KMC Speciality Hospitals: A Micro-Cap Healthcare Gem Riding a Profitability Tsunami – Should You Invest?

In the bustling landscape of Indian healthcare stocks, where giants often dominate headlines, a focused player from Trichy, Tamil Nadu, is scripting a remarkable growth story. KMC Speciality Hospitals (India) Ltd (BOM: 524520) is no longer flying under the radar. Its recent quarterly results have sent a clear signal to the market: this is a story of robust execution, expanding margins, and a clear pathway for sustained growth.

For investors scouting for potential multi-baggers in the small-cap space, a deep dive into KMC is not just recommended; it’s essential.

The Q2 FY26 Blowout: More Than Just Top-Line Growth

The company’s performance for the quarter ending September 2025 isn’t just good; it’s a masterclass in profitable scaling. While revenue growth is impressive, the real story lies in how efficiently this revenue is trickling down to the bottom line.

The table below showcases a financial explosion that is hard to ignore:

| Financial Metric (INR Crores) | Q2 FY25 | Q2 FY26 | YoY Growth | The Analyst’s Take |

|---|---|---|---|---|

| Total Income | 56.7 | 76.1 | +34.3% | Strong top-line momentum. |

| EBITDA | 13.0 | 22.1 | +70.2% | Profitability is growing twice as fast as revenue. Superb operating leverage. |

| EBITDA Margin | 22.9% | 29.0% | +610 bps | A massive expansion, indicating superior cost control and pricing power. |

| Profit After Tax (PAT) | 3.9 | 10.7 | +175% | The pièce de résistance. Earnings have nearly tripled. |

| PAT Margin | 6.9% | 14.0% | +710 bps | The company is keeping significantly more of every rupee it earns. |

The Engine Room: Operational Metrics That Validate the Model

Financials are an outcome of operational excellence. KMC’s key performance indicators (KPIs) reveal a hospital operating at peak efficiency, successfully monetizing its expanded capacity.

| Operational Metric | Q2 FY25 | Q2 FY26 | Change | What This Tells Us |

|---|---|---|---|---|

| Occupied Beds (Avg per day) | 229 | 241 | +5% | Demand is steadily absorbing new capacity. |

| Bed Occupancy Rate | 69% | 73% | +4 pp | Moving towards optimal utilization. |

| Blended ARPOB (₹) | 26,091 | 32,710 | +25% | The key driver. They are earning significantly more per occupied bed per day. |

| Average Length of Stay (Days) | 5.6 | 4.9 | -13% | Higher efficiency; treating more patients without increasing stay duration. |

The ARPOB Leap: The 25% surge in Average Revenue Per Occupied Bed (ARPOB) is arguably the most critical number. It suggests a favourable mix of higher-margin specialities, better realizations, and effective pricing.

The Growth Catalyst: “Maa Kauvery” and the Capacity Expansion

The stellar performance isn’t accidental. It’s the direct result of a well-timed and well-executed expansion strategy. In January 2024, KMC operationalized “Maa Kauvery,” a new 200-bed facility dedicated to Mother and Child Care. This increased the company’s total capacity from 250 beds to 450 beds—a massive 80% jump.

The Q2 FY26 results are the first clear evidence that this new capacity is not lying vacant but is being successfully monetized at highly profitable rates. This “capacity-led growth” phase is precisely what investors look for in small-cap compounders.

Investment Thesis: The Bull vs. The Bear

The Bull Case:

- Proven Execution: The management has demonstrated its ability to plan and execute a major expansion without compromising profitability.

- Regional Dominance: With 92% of in-patients coming from its catchment area, it has a strong, defensible moat in Trichy and surrounding districts. Its Centers of Excellence (e.g., Neurosciences, Organ Transplants) draw patients from over 200 km away.

- Parental Backing: Backed by Sri Kauvery Medical Care, a seasoned healthcare group with 2,500+ beds, providing strategic depth and operational expertise.

- Strong Balance Sheet: Despite expansion, the Debt-to-Equity ratio stands at a comfortable 0.42, with a robust cash balance of ₹32.7 Cr. The financial risk is manageable.

- Sector Tailwinds: It is a direct play on India’s rising healthcare demand and medical tourism.

