Captain Polyplast: Navigating Profit Dips Amid Solar Surge – Is This Small-Cap Gem Ready to Irrigate Investor Portfolios in 2026?

Rajkot, December 24, 2025: In a sector where water scarcity meets innovative tech, Captain Polyplast Ltd (BSE: 536974) has just bagged an Rs 8.17 crore order for solar photovoltaic water pumping systems – a timely boost amid a shocking 74% quarterly profit plunge. But with India’s irrigation machinery market poised for an 11.2% CAGR through 2029, driven by government schemes like PM-KUSUM, could this micro-irrigation player be the underrated pick for savvy investors? Or is the high volatility and mounting debtors a red flag signalling stormy seas ahead? We dive deep into the numbers, prospects, and pitfalls to uncover if Captain Polyplast deserves a spot in your 2026 watchlist.

1️⃣ Business Overview

Company Background & History:

Captain Polyplast Ltd. (CPL) was incorporated in 1997. It began as a micro-irrigation player, went public on the BSE SME platform in 2013, and migrated to the mainboard in 2016. Over 27+ years, it has evolved from a regional irrigation manufacturer to a diversified player in micro-irrigation, solar EPC (Engineering, Procurement, Construction), and polymer marketing.

Core Business Segments:

- Micro Irrigation Systems (MI): Core business. Manufactures and supplies drip & sprinkler irrigation systems, primarily for agriculture.

- Solar EPC Services: A growth vertical started in 2017. Focuses on off-grid solar water pumps (under govt. schemes like PM-KUSUM) and rooftop solar systems.

- Polymer Marketing: Strategic channel partnership with Indian Oil Corporation Ltd. (IOCL) for marketing polymer products in Gujarat.

Revenue Contribution by Segment:

While the exact segmental split isn’t provided, disclosures indicate:

- Micro-Irrigation: Likely the largest contributor (60-70%+), but share is declining as Solar EPC grows.

- Solar EPC: Fast-growing segment. FY26-to-date cumulative orders for 1,500 solar pumps from MSEDCL (~₹41 Cr) signal strong growth.

- Polymer Marketing: Likely a small, stable contributor.

Presence:

- Domestic: Strong network across 16 states via 750+ dealers.

- Global: Exports to Africa, Latin America, and the Middle East.

Business Model (Simplified):

CPL operates a B2B2G (Business-to-Business-to-Government) model.

- Micro-Irrigation: Farmers are the end-users, but sales are heavily driven by government subsidy schemes. CPL works through a process of application collection, subsidy approval, system installation, and then collecting payment partly from the farmer and partly from the government.

- Solar EPC (Pumps): Almost entirely government-scheme driven (PM-KUSUM). CPL gets empanelled as a vendor by state electricity boards (like MSEDCL). It then supplies, installs, and maintains solar pumps for farmers, receiving payment from the government agency.

- Rooftop Solar & Exports: More traditional B2B/B2C commercial operations.

2️⃣ Industry & Sector Analysis

Industry Size & Growth Rate:

- Micro-Irrigation: India’s micro-irrigation coverage is ~15-18% of potential, indicating a long runway. The market is expected to grow at a CAGR of ~10-12%, driven by water scarcity and government push.

- Solar Pumps (Off-grid): A sunrise sector. The PM-KUSUM scheme aims to install 3.5 million solar pumps. The market is poised for high double-digit growth over the next 5 years.

Key Demand Drivers:

- Increasing water stress and the need for efficient irrigation.

- Government Subsidies: PMKSY (Per Drop More Crop) for MI, PM-KUSUM for solar pumps, and PM Surya Ghar for rooftop solar.

- Rising farmer awareness and electricity cost savings from solar pumps.

- Focus on renewable energy and sustainable agriculture.

Government Policies & Regulations:

- Positive: Strong policy thrust via PM-KUSUM, PMKSY, and Surya Ghar schemes. Recent GST reduction from 12% to 5% on MI and solar equipment boosts affordability.

- Risk: Business model is heavily dependent on continuity and timely fund disbursement under these schemes.

Competitive Intensity (Simplified):

- Rivalry (High): Fragmented micro-irrigation industry with national (Jain Irrigation, Finolex Plasson) and numerous regional players. Solar EPC also has increasing competition.

