Emerald Finance: A High-Growth NBFC at a Crossroads? An Analysis of Its EWA Push and Financial Metrics

What’s Happening With Emerald Finance Stock? A Deep Dive into Financials & Future Outlook

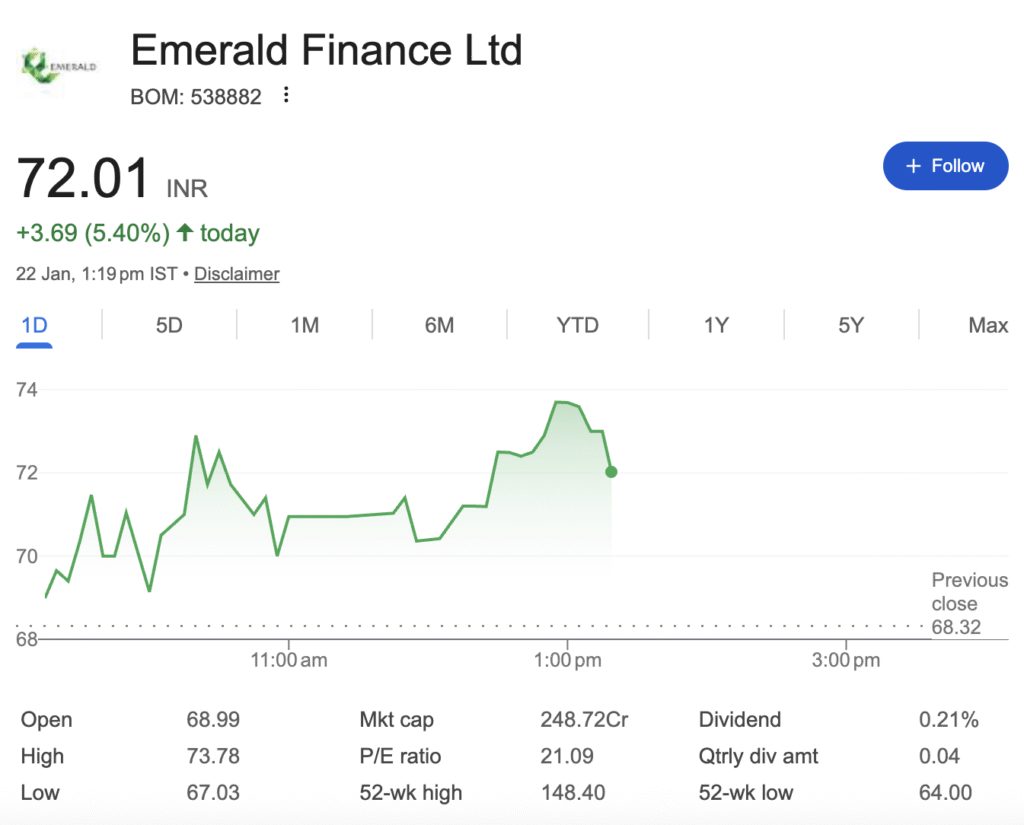

In the dynamic world of Indian non-banking finance companies (NBFCs), Emerald Finance Ltd has charted a remarkable journey. From its origins as a loan distributor to its current pivot as a tech-enabled lender specializing in Earned Wage Access (EWA), the company’s stock has experienced dramatic swings. After a meteoric rise in recent years, the share price has corrected significantly, trading closer to its 52-week low than its high. This analysis delves into the company’s business model, dissects its strong financial growth, and examines the key opportunities and risks that define its path forward, providing retail investors with a comprehensive, data-driven overview.

1. Company Overview

Emerald Finance Ltd, incorporated in 1983 and based in Chandigarh, is a non-deposit-taking NBFC. Its business model has evolved across three core segments:

- Direct Selling Agent (DSA) & Loan Origination: This is the company’s legacy business, where it acts as a distributor for over 40 banks and financial institutions, sourcing products like personal, gold, and home loans. It earns commission on disbursals.

- Retail & MSME Lending: As an NBFC, the company directly lends to retail customers and micro, small, and medium enterprises (MSMEs).

- Earned Wage Access (EWA): This is the company’s flagship and fastest-growing segment. EWA allows employees to access a portion of their already-earned salary before the official payday, offering an alternative to high-cost informal loans.

The company operates primarily in North India (Chandigarh, Punjab, Haryana, Delhi, Uttar Pradesh) but has a loan distribution presence across 85 cities. Its revenue is entirely domestic.

2. Industry & Sector Overview

Emerald operates in the vast Indian NBFC and fintech sector. The Earned Wage Access market is nascent but growing rapidly in India, driven by a large workforce living paycheck-to-paycheck and increased digital penetration. It addresses a genuine need for financial flexibility and is seen as an employee wellness tool by corporates.

- Competitive Landscape: The EWA space is becoming competitive. While Emerald is an early mover, it faces competition from dedicated fintech startups like Refyne and Jify, which are also scaling aggressively. Larger NBFCs and banks could enter the space as it matures.

- Tailwinds: Formalization of the economy, digital adoption, and corporate focus on employee benefits are strong growth drivers.

- Headwinds: The primary risk is regulatory. The Reserve Bank of India (RBI) has not yet issued specific guidelines for EWA products. Any future regulation could impact the business model, fee structures, or capital requirements. Additionally, credit risk during economic downturns is a perennial concern for lenders.

3. Financial Performance Analysis (Last 5 Years)

Emerald Finance has demonstrated a track record of very strong growth, particularly in profitability.

Table 1: Key Financial Growth (Consolidated)

- Growth Trends: The company has delivered a spectacular 5-year compounded profit growth (CAGR) of 47.6%. Recent quarters continue this trend, with Q3 FY26 net profit jumping 61.3% year-on-year to ₹4.0 Crores.

