AXISCADES Technologies: A Deep Dive After the Hyperscaler Contract Win – Is the Growth Story Intact?

AXISCADES Technologies Ltd (NSE: AXISCADES), a prominent player in the engineering and digital solutions space, has captured investor attention with the recent announcement of a new international contract secured by its subsidiary, Mistral Solutions. While the ~$1 million deal for audio product testing with a hyperscaler client is a positive stride, it arrives at a critical juncture for the company’s stock, which has seen significant volatility and is trading well below its yearly highs. This analysis delves beyond the headline to examine the company’s financial bedrock, future growth runway, and whether the current price offers a compelling entry point for investors.

The Financial Bedrock: Growth, Profitability, and Areas of Concern

A bottom-up analysis of AXISCADES’ financials reveals a company with a strong historical growth trajectory but facing questions on valuation and operational efficiency.

The company has demonstrated robust top-line expansion, with sales growing at a compounded annual growth rate (CAGR) of 12% over the past decade and 19% over the last three years. More impressively, profit growth has significantly outpaced revenue growth, with a 5-year profit CAGR of 21.3% and a staggering 102% growth in the trailing twelve months (TTM). Key profitability metrics like Return on Capital Employed (ROCE) and Return on Equity (ROE) stand at a healthy 13.8% and 12.7%, respectively.

However, several flags warrant a closer look. The stock trades at a lofty Price-to-Earnings (P/E) ratio of approximately 53, which appears expensive against its historical and projected growth. Other valuation multiples, such as a Price-to-Book (P/B) ratio of over 7, further underscore premium pricing. Operational challenges are evident in the steady increase in working capital days from 48.9 to 74.8 days over recent years, indicating potential strain in managing receivables and inventory. Furthermore, promoter holding has decreased by 8.14% over the last three years, a trend investors often monitor closely.

*Table 1: AXISCADES Technologies – Key Financial Snapshot*

Future Growth Prospects: Analysts See Acceleration, But Coverage is Thin

The future growth narrative for AXISCADES is a mix of high projections and notable uncertainty due to limited analyst coverage.

Available forecasts suggest an acceleration in performance. Analysts project a revenue CAGR of 21% and a net income CAGR of 63% for the next year. These projections are buoyed by the company’s positioning in high-growth areas like embedded systems, aerospace, defense, and its recent foray into serving hyperscaler clients in areas like AI-enabled solutions and acoustic testing. The global push for digital transformation and engineering outsourcing provides a strong industry tailwind.

A significant caveat, however, is the near-total lack of formal analyst coverage and consensus estimates. SimplyWall.St notes that this lack of reliable past data or analyst forecasts makes future earnings difficult to project reliably, a situation uncommon for listed firms. This means the high growth projections are based on thinner data than for most comparable companies, increasing the investment risk.

Recent Stock Moves: A Tale of Volatility and Sharp Correction

AXISCADES’ stock price action has been dramatic. The shares have delivered astronomical multi-year returns, including a 2,099% gain over 5 years. However, recent months tell a different story.