- Supplier Power (Moderate): Raw materials (polymers) are commodity-linked.

- Buyer Power (High): Government is a large buyer (for schemes), giving it pricing power. Farmers are price-sensitive.

- Threat of New Entrants (Moderate): Requires technical know-how, manufacturing setup, and most critically, government empanelments, which act as a barrier.

- Threat of Substitutes (Low): Traditional flood irrigation is inefficient; solar pumps are superior to grid/diesel pumps.

Industry Cycle Positioning:

Both micro-irrigation and off-grid solar pump segments are in the growth phase, supported by structural demand and strong policy tailwinds.

3️⃣ Financial Performance Deep Dive (3 Years Available)

Financial Snapshot (Consolidated):

| Metric / Fiscal Year | FY23 | FY24 | FY25 | Key Observation |

|---|---|---|---|---|

| Revenue (₹ Cr) | 224.6 | 284.3 | 286.8 | Stagnant in FY25 after a jump in FY24. |

| Revenue Growth (%) | – | 26.6% | 0.9% | Growth slowdown. |

| EBITDA (₹ Cr) | 19.8 | 35.2 | 35.1 | Margins expanded, then stabilized. |

| EBITDA Margin (%) | 8.8% | 12.4% | 12.2% | Healthy expansion from FY23 levels. |

| PAT (₹ Cr) | 6.0 | 17.8 | 31.3 | FY25 PAT includes Exceptional Gain of ~₹15.6 Cr. |

| PAT Margin (%) | 2.7% | 6.3% | 10.9% | Skewed by exceptional item. Adjusted PAT ~₹15.7 Cr (5.5%). |

| ROE (%) | 8.3% | 18.6% | 21.0% | Improving steadily. |

| ROCE (%) | 11.3% | 16.7% | 15.0% | Healthy, but dipped in FY25. |

| Debt-to-Equity | 0.80 | 0.93 | 0.44 | Significant deleveraging in FY25. |

| Operating CF (₹ Cr) | 11.3 | -13.7 | 9.0 | Volatile; major stress in FY24. |

| EPS (₹) | 1.18 | 3.36 | 5.54 | FY25 EPS is ~₹2.8 if adjusted for exceptional gain. |

Analysis:

- Quality of Earnings: Low to Moderate. A large portion of FY25 profit came from a one-time exceptional gain (likely asset sale). Adjusted PAT growth is modest. Business is working capital intensive, leading to volatile operating cash flows.

- Margin Expansion/Contraction: EBITDA margin expanded healthily from FY23 to FY24, likely due to operating leverage and better product mix. It stabilized in FY25.

- Red Flags:

- Poor Cash Flow Generation: Operating cash flow is inconsistent and weak relative to profits (e.g., FY24 OCF was deeply negative despite ₹18 Cr PAT).

- High Receivables: Trade receivables (₹186 Cr in FY25) are 65% of annual revenue, indicating very slow collections, typical of government-linked business.

- Low Cash Balance: Consistently minimal cash (~₹1-5 Cr) against significant current debt, indicating tight liquidity.

4️⃣ Balance Sheet & Cash Flow Analysis

- Debt Structure & Repayment Comfort: Debt-to-Eq improved sharply to 0.44x in FY25. However, current borrowings are high (₹56 Cr) vs. long-term debt (₹11 Cr). Short-term liquidity pressure is evident. Interest coverage is comfortable (>4x).

- Working Capital Cycle: A Major Concern. The cycle is stretched. High inventory (₹39 Cr) and extremely high receivables (₹186 Cr) tie up capital. This explains the volatile and weak operating cash flows.

- Capex vs. Cash Generation: Capex has been moderate. The upcoming Ahmedabad factory (70,000 sq. ft.) is the key ongoing project. Cash generation from ops has been insufficient to fund this, leading to reliance on borrowings.

- Free Cash Flow Trend: Largely negative or negligible over the past 3 years, due to working capital drains.

- Promoter Pledging: None. A positive sign.

5️⃣ Management & Corporate Governance

- Promoter Background: Founders are the Khichadia family with deep, 25-30+ years of experience in irrigation. The second generation (Ritesh Khichadia – IIT/IIM) brings professional strategy and finance expertise.

- Promoter Holding Trend: High and stable at 69.08% (as of Sep 2025). This aligns promoter interests with minority shareholders.

