360 ONE WAM: Wealth Giant’s Q3 Surge Fuels 18% Profit Jump – Is This the Next Big Bet for HNIs in India’s Booming Asset Market?

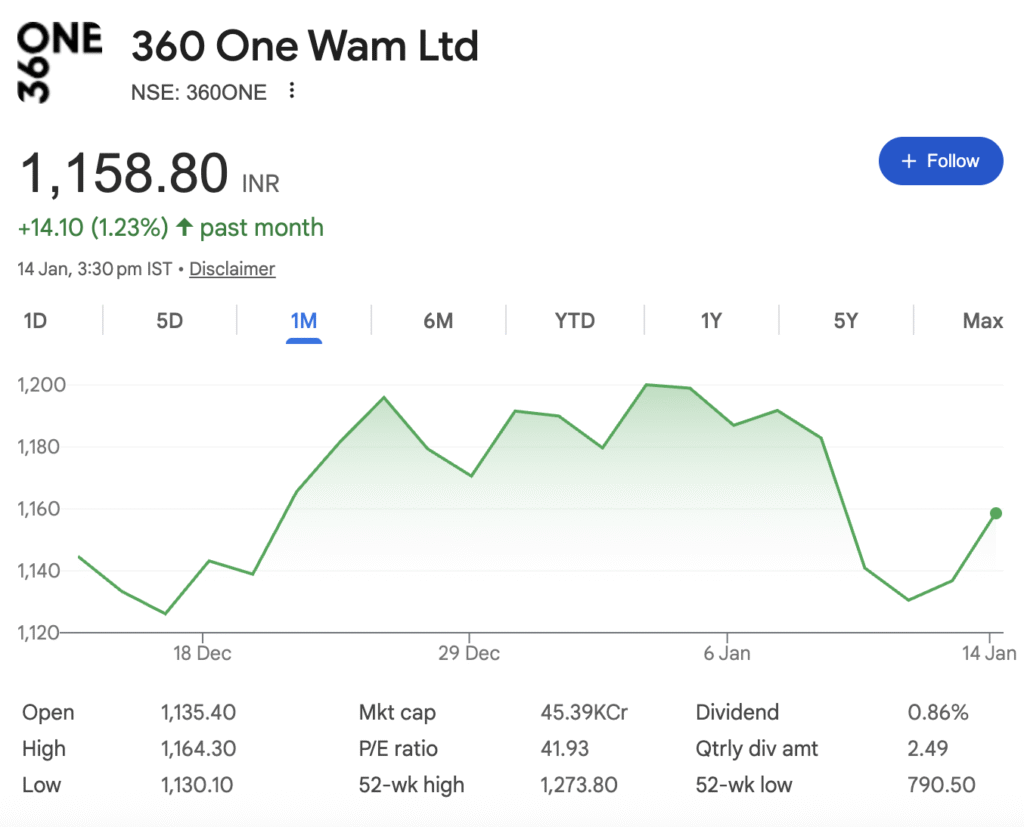

In a market where high-net-worth individuals (HNIs) are pouring billions into alternatives and structured products, 360 ONE WAM Ltd is emerging as the silent powerhouse. With assets under management (AUM) skyrocketing to a staggering ₹7.11 lakh crore and profits climbing 18% year-on-year in Q3 FY26, this wealth manager isn’t just riding the wave—it’s shaping it. But with shares trading at a premium valuation, is now the time to dive in, or should investors wait for a dip? Let’s unpack the numbers that could make or break your portfolio.

Formerly known as IIFL Wealth Management, 360 ONE WAM Ltd has carved out a niche as India’s premier wealth and alternate asset manager. Catering to ultra-high-net-worth individuals (UHNIs), family offices, and institutions, the company offers everything from estate planning to lending solutions. Listed on BSE and NSE under the ticker 360ONE, it’s a pure-play on India’s financialization boom—where rising incomes and market sophistication are driving HNIs to diversify beyond traditional stocks and bonds. Recent moves, like an exclusive tie-up with UBS for cross-border wealth services and a new subsidiary in GIFT City for fund management, signal aggressive expansion into global arenas.