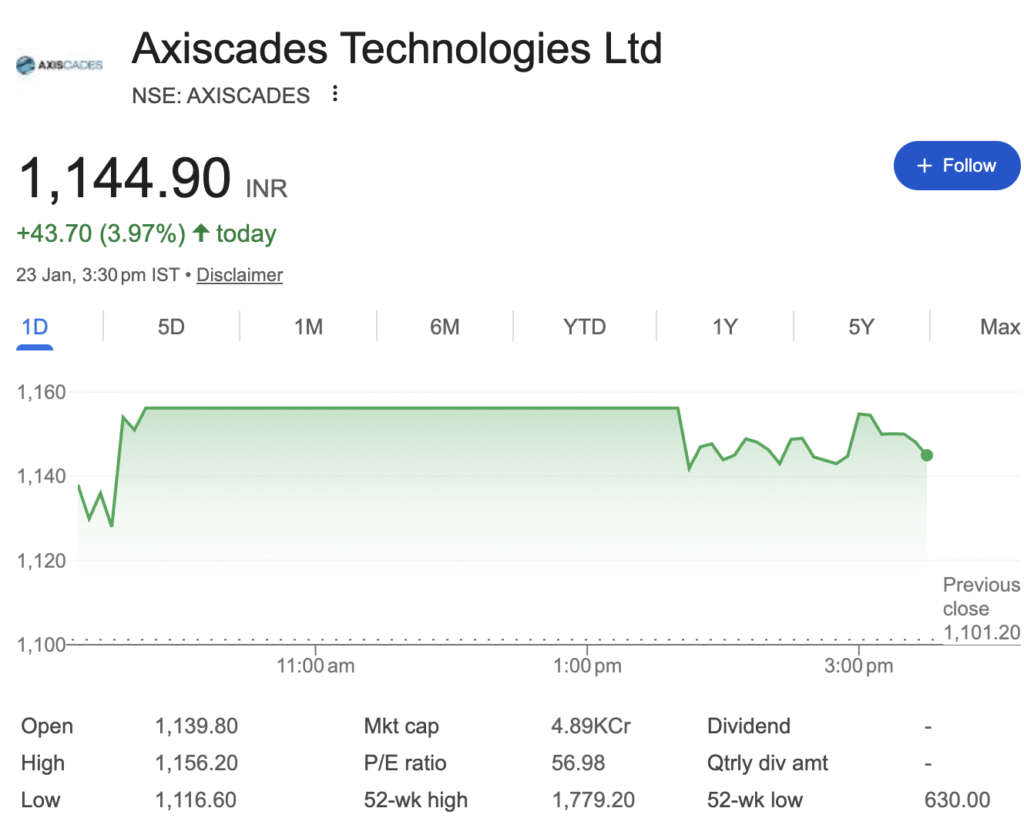

The stock hit a 52-week high of ₹1,779.20 in late 2025 but has since undergone a sharp correction. As of January 23, 2026, it trades around ₹1,152.40, representing a decline of over 35% from its peak. In the very short term, the stock is down approximately 15% over the past month. This decline has brought it closer to its 52-week low of ₹630.00.

Technically, the stock is in a short-to-mid-term downtrend, trading below key moving averages like the 50-day and 200-day Exponential Moving Averages (EMA). Immediate support and resistance levels are clustered between ₹1,019 and ₹1,124.

Table 2: Recent Stock Performance & Technical Context

Investment Verdict: A High-Growth, High-Risk Proposition

Should you invest in AXISCADES Technologies?

The answer hinges entirely on your risk appetite and investment horizon.

- For the Aggressive, Growth-Oriented Investor: AXISCADES presents a compelling, albeit risky, story. Its stellar historical profit growth, positioning in strategic sectors, and ambitious future projections are attractive. The recent sharp correction from highs could be seen as a potential entry point for those believing the long-term growth narrative remains intact. The new hyperscaler contract, though small in isolation, validates its capabilities in a lucrative market.

- For the Conservative or Valuation-Sensitive Investor: The stock presents significant hurdles. The extreme valuation (P/E >50) is difficult to justify unless the projected 60%+ earnings growth materializes flawlessly. The lack of analyst coverage increases uncertainty, and the deteriorating working capital efficiency and declining promoter holding are red flags. The current technical downtrend also suggests caution.

Bottom Line:

AXISCADES is not for the faint-hearted. It is a classic “growth at a price” stock where future potential is already richly valued. The recent contract win is a positive operational development but does not materially change the financial scale. Investors should wait for more consistent earnings delivery, an improvement in working capital metrics, and a clearer technical reversal before considering an investment. For existing holders, it’s a hold-with-caution, but new money might be better deployed waiting for either a lower price or stronger fundamental confirmation.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.