Monarch Surveyors: A 68.5% IPO Pop Signals Strong Growth – Here’s What’s Next

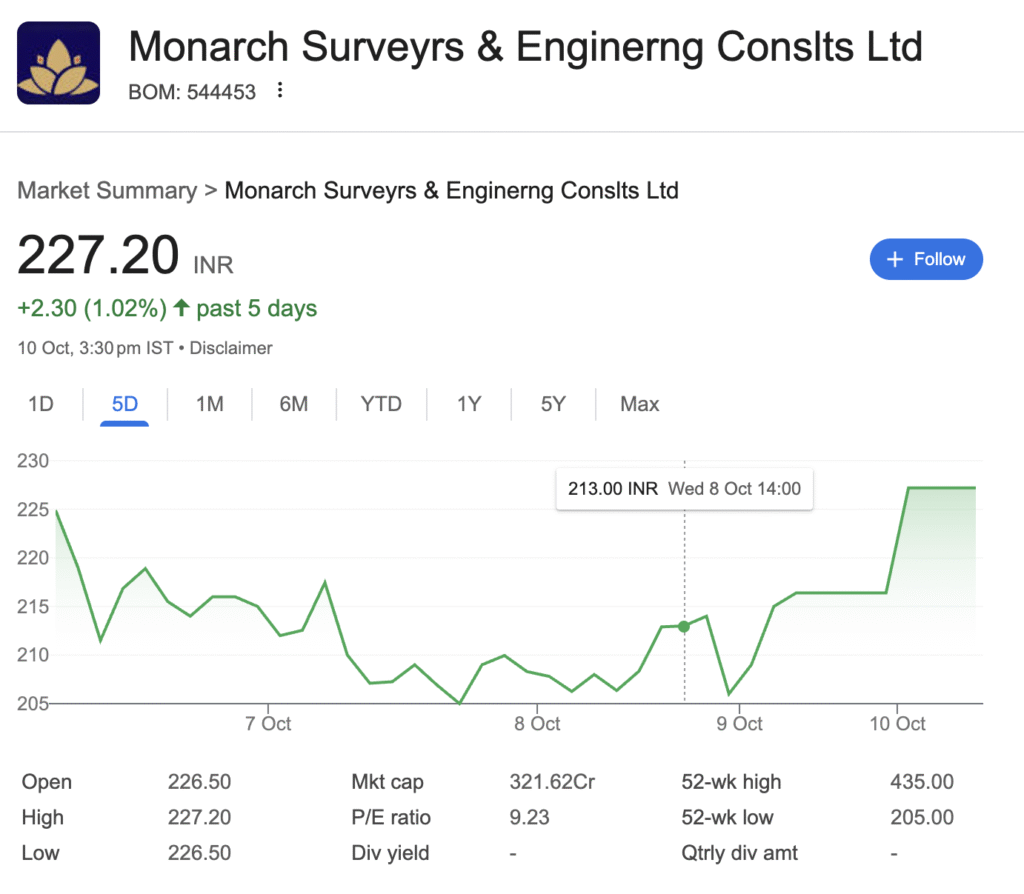

Monarch Surveyors and Engineering Consultants Limited (MSECL), a comprehensive engineering consultancy provider, has emerged as a notable player in India’s infrastructure landscape. With a stellar listing performance of 68.5% premium on its July 2025 IPO debut, the company has captured investor attention. This analysis delves into MSECL’s financial health, growth prospects, and valuation metrics to determine its investment attractiveness. While the company demonstrates impressive profitability ratios and a strong order book, certain risk factors warrant careful consideration for potential investors.

The company’s transition from private to public limited status in early 2024 marks a significant milestone in its growth journey, founded in 1999 and headquartered in Pune. MSECL provides integrated consultancy services spanning the entire infrastructure project lifecycle—from concept to commissioning—across sectors including roads, railways, metros, geospatial mapping, land acquisition, and water management .

Company Overview: Niche Expertise in Infrastructure Consulting

Monarch Surveyors and Engineering Consultants has established itself as a specialized player in India’s infrastructure consulting space, bringing over two decades of expertise to the table. The company’s service portfolio encompasses surveying, design, technical supervision, project management, and land acquisition services for various infrastructure projects. Their clientele includes central and state governments, municipalities, and corporate entities, positioning them as a trusted partner in India’s infrastructure development story.

The company maintains a diversified workforce of approximately 507 employees as of March 2025, specializing in various engineering and technical domains. MSECL’s recent IPO in July 2025, which raised approximately ₹93.75 crore through a fresh issue, underscores its growth ambitions and capital requirements for expansion. The funds are earmarked for working capital requirements, capital expenditure toward machinery purchase, and general corporate purposes.

Financial Performance Analysis: Robust Growth Trajectory

MSECL has demonstrated impressive financial performance over recent fiscal years, with both top-line and bottom-line showing consistent improvement. The company’s fundamental strength is reflected in its expanding profit margins and efficient capital utilization.

