Navkar Corporation: A Deep Dive into the JSW-Backed Logistics Play – Value Trap or Turnaround Bet?

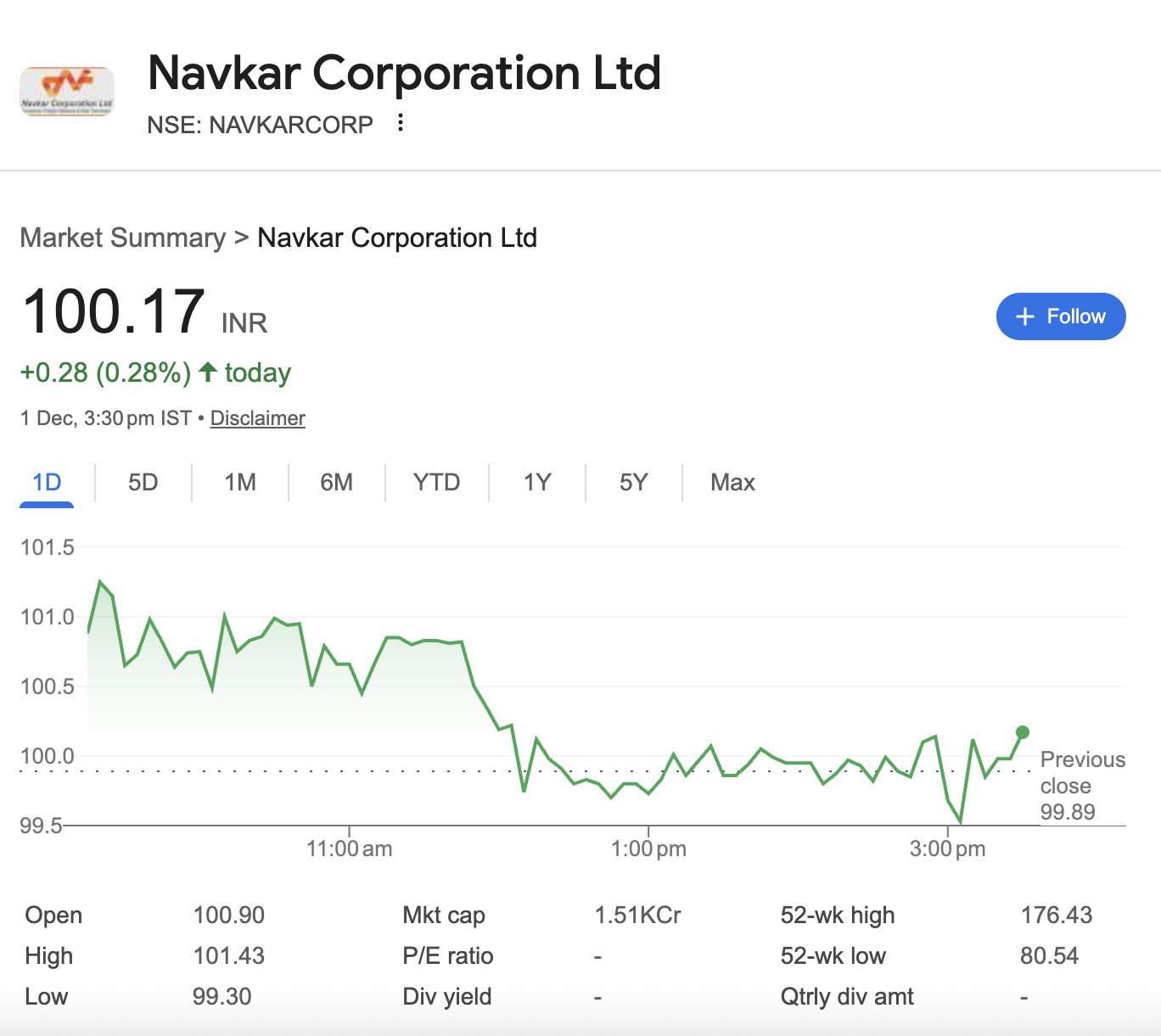

In the bustling corridors of India’s logistics and port-led growth story, Navkar Corporation Ltd (NSE: NAVKARCORP) presents a curious case. Trading quietly around the ₹100 mark, far from its 52-week high of ₹176, the company appears subdued on the surface. However, a bottom-up analysis, spurred by its acquisition by port giant JSW Infrastructure, reveals a narrative sharply at odds with its current market sentiment. This report delves into the financial veins and growth arteries of Navkar to separate signal from noise.

