TCC Concept Ltd: A Meteoric 3,711% Rise – Acquired Pepperfry, Is This High-Flying Stock Still a Buy?

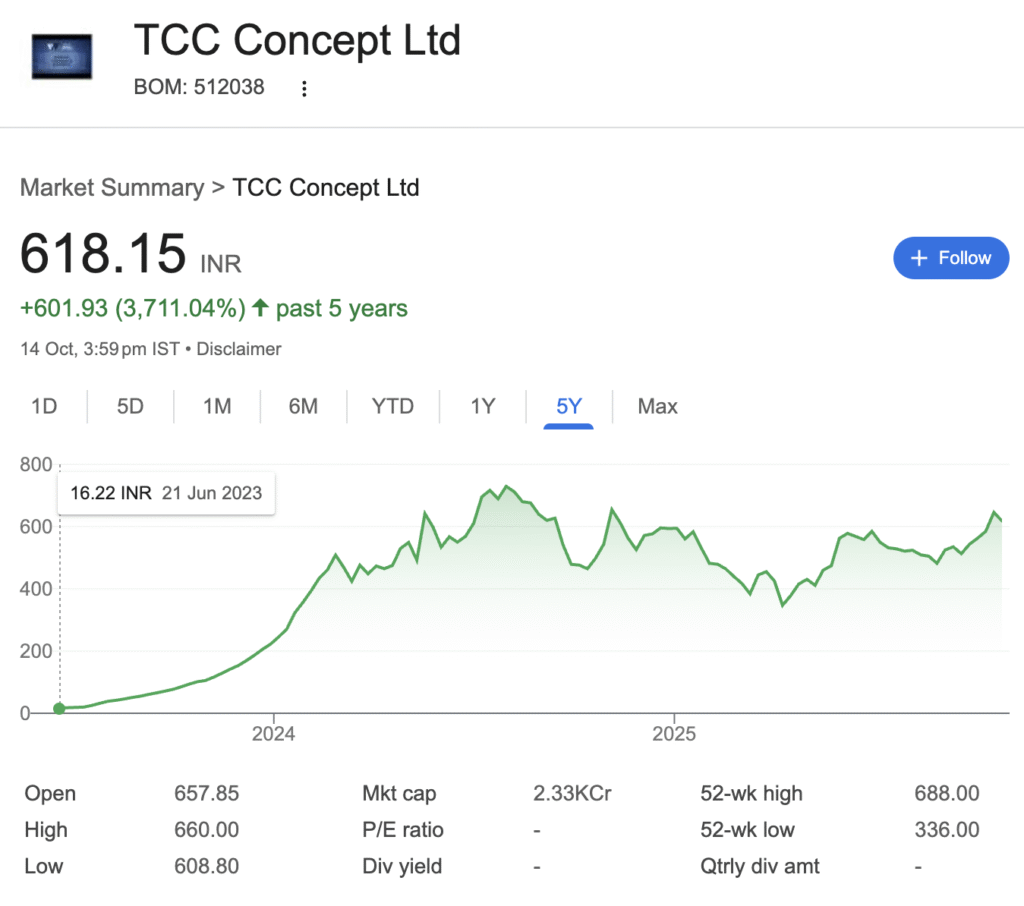

In one of the most spectacular rallies in recent memory, TCC Concept Ltd (BOM: 512038) has delivered a staggering 3,711% return over five years, transforming every ₹10,000 invested into nearly ₹381,000. Now trading at ₹618.15 with a market capitalization of ₹2,330 crores, this micro-cap turned small-cap phenomenon has captured investor attention. But after this parabolic rise and its recent blockbuster acquisition of Pepperfry Limited, the critical question for investors is whether TCC Concept still has runway or is running on fumes.

The Balance Sheet Breakdown: Profits Soaring, But at What Cost?

TCC’s transformation isn’t smoke and mirrors; it’s etched in its ledgers. From a FY24 revenue of ₹81.3 crore, the firm clocked a blistering 15% annual uptick to ₹93.5 crore in FY25, fueled by IT segment margins hitting 72% EBITDA. Yet, quarterly volatility tells a tale of acquisition integration pains: Q1 FY26 sales dipped 31% quarter-on-quarter to ₹23.5 crore, while profits remained steady at ₹9.4 crore. The real fireworks? Q4 FY25’s 255% PAT explosion to ₹17.1 crore, thanks to NES’s data ops kicking in.

For the detail-obsessed investor, here’s the fiscal snapshot – straight from consolidated filings. Notice the “Other Income” spike? That’s acquisition goodwill at work, but watch the debt creep from zero to a manageable 1% debt-to-equity. ROE at 5%? Fair, but primed for a jump if Pepperfry synergies click.

| Metric | FY25 (₹ Cr) | FY24 (₹ Cr) | YoY Change (%) | Q1 FY26 (₹ Cr) | Q1 FY25 (₹ Cr) | YoY Change (%) |

|---|---|---|---|---|---|---|

| Revenue | 93.5 | 81.3 | +15 | 23.5 | 12.4 | +89 |

| EBITDA | 74.3 | 25.6 | +190 | 15.2 | 4.5 | +238 |

| PAT | 46.1 | 18.2 | +153 | 9.4 | 5.4 | +73 |

| EPS (₹) | 12.9 | 5.1 | +153 | 2.64 | 1.52 | +73 |

| Net Debt | 2.0 | 0.0 | N/A | 1.5 | 0.0 | N/A |

| ROE (%) | 5.0 | 2.8 | +78 | 2.6 | 1.5 | +73 |

| P/E Ratio (x) | 43.5 | 25.2 | +73 | 47.7 (TTM) | N/A | N/A |

Source: Company filings; TTM as of Oct 14, 2025. Note: Includes one-off gains from acquisitions; adjusted core margins at 66% pre-tax.