The Bottom Line: Impressive & Accelerating Growth

The company’s recently declared Q3 FY26 results underscore its operational strength. For the quarter ended December 31, 2025, 360 One Wam reported a consolidated net profit of ₹327 crore, marking an 18.5% year-on-year rise. The top-line expansion was even more striking, with revenue from operations surging 51% to ₹1,181 crore. This performance is not a one-off but part of a sustained trend of robust growth in Assets Under Management (AUM), the core driver of its wealth and asset management fees.

*Table: Financial Performance Snapshot – Q3 FY26*

Decoding the Financial Fortress: Profitability and Returns

Beyond the quarterly surge, 360 One Wam’s financials reveal a company with a powerful and efficient operating model.

- Consistent Profit Growth: The company has delivered a profit growth (CAGR) of 39.9% over the last 5 years. Even over three years, Earnings Per Share (EPS) has grown at a healthy annual rate of 15%.

- High Profitability Ratios: It maintains an operating profit margin (OPM) consistently above 58% and a robust Return on Equity (ROE) of 20.6%, indicating excellent efficiency in generating profits from shareholder capital.

- Strong Balance Sheet with a Caveat: While the company’s fundamentals are rated “Good,” analysts note a “High” debt level on a consolidated basis. The consolidated debt-to-equity ratio stands elevated, which is a key factor to monitor.

The Valuation Conundrum: Quality at a Steep Price

This is where the investment thesis for 360 One Wam gets complex. The company’s outstanding quality is universally recognized, but the market has priced it to near perfection.

Table: Valuation & Peer Comparison

Analysts at Smart Investing conclude the stock is “Over Valued” based on intrinsic value estimates, with models suggesting a potential fair value around ₹918. The current price reflects high growth expectations for years to come.

Growth Engines Fueling the Future

For the premium valuation to be justified, 360 One Wam must continue its hyper-growth. Several factors support this possibility:

- Wealth Management Juggernaut: The core Wealth Management segment is a heavyweight, with its ARR AUM soaring 34.5% YoY to ₹2,18,957 crore. The specialized ‘360 ONE Plus’ service for ultra-high-net-worth individuals (UHNIs) grew a remarkable 41.7%, capturing the fastest-growing client segment.

- Strategic Acquisition: The recent acquisition and integration of Batlivala & Karani Securities India Pvt Ltd (B&K Securities) is now contributing to the financials, potentially adding new capabilities and clientele.

- Macroeconomic Tailwinds: India’s growing economy, rising financialization of savings, and increasing number of HNIs create a long-term structural tailwind for wealth managers.

Key Risks and Investor Considerations

- Valuation Sensitivity: The biggest risk is a derating of its high multiples. Any slowdown in growth or market correction could lead to disproportionate stock price declines.

- Promoter Holding Dynamics: While insiders hold a significant ₹62 billion worth of shares aligning their interests, promoter holding is relatively low at 6.26% and has been decreasing. Furthermore, a large portion (89.6%) of the promoter holding is pledged, which is a risk factor to monitor.

- Market Dependence: Performance is linked to capital markets. A prolonged bear market can impact AUM growth and fee income.

The Final Verdict: To Invest or Not?

For the Growth-Oriented Investor with a Long Horizon: 360 One Wam is a best-in-class play on India’s wealth management story. Its financial performance is exemplary, and its growth engines are firing. If you believe the company can consistently outperform and sustain high growth rates for the long term, the current premium may be acceptable. Consider a staggered investment approach to mitigate valuation risk.

For the Value-Conscious or Risk-Averse Investor: The stock is unequivocally expensive. The high P/E and P/B ratios leave little margin for error. There is a significant risk of price correction if quarterly growth ever falters. It might be prudent to wait for a more attractive valuation entry point or consider other players in the financial space with more reasonable multiples.

Analyst Sentiment: The street remains bullish on its prospects, with an average 12-month price target of ₹1,355, implying an upside of nearly 18% from current levels. However, the investment decision must balance this optimism against the clear valuation warnings.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.