- Margin Expansion: A standout feature is the dramatic improvement in Operating Profit Margin (OPM), which has expanded from 27% in FY20 to 70% in FY25. This suggests significant operating leverage, likely from the scalable, tech-led EWA model.

- Cash Flow: Historically, cash flow from operations has been volatile, a common trait in growing lending and financial services businesses. Recently, cash flow from financing activities has been positive, supporting business expansion.

4. Balance Sheet & Debt Analysis

The balance sheet has strengthened alongside profit growth.

- Asset Growth: Total assets have grown from ₹23 Crores in Mar 2021 to ₹106 Crores in Mar 2025.

- Debt Position: The company utilizes debt to fund its lending operations. Long-term debt stood at ₹141.7 Crores as of March 2025. The Debt-to-Equity ratio is approximately 0.23 (calculated from Mar 2025 data: Debt ₹141.7Cr / Equity ₹860.3Cr), which is considered conservative for an NBFC.

- Liquidity & Efficiency: Cash reserves increased significantly to ₹184.4 Crores in Mar 2025. The working capital cycle (Debtor Days) has improved, falling from 103 days in Mar 2018 to 36 days in Mar 2025, indicating better efficiency in recovering funds.

5. Shareholding Pattern (As of Dec 2025 Quarter)

| Category | Percentage Holding | Change (vs. Mar 2024) |

|---|---|---|

| Promoters | 59.50% | -8.30 pp |

| Foreign Institutional Investors (FII) | 1.74% | -7.66 pp |

| Domestic Institutional Investors (DII) | 0.00% | 0.00 pp |

| Public & Others | 38.76% | +15.96 pp |

Implications: Promoter holding remains high and stable in the recent quarter, indicating skin in the game. However, over a longer 3-year period, promoter holding has decreased by 8.30 percentage points. Notably, FII holding has reduced significantly from 9.4% in Mar 2025 to 1.74% in Dec 2025, while retail public holding has increased substantially. This suggests a shift in shareholder base from institutional to retail investors in recent quarters.

6. Key Positives & Strengths

- Explosive Profitability Growth: The high double-digit CAGR in profits and expanding margins are the core financial strengths.

- Scalable & Modern Business Model: The EWA platform is a tech-enabled, asset-light model with potential for high margins and scalability across corporate partners.

- Conservative Leverage: A low debt-to-equity ratio provides a cushion against economic stress and room for leveraging growth when needed.

- Diversified Revenue Streams: The mix of commission-based distribution and direct lending (including EWA) diversifies income sources.

7. Key Risks & Concerns

- Regulatory Uncertainty: The lack of a clear RBI framework for EWA is the single largest business risk. Adverse regulation could disrupt operations.

- Concentrated Business Geography: Despite a pan-India DSA network, its core lending and EWA operations are focused in North India, exposing it to regional economic factors.

- Asset Quality in a New Segment: As the EWA book grows, the credit performance of this relatively new product category through economic cycles remains untested.

- Valuation & Share Price Volatility: The stock trades at a premium to its book value (P/B of 2.74) and has shown high volatility, falling over 50% from its 52-week high.

8. Recent Developments & Management Focus

The company’s recent earnings highlights and communications underscore a sharp focus on scaling the Earned Wage Access business. Management commentary points to active onboarding of corporate clients for EWA and leveraging technology for growth. The company has also declared dividends, with a payout ratio around 5-7% in recent years, indicating a balance between rewarding shareholders and retaining capital for growth.

9. Valuation Snapshot

- Vs. Historical Self: The current P/E ratio of ~18x is near the middle of its range over the past five years, significantly below its peak of over 70x in early 2025.

- Vs. Industry Peers: Compared to the broader consumer finance industry average P/E of 23.4x, Emerald appears reasonably valued. However, peer comparison is tricky as few listed peers have an identical EWA-focused model.

- Price to Book (P/B): At 2.74x, it is higher than the sector average P/B of 2.42, reflecting the market’s premium for its growth profile.

10. Long-Term Outlook

The long-term outlook hinges on the successful execution of its EWA strategy.

- Growth Triggers: Widespread adoption of EWA by Indian corporates, expansion into new geographical markets, and successful cross-selling of other financial products to its EWA user base are key potential triggers.

- Sustainability of Earnings: The sustainability of its high margins depends on maintaining low operating and credit costs as the EWA business scales. Managing growth while maintaining asset quality is critical.

- Sector Alignment: The company is well-aligned with the fintech and digital lending megatrend in India. Its success is tied to navigating the evolving regulatory landscape for digital financial products.

Objective Summary

Emerald Finance Ltd presents a compelling case of a traditional NBFC transforming into a niche, tech-driven lender. Its financial performance over the past five years has been outstanding, marked by explosive profit growth and soaring margins, largely fueled by its foray into the promising Earned Wage Access market. However, the investment thesis is coupled with distinct risks—primarily regulatory uncertainty surrounding its flagship EWA product and the recent exodus of institutional investors. The stock’s significant correction from its highs has made its valuation more reasonable relative to its growth. For investors, Emerald represents a high-growth, high-potential but also higher-risk proposition within the small-cap finance space, where future performance will be a direct function of its ability to scale its new-age lending model sustainably and navigate the regulatory road ahead.

SEBI-Compliant Disclaimer: This article is for educational and informational purposes only. It has been prepared based on publicly available information and is not an investment advisory or a research report. The content does not constitute a recommendation to buy, sell, or hold shares of Emerald Finance Ltd or any other security. Investors are advised to consult with their own financial advisors and conduct their own independent research and analysis before making any investment decisions. The author and the publisher assume no responsibility for any financial losses or gains arising from decisions made based on this information. Past performance is not indicative of future results.