Ameenji Rubber: This Small-Cap Gem is Riding India’s Infra Boom with 103% Profit Surge

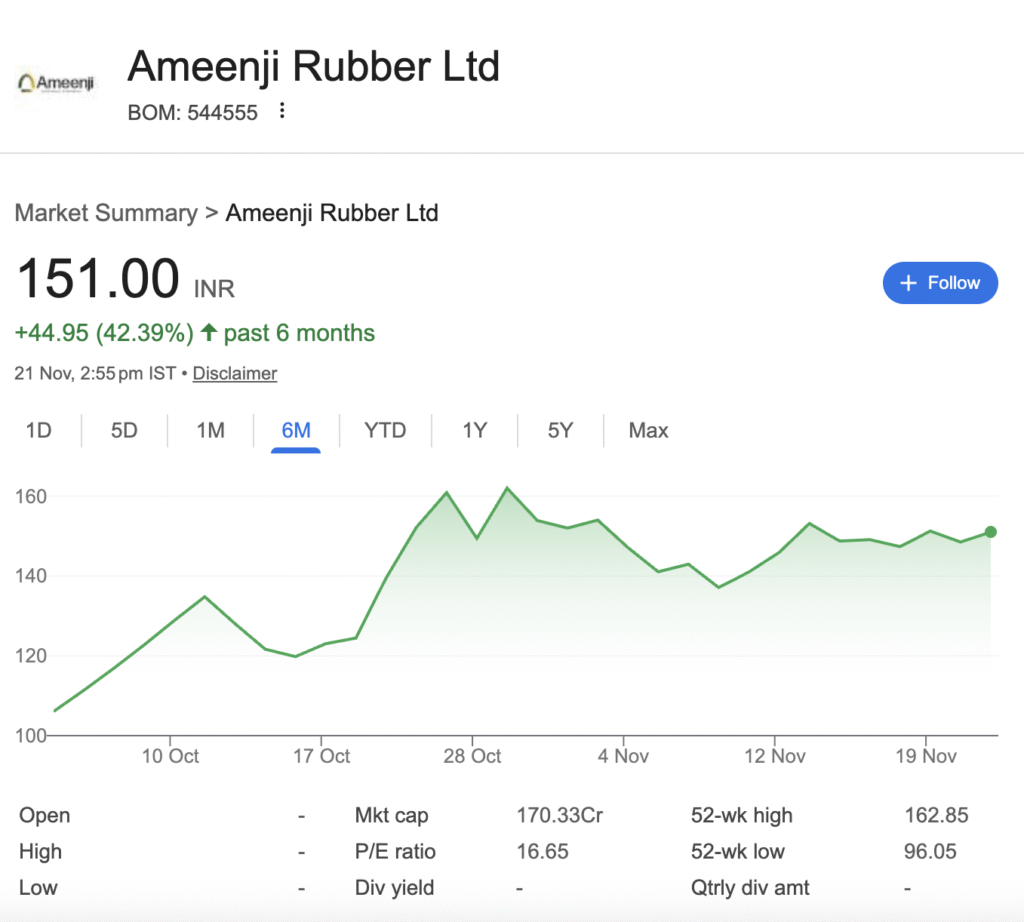

In the bustling landscape of Indian small-caps, where hype often overshadows fundamentals, Ameenji Rubber Ltd (BOM: 544555) is making a compelling case based on sheer performance. While the stock has rocketed 42.39% in the past six months, the real story lies beneath the surface—in its explosive financials, its unassailable regulatory moat, and its direct pipeline to the government’s colossal infrastructure spending.

This isn’t just a rubber manufacturer; it’s a critical supplier building the backbone of India’s railways and highways. For investors looking for a concrete play on the nation’s development, Ameenji Rubber demands a closer look.

The Financial Engine: From Steady to Stellar

The company’s transition from a steady player to a high-growth contender is starkly visible in its half-yearly numbers. The bottom-line growth is nothing short of spectacular.

| Financial Snapshot (₹ in Lakhs) | H1 FY26 | H1 FY25 | YoY Growth % | Key Investor Takeaway |

|---|---|---|---|---|

| Revenue from Operations | 4,270.41 | 3,936.94 | 8.47% | Steady top-line growth. |

| EBITDA | 1,143.70 | 709.05 | 61.30% | Operational efficiency soaring; massive margin expansion. |

| EBITDA Margin % | 26.63% | 17.99% | 480 bps expansion | Core profitability is transforming. |

| Profit After Tax (PAT) | 437.59 | 215.00 | 103.53% | Profits have more than doubled, indicating superior cost control or product mix. |

| Net Margin % | 10.19% | 5.45% | 474 bps expansion | More of each rupee of sales is converting to profit. |

| Earnings Per Share (EPS) | ₹ 5.28 | ₹ 2.60 | 103.08% | Direct benefit to shareholder value. |

This dramatic margin expansion suggests a strategic shift towards higher-margin, engineered products and improved operational leverage, a key signal of a maturing business hitting an inflection point.

The Bull Case: Why the Street is Betting on Ameenji

- The “Approval” Moat: In the B2B infrastructure space, certifications are the ultimate gatekeeper. Ameenji holds the golden tickets: RDSO (Indian Railways) and MoRTH (Ministry of Road Transport & Highways). These are not just accolades; they are a formidable barrier to entry that guarantees a seat at the table for multi-year government and PSU projects.

- A Direct Play on National Capex:

- Railways: The Union Budget allocated ₹2.62 Lakh Crore to railways. With plans to upgrade 40,000 conventional coaches to Vande Bharat standards, Ameenji’s sole plates, vestibules, and level crossing pads are in direct demand.

- Highways & Bridges: The company’s elastomeric bearings and expansion joints are essential components for bridges and flyovers, benefiting from the relentless national highway expansion.

- Strategic Growth Levers in Motion:

- Capacity Expansion: The company is deploying IPO proceeds to launch a new conveyor belt manufacturing line, diversifying into the mining, cement, and steel sectors.

- Global Ambitions: With a CE mark for Europe and a newly incorporated subsidiary in North Carolina, USA (Ameenji Rubber Inc.), the export footprint is set to widen beyond existing markets like Saudi Arabia and Poland.

From a research perspective, the case for Ameenji Rubber is powerful, but it comes with caveats.

- Strengths: Explosive profit growth, a niche market with high entry barriers, clear industry tailwinds, and a sensible diversification strategy.

- Risks: The stock is not cheap, trading at a P/E of 16.65x. It is a small-cap (Market Cap: ~₹170 Cr), which inherently carries higher volatility and liquidity risks. Furthermore, the company’s finance costs have risen significantly, a metric that requires monitoring in subsequent quarters.

The Bottom Line:

Ameenji Rubber Ltd presents a classic “picks and shovels” investment opportunity. Instead of betting on the entire infrastructure sector, you are betting on a critical, approved supplier to that sector. The H1 FY26 results demonstrate that the company is not just benefiting from macro trends but is also executing superbly at an operational level.

For investors with a higher risk appetite and a medium to long-term horizon, Ameenji Rubber offers a compelling narrative of growth, quality, and strategic positioning. It is a stock that seems poised to build wealth, quite literally, on the foundations of India’s future.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice., We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.