The Core Proposition: More Than Just a Stock Tick

Navkar is no longer a standalone entity. Its acquisition by JSW Infrastructure Limited, India’s second-largest private port operator, has fundamentally altered its strategic orbit. Navkar is now the spearhead for JSW’s ambitious foray into integrated logistics, aiming to build a seamless cargo highway from ports to hinterlands.

Financial Health Scan: The Vital Signs

A look beyond the surface P/E (which remains undefined due to historical phases) is crucial. The real story unfolds in the operational and segmental data post-acquisition.

Table 1: Operational Pulse (Post-JSW Integration)

| Metric | Q2 FY26 Performance | Implied Trend |

|---|---|---|

| Domestic Cargo Volume | Up 46% YoY | Explosive growth in inland logistics. |

| EXIM Cargo Volume | Up 20% YoY | Strong traction in core port-connectivity services. |

| ICD Volume Handled | 20,000 TEUs (Q2 FY26) | Steady utilization of inland container depots. |

Table 2: Financial Fragment (Logistics Segment – H1 FY26)

| Parameter (₹ Crore) | H1 FY26 | Analysis |

|---|---|---|

| Revenue from Operations | 300.8 | Robust top-line for the segment. |

| Operating EBITDA | 44.8 | Indicates underlying operating profitability. |

| EBITDA Margin | ~14.9% | Healthy margin profile for capital-intensive logistics. |

| PAT (Post-Tax) | 8.6 | Profitable at net level; scalability is key. |

Source: JSW Infrastructure Investor Presentation, Dec 2025.

The Growth Rocket Fuel: JSW’s Master Plan

This is where the investment thesis gets compelling. Navkar is not growing in a vacuum. It is the central piece in JSW Infrastructure’s ₹9,000 crore logistics CAPEX plan (FY25-FY30).

Key Growth Drivers:

- Monetizing the JSW Ecosystem: Navkar will develop Greenfield Inland Container Depots (ICDs) and logistics parks near JSW Group’s vast steel, cement, and paint plants, guaranteeing baseline cargo.

- Asset-Light Expansion via GCTs: The successful bid for a Gati Shakti Cargo Terminal (GCT) at Arakkonam provides a blueprint for asset-light, high-return expansion using railway land.

- Inorganic Ambition: JSW has explicitly stated that acquiring Navkar is a template for future acquisitions of CFS and ICD businesses, signaling consolidation potential.

- Macro Tailwinds: The PM Gati Shakti and National Logistics Policy are multi-year growth catalysts for integrated players.

The FY30 Ambition: JSW targets a logistics revenue of ₹8,000 crore and EBITDA of ₹2,000 crore. Even a conservative share for Navkar’s integrated operations implies a staggering growth runway from its current scale.

Risk Assessment: The Other Side of the Coin

- Execution Risk: The ambitious plan hinges on timely project execution and seamless integration.

- Economic Cyclicality: Logistics demand is linked to industrial and trade activity, susceptible to economic slowdowns.

- Stock Performance Hangover: The stock’s steady decline from highs may continue to weigh on sentiment in the near term, requiring investor patience.

Verdict: To Invest or Not to Invest?

Analyst’s Perspective:

Navkar Corporation represents a classic “show me” story transitioning into a “prove it” phase. The current stock price (~₹100), hovering near the lower end of its yearly range, seems to discount the old standalone entity, not the future JSW logistics champion.

The Investment Case is built on:

- Strategic Parentage: Unmatched backing from a cash-rich industry leader (JSW Infra has ~₹3,088 Cr cash).

- Visible Growth Pipeline: Clear 5-year plan with defined CAPEX and revenue targets.

- Operational Momentum: Demonstrated sharp volume growth post-acquisition.

Who Should Consider It?

This is a high-conviction, long-term (3-5 year) play. It is suited for investors who:

- Believe in India’s infrastructure and logistics narrative.

- Can look beyond quarterly volatility and focus on asset and network building.

- Understand that true value accretion will come as Navkar’s financials consolidate and reflect in JSW Infra’s (and consequently Navkar’s) standalone reports.

Final Recommendation: CAUTIOUSLY OPTIMISTIC.

For investors with a higher risk appetite and a long horizon, Navkar at current levels offers an intriguing entry point into a transformational story backed by one of India’s most aggressive industrial groups. It is less a bet on a single company and more a strategic wager on JSW’s execution prowess in logistics. However, the market’s skepticism demands patience. Accumulation on dips, with a strict focus on quarterly execution updates against stated plans, is a prudent strategy.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice., We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.