- Management Commentary Consistency: Commentary has consistently focused on diversification into solar, improving product mix, and capacity expansion. Recent announcements align with this strategy.

- Related Party Transactions (RPTs): The recent order disclosure explicitly states that the order is not an RPT. No material RPTs were highlighted in the investor presentation.

- Governance Red Flags: No major red flags like pledging or controversial RPTs. However, the company’s history of volatile cash flows and high receivables requires strong governance on working capital management.

6️⃣ Competitive Positioning & Moat

- Key Competitors: Jain Irrigation (large, diversified), Finolex Plasson, EPCO, KSB, and many unorganized players.

- Market Share: Small but meaningful player in micro-irrigation. A niche, growing player in the solar pump EPC space within its operating states (Gujarat, Maharashtra, AP).

- Pricing Power: Low. Products are largely commoditized, and buyers (government, farmers) are price-sensitive.

- Entry Barriers: Moderate. Barriers include established dealer networks, brand trust among farmers, and crucially, government empanelments, which are not easy to secure.

- Switching Costs / Brand Strength: Brand has regional strength (“Captain”). Switching costs for farmers are low, but relationships with dealers and government departments provide some stickiness.

- Scalability of Business Model: Model is scalable geographically (adding new states) and across adjacent product lines (MI to Solar). However, scalability is constrained by working capital availability.

7️⃣ Growth Triggers & Future Outlook (2–3 Years)

- Capacity Expansion: New Ahmedabad plant (Q3 FY26) to enhance capacity for critical MI components, improving margins.

- Strong Order Book / Pipeline: Cumulative empanelment for 1,500 solar pumps in FY26 (worth ~₹41 Cr+) provides revenue visibility. Potential for more orders under PM-KUSUM.

- Margin Levers: 1) Operating leverage from the new plant, 2) Higher mix of commercial (non-subsidy) sales and exports, 3) Growth in Solar EPC, which may have better margins.

- Industry Tailwinds: Multi-year government schemes (KUSUM, Surya Ghar) ensure a steady demand pipeline.

- Long-term Visibility: The government’s focus on water conservation and clean energy provides strong thematic tailwinds for the next 5+ years.

8️⃣ Valuation Analysis

- Current Valuation (Based on FY25 Adjusted*):

