Vaibhav Global Ltd.: A Deep Dive Analysis for Discerning Investors – To Invest or Not?

The Enigma of a Vertically Integrated Retail Player

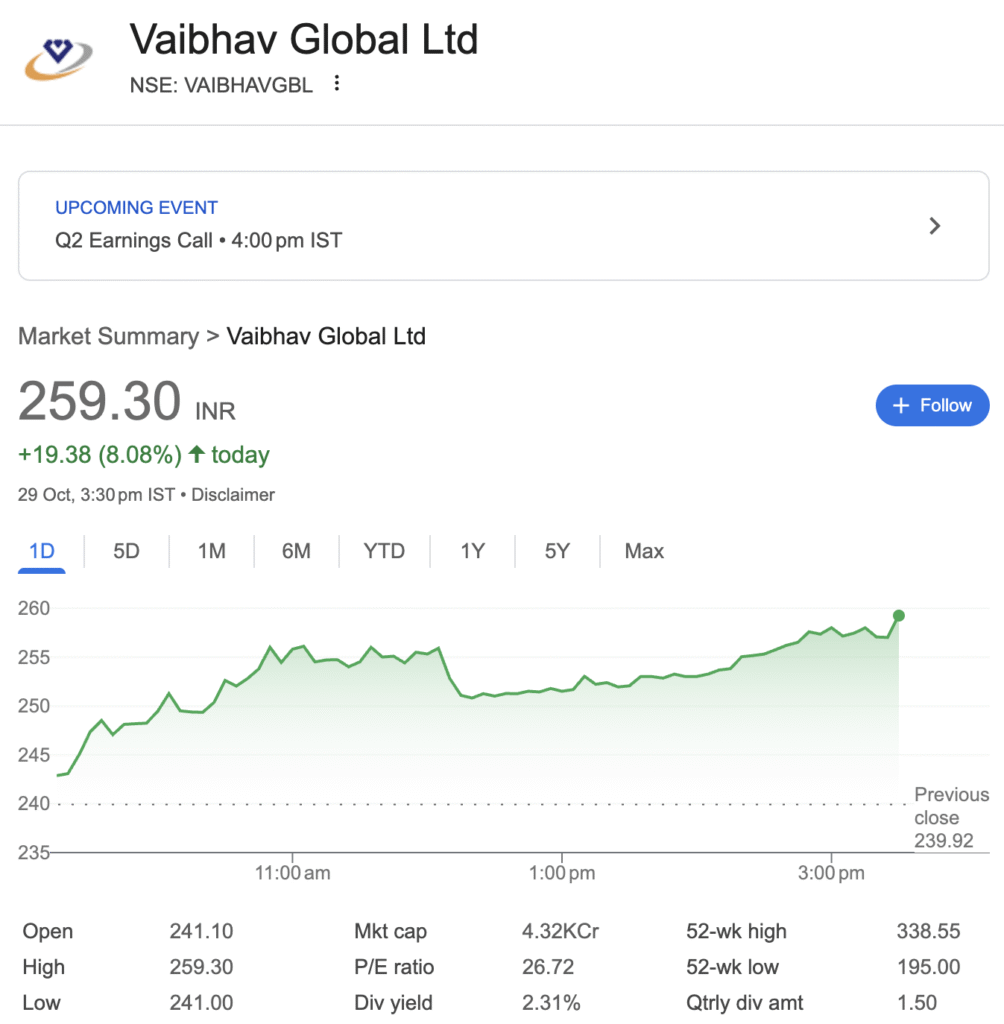

In the bustling landscape of Indian equities, Vaibhav Global Limited (VGL), a small-cap stock with a market capitalization of approximately ₹4,298 crore, often sparks curiosity among investors. This vertically integrated digital retailer of fashion jewellery and lifestyle products has carved a unique niche, serving customers in the developed markets of the US, UK, and Germany directly through its proprietary TV shopping channels and digital platforms. The company’s stock, trading at ₹259 (as of October 29, 2025), witnessed a rise of ₹19 (8%).

The critical question confronting investors today is whether VGL’s current valuation presents a compelling entry point for long-term gains or if its muted growth trajectory warrants caution. This deep-dive analysis dissects VGL’s business model, financials, growth levers, and risks to arrive at a reasoned investment thesis.

Deconstructing the Business Model: A Tale of Vertical Integration

Vaibhav Global’s operational strength lies in its vertically integrated structure. The company controls its entire supply chain, from global sourcing across 30+ countries and in-house manufacturing in Jaipur to direct retailing via its owned channels. This integration allows it to maintain industry-leading gross margins of around 63.5%.

- Omnichannel Retail Presence: VGL reaches an estimated 127 million households through its TV home shopping networks, including Shop LC in the US, Shop TJC & Ideal World in the UK, and Shop LC in Germany. This is complemented by a growing digital footprint comprising e-commerce websites, mobile apps, and presence on third-party marketplaces like Amazon and Walmart.

