Shelter Pharma: A Small-Cap Bet on Exports, But Geopolitical Risks Loom Large

Ahmedabad-based Shelter Pharma Ltd. (BSE: 543963) finds itself at a curious juncture. The small-cap pharmaceutical and nutraceutical player recently secured an international export order, sending its stock on a volatile ride. However, the destination of this order—Sudan, a nation gripped by a severe humanitarian crisis—paints a complex picture of opportunity versus substantial risk. This analysis delves beyond the headline to examine Shelter Pharma’s financial health, the implications of its new contract, and the critical factors investors must weigh.

🚀 Growth Catalysts: The Export and Sector Story

The primary near-term catalyst is the $141,600 (approx. ₹1.18 crore) export order for its ‘Joemega Capsules’ from Taha Drugs & Chemicals Co. Ltd. in Sudan. While the financial size is modest relative to the company’s annual revenue (Trailing Twelve Months revenue: ~₹598.96 crores), its strategic significance is twofold.

- Market Diversification: It represents a foray into a new international market, potentially opening doors in Africa.

- Sector Tailwinds: The company’s focus on nutraceuticals and chronic therapies like diabetes (evidenced by products like ‘Diabetone Tablet’) aligns with strong domestic growth trends. The Indian pharmaceutical market is growing steadily, led by chronic therapy segments like anti-diabetics and cardiac care.

Furthermore, Shelter Pharma is participating in the broader “AYUSH India Expo,” indicating a push towards branded, traditional medicine segments which are gaining consumer interest

📈 Recent Stock Moves: A Volatile Reaction

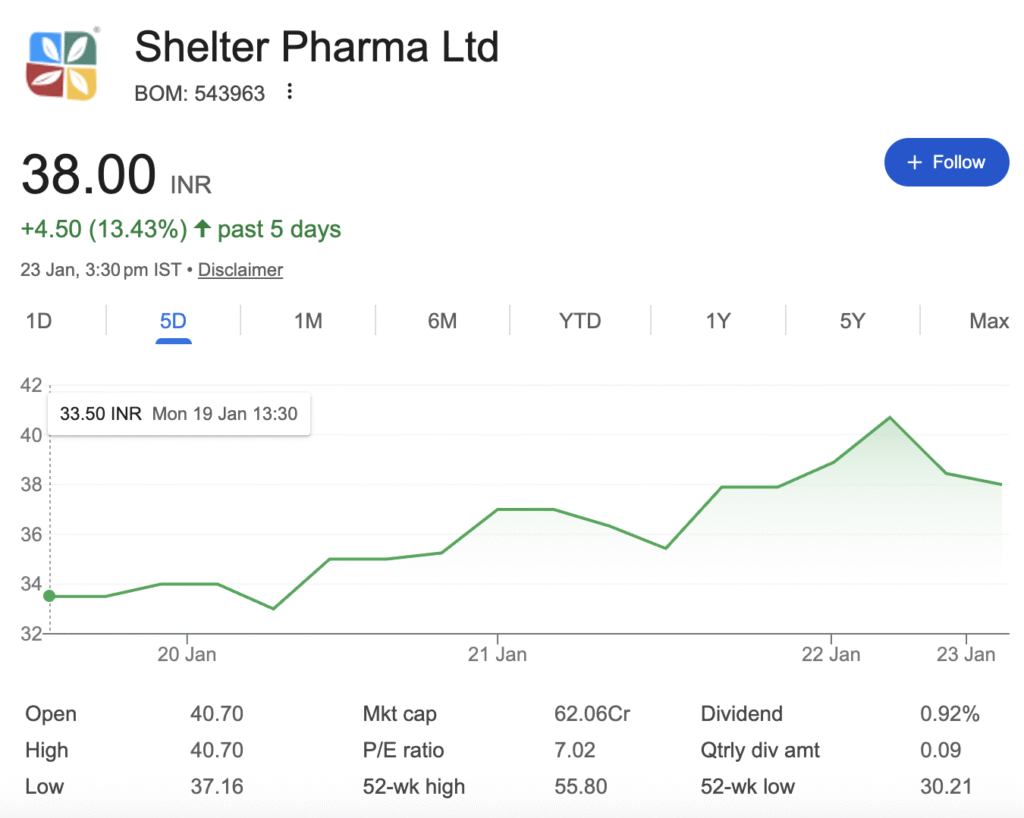

The market’s response to Shelter Pharma’s recent announcements has been characteristically volatile for a small-cap stock. Following a series of order intimation filings with the BSE in recent months, the stock has seen significant price swings. Data reveals a 52-week range between ₹30.21 and ₹55.80, highlighting its inherent volatility.

In the immediate days around the latest order disclosure, the stock exhibited sharp movements. After closing at ₹34.00 on January 19, 2026, it surged over 8% to ₹37.90 on January 21 on high volumes, likely in anticipation or initial reaction to the news. However, this was followed by a corrective dip, with the price adjusting to ₹38.90 by January 22. This pattern is consistent with the stock’s behavior, which often experiences low average trading volumes (around 28,055) that can amplify price moves on any significant news flow.

📊 Financial Health Check: Strengths and Concerns

At its last closing price of approximately ₹38.00, Shelter Pharma commands a market capitalization of around ₹620.65 crores. A look at its key financial metrics reveals a mixed bag:

The company has also been active in corporate actions, recently converting a large number of warrants into equity shares and declaring a dividend of ₹0.35 per share.

⚠️ Risk Assessment: A High-Stakes Landscape

The investment case is tempered by several material risks:

- Geopolitical and Execution Risk (Sudan): The order from Sudan is fraught with risk. The country is enduring a catastrophic civil war, described as facing “one of the world’s worst humanitarian crises” with basic services shattered. Supply chain disruptions, payment delays, and an inability to execute the order are distinct possibilities. The war has directly targeted agricultural and commercial infrastructure, making business operations highly unstable.

- Company-Specific Risks: The negative free cash flow is a red flag for a small company. Additionally, the flurry of warrant conversions increases the share count, which can dilute existing shareholders’ ownership if not matched by proportional earnings growth.

- Sector and Market Risks: As a small-cap stock, Shelter Pharma is subject to high volatility and low liquidity. It also operates in the highly competitive Indian pharmaceutical sector, which, while growing, faces pricing pressures and a challenging transition towards greater API self-sufficiency.

🎯 Investment Verdict: Speculative, For Risk-Tolerant Investors Only

Shelter Pharma presents a classic high-risk, high-potential-reward scenario.

- The Bull Case: A successful execution of the Sudan order could lead to follow-up contracts and validate its export capabilities. Strong profitability metrics (ROE, Margin) and alignment with growing chronic therapy markets are fundamental strengths.

- The Bear Case: The Sudan contract could fail due to forces entirely outside management’s control. Persistent negative cash flow could strain operations, and small-cap illiquidity makes exiting a position difficult during market stress.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.