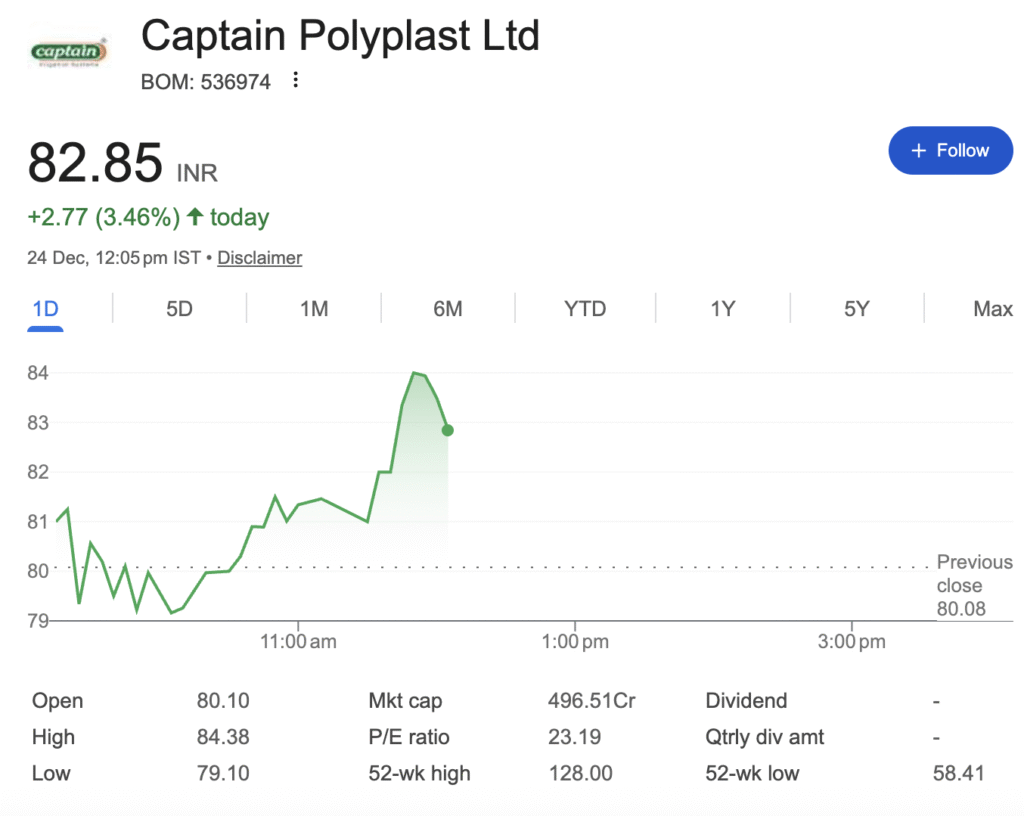

- P/E (Adjusted): ~31.6x (CMP ₹82.85 / Adj. EPS ~₹2.62)

- P/B: ~3.3x (CMP / BVPS ~₹25)

- EV/EBITDA: ~12.5x (Market Cap + Net Debt ~₹550 Cr / EBITDA ₹35.1 Cr)

- Peer Comparison: Trades at a premium to some traditional irrigation peers but may be compared to smaller solar EPC companies, where multiples are often higher.

- Historical Average: Current P/E is below its 52-week high valuations but above its long-term average, especially after the recent run-up.

- Valuation Justification: The premium is for its growth exposure to the solar pump theme. The market is valuing future growth from the Solar EPC segment, not just the stagnant MI business. However, at ~31x adjusted earnings, growth execution needs to be flawless.

Verdict: The stock is fairly valued to slightly expensive based on current earnings, but positioned for growth. The valuation hinges entirely on successful execution in the solar segment and improvement in cash flows.

9️⃣ Risk Factors (Very Important)

- Business & Execution Risks: High dependency on government subsidy disbursements. Execution delays in the new plant or order fulfilment.

- Financial Risks: Extremely high working capital requirements. A poor cash conversion cycle can lead to perpetual debt and liquidity crunches. This is the biggest risk.

- Industry Risks: Changes in government policy or a slowdown in scheme implementation. Delays in subsidy payments by states.

- Regulatory Risks: Any reduction in subsidy rates or alteration in scheme guidelines.

- Competition Risks: Intense competition in both MI and solar EPC squeezing margins.

🔟 Investment Thesis

Bull Case (Why It Can Outperform):

- Becomes a successful play on the PM-KUSUM scheme, with solar EPC contributing significantly to profits.

- New Ahmedabad plant drives operating leverage and margin expansion.

- Management successfully improves working capital cycle, leading to re-rating due to improved cash flows and ROE.

- Consistent order inflows from multiple states under solar schemes.

Bear Case (What Can Go Wrong):

- Working capital spiral continues, leading to increased debt and interest costs, eroding profitability.

- Government delays in payments or scheme rollout intensify cash flow problems.

- Fierce competition in solar EPC leads to margin erosion, making growth less profitable.

- Inability to scale profitably despite order wins.

Key Monitorables for Investors:

- Quarterly Trade Receivables (Days): This number must start declining.

- Operating Cash Flow: Must turn consistently positive and align with net profit.

- Solar EPC Order Inflow & Margins: Track new order announcements and segment profitability.

- Progress of Ahmedabad Plant: Timely commissioning and utilization.

- Debt Levels: Especially short-term borrowings.

📌 Final Verdict

Suitable for: Long-term investors who understand the thematic play and have a 3-5 year horizon. Not suitable for short-term trading due to illiquidity and volatility. A SIP approach could be considered to average into the thematic story.

Investor Profile: Moderate to Aggressive. Conservative investors should avoid due to the high working capital risk and cash flow volatility.

Clear Conclusion:

Captain Polyplast is a thematic bet on India’s micro-irrigation and solar pump adoption, backed by strong government schemes. The company has a credible promoter, a clear growth strategy, and visible near-term order momentum. However, its historical financials reveal a critical weakness: poor cash flow generation due to a bloated working capital cycle. The investment thesis will only work if growth in the solar segment is accompanied by better capital discipline. Until evidence of sustained improvement in cash flows emerges, the stock carries high operational risk. It is an “Execution-Play” – success depends entirely on management’s ability to deliver growth profitably and with better cash conversion.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.