- Asset-Light Expansion: The company’s model is inherently scalable with limited capex requirements, allowing it to generate healthy free cash flows.

Financial Health Check: A Story of Steady Sales but Strained Profits

A decade-long review of VGL’s financial performance reveals a narrative of consistent top-line expansion but fluctuating profitability.

Table: Key Financial Performance Indicators (Consolidated)

| Fiscal Year | Revenue (₹ Cr.) | Operating Profit (₹ Cr.) | OPM (%) | Net Profit (₹ Cr.) | EPS (₹) |

|---|---|---|---|---|---|

| Mar 2021 | 2,540 | 370 | 15% | 272 | 16.70 |

| Mar 2022 | 2,752 | 281 | 10% | 237 | 14.50 |

| Mar 2023 | 2,691 | 200 | 7% | 105 | 6.36 |

| Mar 2024 | 3,041 | 269 | 9% | 127 | 7.72 |

| Mar 2025 | 3,380 | 290 | 9% | 153 | 9.23 |

| TTM (Trailing Twelve Months) | 3,437 | 294 | 9% | 163 | 9.82 |

The data indicates that while revenue has grown at a 5-year CAGR of 11%, operating profit margins have compressed significantly from the highs of 15% in FY21 to around 8-9% recently. This suggests potential pressures from competition, rising costs, or product mix changes.

Cash Flow & Returns: The Silver Lining

Despite profitability challenges, VGL has demonstrated a commendable track record of shareholder returns and robust cash generation.

- Dividend Payout: The company maintains a healthy dividend payout policy of 62.7%. It recently declared its 2nd interim dividend of ₹1.50 per share for FY26, translating to a handsome dividend yield of 2.33%.

- Cash Flow Generation: The company has been net cash positive, with a strong balance sheet showing net cash of ₹156 crore as per recent reports.

- Return Ratios: The Return on Capital Employed (ROCE) and Return on Equity (ROE) for the latest year stood at 16.0% and 11.4%, respectively. These are respectable, though not exceptional, figures.

Table: Key Investment Valuation Multiples

Growth Levers and Strategic Initiatives: Fueling the Future

For VGL to command a higher valuation, it must demonstrate a clear path to accelerated growth. The company is pinning its hopes on several strategic pillars:

- International Market Expansion: The re-entry into Germany and the acquisitions of Ideal World (UK) and Mindful Souls are key growth vectors. Germany is expected to turn EBITDA positive in FY26.

- Digital Transformation: The company is aggressively expanding its digital horizons through OTT platforms (Roku, Google TV), social retail, and live interactive apps. In the US, OTT sales have grown from $2.2 million in FY21 to $10.5 million in H1 FY26.

- Product & Brand Innovation: VGL launches approximately 14,000-15,000 new jewellery designs annually. It is also strengthening its owned brand portfolio, which contributed ~41% to gross B2C sales in H1 FY26, with a target to reach 50% by FY27.

Risk Assessment: The Investor’s Dilemma

No investment analysis is complete without a thorough risk evaluation.

- Muted Growth & Profitability: The company’s poor sales growth of 11.2% over the past five years and declining operating profits are primary concerns. The operating profit has grown at a negative CAGR of -5.36% over the last 5 years.

- Competitive Intensity: VGL operates in a highly competitive space against deep-pocketed players, which could pressure margins further.

- Technical & Market Sentiment: The stock has underperformed the market significantly over multiple time periods (1-year, 3-year, and 5-year). Recent technical analysis suggests a mildly bearish daily trend, indicating weak short-term sentiment.

Valuation & Final Verdict: Is Vaibhav Global a Buy?

The core of the investment decision rests on valuation and future growth potential.

- Intrinsic Value Estimates: Independent analysis suggests a median fair value of ₹411.80 for VGL, based on historical valuation models. This implies a potential upside of over 60% from the current price of ~₹258.

- Relative Valuation: VGL appears significantly undervalued relative to its industry peers. Its P/E ratio of 26.3 is less than half the industry P/E of 61. Similarly, its P/B ratio of 3.2 is a fraction of peers like Titan, which trades at a P/B of over 12.

The Analyst’s Call: A Cautious “Buy” for Long-Term Investors

Based on a bottom-to-top analysis, Vaibhav Global Ltd. presents a classic case of a value stock with identifiable growth triggers.

- The Positives: A virtually debt-free balance sheet, strong cash flow generation, consistent dividend yield, and a distinct, scalable business model are undeniable strengths. The current valuation is undemanding, and prices are much of the past pessimism.

- The Caveats: Investors must be patient. The stock is not a likely candidate for rapid re-rating unless the company delivers sustained improvement in revenue growth and operating margins. The success of its international expansions and digital initiatives is crucial.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.