The Bear Case & Risks:

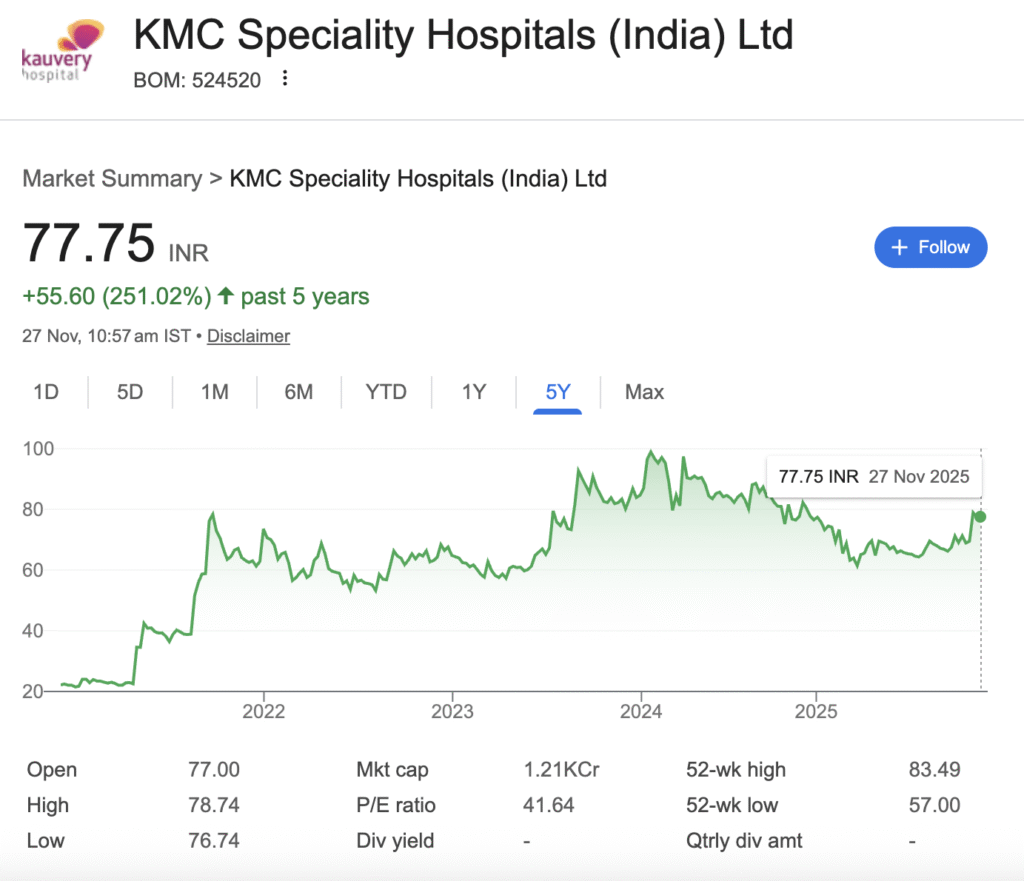

- Rich Valuations: Success has its price. The stock is trading at a P/E of over 41 (as of late November 2025), which is a significant premium. It prices in near-perfect execution for the foreseeable future.

- Execution Stumbles: The ability to consistently maintain high occupancy and ARPOB at the new facility will be critical. Any slip-up could severely impact sentiment.

- Geographical Concentration: Its heavy reliance on one region is a double-edged sword; any local economic downturn or increased competition could hurt.

- Small-Cap Volatility: As a micro-cap stock (Market Cap ~₹1,200 Cr), it is inherently more volatile and less liquid than its large-cap peers.

Verdict: To Invest or Not to Invest?

KMC Speciality Hospitals presents a compelling, high-growth narrative backed by exceptional recent financial performance. The company is in a sweet spot where capacity expansion is directly translating into surging profits.

From an investor’s perspective:

- For Growth-Oriented Investors with a higher risk appetite and a long-term horizon, KMC represents a potent opportunity. The Q2 numbers validate the growth story, and if the company can sustain this momentum, current valuations may still be considered attractive in hindsight.

- For Conservative, Value-Focused Investors, the steep run-up in price and premium valuation warrants caution. Waiting for a potential market correction or a quarter of consolidated performance might offer a better risk-reward entry point.

Final Analysis: KMC Speciality Hospitals is not just a stock; it’s a well-orchestrated growth project that is currently firing on all cylinders. While the risks associated with a high-flying small-cap are real, the quality of its earnings growth, the clarity of its expansion strategy, and its operational excellence make it a stock that deserves a dedicated spot on every investor’s watchlist, if not in their portfolio.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.