Table: Financial Performance Snapshot (Values in ₹ Crores)

| Particulars | Mar 2022 | Mar 2023 | Mar 2024 | Mar 2025 |

|---|---|---|---|---|

| Net Sales/Revenue | 43.43 | 71.68 | 139.49 | 154.14 |

| Total Expenditure | 37.72 | 60.00 | 96.71 | 103.03 |

| Operating Profit | 5.71 | 11.68 | 42.78 | 51.10 |

| Operating Profit Margin (%) | 13% | 16% | 31% | 33% |

| Net Profit | 4.39 | 8.59 | 30.01 | 34.83 |

| Net Profit Margin (%) | 10% | 12% | 22% | 23% |

Source: Compiled from multiple sources

Key Financial Ratios and Metrics

Table: Critical Investment Metrics

| Metric | Current Value | Industry Standard | Assessment |

|---|---|---|---|

| P/E Ratio (TTM) | 9.23 | Varies | Undervalued |

| Return on Equity (ROE) | 38.1% | 15-20% | Excellent |

| Return on Capital Employed (ROCE) | 46.4% | 15-20% | Exceptional |

| Debt to Equity | 0.13 | <1.0 | Low Leverage |

| Operating Profit Margin | 33% | Varies by sector | Strong |

| Promoter Holding | 98.42% | >50% | High |

The financial ratios paint a picture of a fundamentally strong company with efficient operations and healthy profitability. The high ROE and ROCE indicate superior capital allocation efficiency, while the low debt-to-equity ratio suggests a comfortable leverage position. The P/E ratio of 9.23 appears attractive compared to sector peers, which reportedly trade at P/E multiples of 18-22 .

Growth Prospects & Future Outlook: Riding India’s Infrastructure Wave

Order Book and Recent Contract Wins

MSECL’s growth visibility remains strong, evidenced by recent contract announcements in October 2025. The company has secured multiple significant projects, including:

- Land acquisition consultancy for Package-3 (Rajkot to Dwarka) of the proposed Somnath Dwarka Expressway valued at ₹41.43 crore

- Land acquisition consultancy for Package-6 (Jetpur to Somnath) of the same expressway, worth ₹21.80 crore

- Land acquisition activities for Package-4 (Rajkot to Porbandar) valued at ₹37.66 crore

- Measurement of all yards using an advanced trolley for the Bilaspur Division is worth ₹2.05 crore

- Comprehensive project report for Jammu Tawi to Shri Mata Vaishno Devi Katra railway line valued at ₹6.18 crore

These contracts, aggregating to approximately ₹109 crore, provide revenue visibility and underscore the company’s capability to secure repeat business from government clients.

Market Positioning and Expansion Potential

MSECL’s comprehensive service offerings under one roof provide a competitive advantage in securing large infrastructure projects. The company’s established track record, including recently commissioned projects like the Gadchiroli-Nagpur Expressway and Nagpur-Mumbai Samruddhi Expressway, enhances its credibility for future bids.

The Indian government’s continued emphasis on infrastructure development, with significant allocations in union budgets, creates a favourable macroeconomic environment for companies like MSECL to capitalize on emerging opportunities across road, rail, and urban infrastructure projects.

Risk Assessment: Challenges and Concerns

Despite the promising outlook, investors should remain cognizant of several risk factors:

- High Client Concentration: MSECL’s revenue is heavily dependent on government projects, with the top 10 clients accounting for 83-86% of revenue in recent years. Any reduction in government infrastructure spending could adversely impact business.

- Geographical Concentration: A significant portion of revenue (84% in FY25) is derived from Maharashtra, creating regional dependency risks.

- Working Capital Concerns: Trade receivables have surged to ₹39.63 crore in FY25 from ₹9.86 crore in FY24, while debtor days have increased from 50.4 to 93.8 days, indicating potential collection issues.

- Contingent Liabilities: The company has reported rising contingent liabilities of ₹16.16 crore in FY25, up from ₹13.39 crore in FY24, which could materialize and impact financials.

- Cash Flow Challenges: The company reported negative cash flow from investing activities (₹28.70 crore in FY25) and financing activities (₹0.37 crore in FY25), potentially indicating liquidity pressures.

Investment Verdict: Cautious Optimism for Long-Term Investors

Based on a comprehensive analysis of MSECL’s financials, growth prospects, and risk factors, the stock presents a mixed but promising investment case.

Strengths Supporting Investment Thesis:

- Strong financial fundamentals with high ROE/ROCE and improving margins

- Attractive valuation compared to sector peers

- Robust order pipeline providing revenue visibility

- Niche expertise in infrastructure consulting with comprehensive service offerings

- Experienced management with industry expertise

Concerns Requiring Monitoring:

- Deteriorating working capital efficiency and rising receivables

- High dependence on government contracts and the Maharashtra region

- Increasing contingent liabilities creates potential financial obligations

- Cash flow challenges that need resolution

MSECL presents a compelling case for investors seeking exposure to India’s infrastructure theme, but with cautious optimism. The stock appears fundamentally undervalued based on earnings capacity and growth prospects, but requires monitoring of working capital and client diversification initiatives.

Risk-appetite based allocation:

- Aggressive Investors: Can consider accumulation on dips with 2-3 year horizon

- Moderate Investors: May allocate small positions with regular monitoring of quarterly results

- Conservative Investors: May await improvement in receivable days and geographic diversification

The company’s ability to convert its strong order book into profitable revenue while managing working capital efficiency will be the key determinant of stock performance in the medium term. Investors are advised to track quarterly results for signals of improving cash flows and receivable days reduction.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.