Table: TCC Concept Ltd at a Glance

| Metric | Value | Analyst Assessment |

|---|---|---|

| Current Price | ₹618.15 | Trading near 52-week high (₹660), at critical resistance |

| 5-Year Return | +3,711.04% | Astronomical, unsustainable pace sets extreme growth expectations |

| 52-Week Range | ₹608.80 – ₹660.00 | An astronomical, unsustainable pace sets extreme growth expectations |

| Market Capitalization | ₹2,330 Crores | Substantial valuation requiring significant future earnings justification |

| P/E Ratio | Not Available (N/A) | Major Red Flag: Suggests lack of consistent profitability, speculative valuation |

🚀 The Catalyst: Analyzing the Pepperfry Acquisition

TCC Concept’s recent announcement to acquire 95.18% of Pepperfry Limited for ₹659.44 crores via a share swap arrangement represents a fundamental transformation of the company. This isn’t merely an acquisition—it’s a strategic pivot that effectively reverse-lists India’s largest omnichannel furniture marketplace into a publicly traded entity.

The Strategic Rationale:

- Market Position: TCC gains control of an established brand with 150+ studios across 100+ cities and a robust supply chain

- Revenue Integration: Pepperfry brings reported revenues of ₹164.18 crores (FY25), though this represents a concerning decline from ₹272.40 crores in FY23

- Digital Transformation: The acquisition aligns with TCC’s stated vision of building “scalable and technology-enabled consumer platforms”

Valuation Context:

The acquisition price represents approximately 28% of TCC’s entire market capitalization, making this an enormous, company-defining bet. The deal values Pepperfry at approximately 4x sales for a business with declining revenues—a premium valuation that demands a successful turnaround.

🌍 The Broader Market Context

The current market environment presents both opportunities and significant warnings for high-growth stories like TCC Concept.

Positive Macro Factors:

- Emerging Market Strength: EM equities have rallied for nine straight months and are forecast by Goldman Sachs Research to rise through 2025, with the MSCI EM index expected to reach 1,480.

- AI Optimism: “Continued adoption of artificial intelligence could lead to a productivity boom, as in the late 90s,” according to Morgan Stanley’s outlook.

Valuation Warnings:

- Market Caution: The Shiller P/E ratio recently closed at over 40, compared to a historical average of 17.3, levels that have previously preceded major corrections.

- Sector Considerations: The consumer discretionary sector (Pepperfry’s classification) faces risks from “any further softening in consumer spending” and “higher tariffs,” according to Schwab’s sector analysis .

⚖️ The Investment Case: Bull vs Bear

Table: The Bull and Bear Cases for TCC Concept

| Bull Argument | Bear Argument |

|---|---|

| Transformational potential in large home goods market | Declining revenue at target (₹272Cr FY23 → ₹164Cr FY25) raises turnaround questions |

| Established brand & infrastructure with 150+ studios | Transformational potential in the large home goods market |

| Potential operational synergies with TCC’s digital expertise | Execution risk in integrating and reviving a complex e-commerce business |

| Possible multiple expansion if successful integration | Massive dilution from issuing 1.18 crore new shares to fund acquisition |

🧭 The Analyst Recommendation

For Aggressive, High-Risk Tolerance Investors:

- Consider a small position only, understanding this is a speculative bet on the Pepperfry turnaround potential

- Monitor closely for successful integration milestones over the next two quarters

- Set strict stop-losses to protect against potential corrections from current elevated levels

For Conservative, Long-Term Investors:

- AVOID / WAIT AND WATCH – The combination of speculative valuation, lack of proven profitability, and high-stakes acquisition of a company in decline presents an asymmetric risk profile skewed toward downside

- Demand evidence of successful integration through at least two quarters of post-acquisition financials showing:

- Revenue stabilization and growth at Pepperfry

- A clear path to consolidated profitability

- Successful operational integration without significant hiccups

📉 Bottom-Line Assessment

TCC Concept represents a fascinating case study in market transformation. The 3,711% historical return tells a story of spectacular past performance, but the current investment thesis rests entirely on the successful execution of the Pepperfry acquisition and reversal of its declining revenues.

The extremely high valuation multiples absent measurable earnings, combined with the significant execution risk of integrating a complex e-commerce business, suggest substantial downside risk at current levels. In a market environment where valuation metrics are flashing warning signs, TCC Concept appears particularly vulnerable to a shift in investor sentiment away from speculative stories.

While the potential upside exists if management can successfully leverage Pepperfry’s platform, the risk-reward profile at current prices appears unfavourable for all but the most risk-tolerant investors. The prudent approach is to watch from the sidelines until concrete evidence of execution emerges.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.