ratio: With minimal debt and interest expenses, the coverage ratio has improved, though it remains low due to operating losses.

- Working Capital Cycle: Historically extended due to stalled operations, this is expected to normalise as new projects commence. The new tanker order will involve an advance payment structure, which should aid cash flow during the construction phase.

- Capital Allocation Quality: The focus post-revival has been on refurbishing and upgrading the Pipavav shipyard to be “future-ready”. The decision to pursue high-value, technologically advanced vessels like the IMO Type II chemical tankers indicates a strategic allocation towards high-margin niches.

6️⃣ Shareholding Pattern (As of Latest Quarter)

A high promoter holding is often seen as a sign of strong insider confidence, especially following a restructuring.

Table 2: Shareholding Pattern

7️⃣ Key Positives & Strengths

- Landmark Order Book Revival: The $227 million chemical tanker order is a game-changer. It validates the shipyard’s capabilities on a global stage, provides revenue visibility for the next 3-4 years, and includes a valuable option for six more vessels.

- World-Class Infrastructure: Ownership of India’s largest dry dock and modular fabrication facility provides a significant competitive moat and the capacity to execute large, complex projects.

- Strategic Parentage & Cleaned Balance Sheet: As a subsidiary of Swan Corp Ltd, it has corporate backing. The resolved CIRP and restructured debt have removed a critical overhang, allowing the company to start afresh.

- Alignment with National Priorities: The company is a key player in India’s defence indigenisation and commercial shipbuilding growth plans, making it a potential beneficiary of policy tailwinds and government contracts.

8️⃣ Key Risks & Concerns

- Execution Risk: The company has a history of project delays. Delivering the first tanker within the 33-month schedule is crucial for rebuilding market trust and securing future orders.

- Financial Risk from Past Losses: While debt is reduced, the company has a large accumulated deficit from past losses, resulting in a negative net worth. Sustained profitability over several years is needed to repair the balance sheet fully.

- Sector-Specific Cyclicality: Shipbuilding is a cyclical industry dependent on global trade and charter rates. A downturn could affect the pipeline of future orders.

- Stretched Valuations: The stock’s meteoric rise (over 4000% from its 52-week low) and high P/B ratio price in a perfect execution of the turnaround, leaving little room for error.

9️⃣ Recent News, Events & Management Commentary

The defining recent event is the $227 million contract win from Rederiet Stenersen AS of Norway. Management has termed this a “historic milestone” and a “defining moment for Indian shipbuilding,” highlighting its role in showcasing India’s capability to build advanced, future-ready vessels.

- Earnings Highlights: Recent quarterly earnings continue to show minimal operational income as the yard was being prepared for new projects.

- Capex & Expansion: The focus has been on revitalising the Pipavav shipyard. The nature of the new order suggests investments may be directed towards specific technologies for hybrid propulsion and advanced automation systems.

🔟 Valuation Snapshot

Valuing SDHI on traditional metrics like P/E is not feasible due to the lack of current earnings. The market is valuing the company based on its asset potential, order book revival, and long-term growth story within India’s strategic shipbuilding push.

- Peer Comparison: Direct, listed Indian peers in private large-scale shipbuilding are limited. Comparisons are often drawn with public sector shipyards like Cochin Shipyard and Mazagon Dock, which trade at high valuations due to their robust defence order books. SDHI’s valuation premium reflects its similar potential and unique infrastructure.

- Historical Range: The stock has experienced an unprecedented re-rating, moving from a deep-value situation (sub-₹50) to a growth-story valuation (above ₹1,700). Current prices reflect expectations far into the future.

1️⃣1️⃣ Long-Term Outlook (Neutral & Analytical)

The long-term outlook hinges on the company’s ability to leverage its strategic reset. The primary growth trigger is the successful execution of the chemical tanker order, which can establish SDHI as a credible global vendor for specialised commercial vessels. This, coupled with the expected surge in Indian naval and coast guard procurement, could create a dual-engine growth model.

The sustainability of earnings will only be proven over the next 3-5 years as the current order flows into the P&L and new orders are secured. The company’s alignment with the sector outlook is strong, given India’s targeted investment and policy support to multiply its share of global shipbuilding. However, transitioning from a promising turnaround story to a consistently profitable entity remains the core challenge.

1️⃣2️⃣ Conclusion & Objective Summary

Swan Defence and Heavy Industries Ltd represents a high-stakes corporate turnaround story in a strategically vital sector. The company has overcome its most significant hurdle—a burdensome debt legacy—and has secured a flagship order that validates its technical capabilities. Its world-class infrastructure and alignment with national goals are clear strengths. However, the investment proposition is binary and forward-looking. The current valuation discounts a high probability of flawless order execution and future order flow continuity. Investors must weigh the substantial potential of a revived Indian shipbuilding champion against the very real risks of execution missteps, sector cycles, and the rich valuations that leave minimal margin for disappointment.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.