Hiliks Technologies Soars 20%: A Micro-Cap Gem or a Speculative Bubble? Deep Dive Into the Numbers

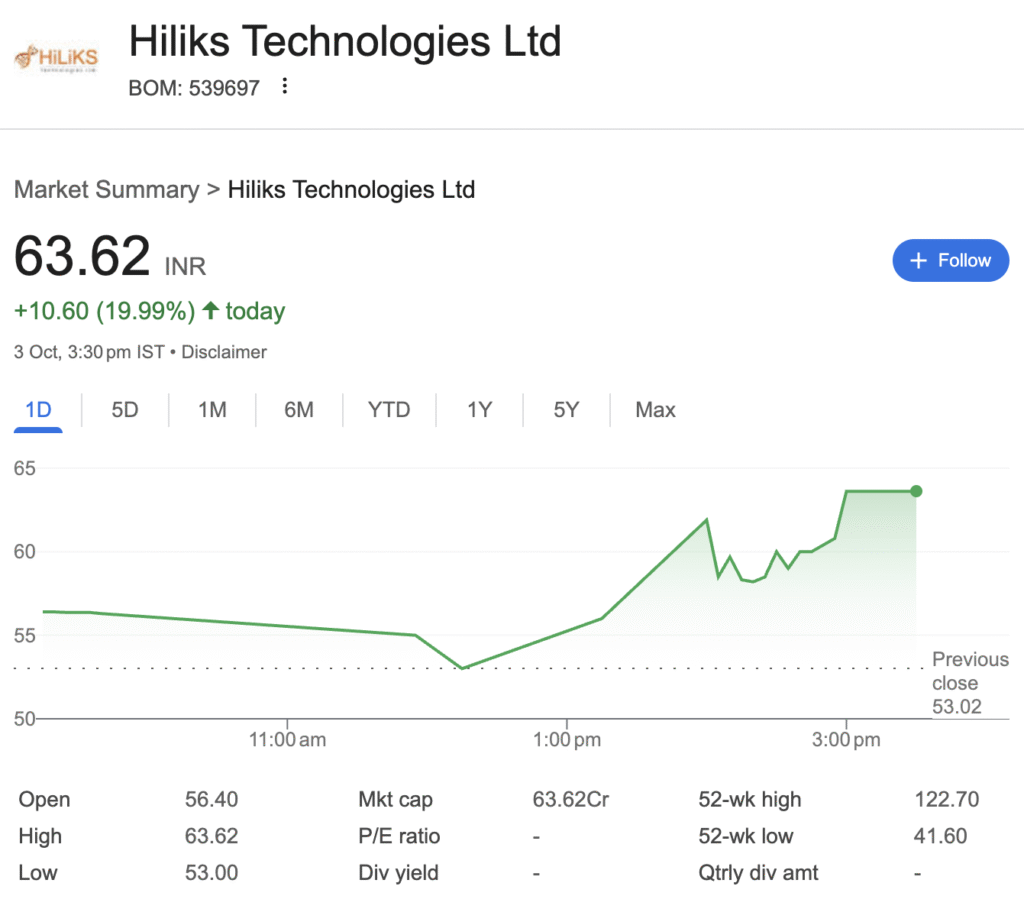

In a dramatic trading session on October 3rd, shares of Hiliks Technologies Ltd (BOM: 539697) skyrocketed, hitting the upper circuit of 20% to close at ₹63.62. This blistering rally, which saw the stock surge from ₹53.00 to its day’s high, wasn’t without reason. The company announced a monumental sub-contract order worth ₹33.39 crore, a figure that dwarfs its entire revenue from the last fiscal year.

But for the astute investor, a single order does not make a sound investment. The question echoing through the market is whether this micro-cap IT and infrastructure services player is on the cusp of a transformative growth story or if this is a classic “pump and dump” scenario. We delved deep into the company’s 40th Annual Report and recent disclosures to separate the signal from the noise.

The Trigger: Decoding the ₹33 Crore Rail Order

The fuel for the recent firestorm was a regulatory filing on October 3rd. Hiliks has secured a sub-contract from MSR-MEDIKONDA JV for comprehensive signalling and telecommunication works for the doubling of a railway track in the South Central Railway zone.

| Order Snapshot | Details |

|---|---|

| Value | ₹33.39 Crore |

| Client | MSR-MEDIKONDA JV (for South Central Railway) |

| Nature | Sub-Contract |

| Timeline | 18 Months |

| Work | Electronic Interlocking & OFC Communications |

This order is significant not just for its size but for its domain—railway infrastructure. It signals a strategic pivot or diversification from its core IT services into high-value engineering projects, a segment with substantial government spending.

The Financial Health Check: A Tale of Two Years

To understand the true impact of this order, one must first examine the company’s financial bedrock. The numbers reveal a story of explosive growth, but also one that requires careful scrutiny.

| Financial Metric (Standalone) | FY 2024-25 (in ₹ Cr) | FY 2023-24 (in ₹ Cr) | Change (%) |

|---|---|---|---|

| Revenue from Operations | 69.77 | 9.93 | +603% |

| Procurement of Services Cost | 77.26 | 15.69 | +392% |

| Employee Benefit Expenses | 0.94 | 0.21 | +348% |

| Profit Before Tax (PBT) | 6.37 | 1.04 | +513% |

| Net Profit After Tax (PAT) | 4.63 | 0.53 | +774% |

| Earnings Per Share (EPS) | ₹0.53 | ₹0.09 | +489% |

| Paid-Up Capital | 8.82 | 6.00 | +47% |

| Net Worth | 20.45 | 7.72 | +165% |

| Cash & Cash Equivalents | 0.57 | 0.20 | +185% |

| Trade Receivables | 12.66 | 4.12 | +207% |

📊 Shareholding Pattern (as of September 2025)

📈 Historical Trend Analysis

A look at the historical data reveals a significant trend of declining promoter holding, while public ownership has increased.

| Quarter Ending | Promoter Holding | Public Holding |

|---|---|---|

| Sep 2024 | 8.33% | 91.67% |

| Dec 2024 | 6.41% | 93.59% |

| Mar 2025 | 5.87% | 94.13% |

| Jun 2025 | 5.67% | 94.33% |

| Sep 2025 | 5.26% | 94.74% |

The Bull Case: What the Numbers Scream

- Exponential Growth: The top-line and bottom-line growth is nothing short of spectacular. Revenue grew over 7x, and net profit expanded by nearly 8x. This isn’t incremental growth; it’s a fundamental business upswing.

- Profitability: The company is not just growing sales; it’s converting them into profits efficiently. The Net Profit Margin improved from 5.3% in FY24 to 6.6% in FY25.

- Strong Balance Sheet: The company is virtually debt-free. With no significant borrowings and a healthy increase in net worth, the financial base is solid for a company of its size.

The Bear Case: The Red Flags Lurking Beneath

- Sky-High Receivables: The most glaring concern is the 207% jump in Trade Receivables to ₹12.66 Crore. This means a massive portion of their recorded revenue is yet to be converted into cash. The business is generating sales on paper, but cash flow is a critical area to watch.

- Working Capital Strain: The high receivables, coupled with a significant increase in work-in-progress (W-I-P), suggest potential strain on working capital management. The company will need robust cash flow to execute the new large order.

- Past Governance Lapses: The Secretarial Audit Report flags several past compliance issues, including delayed filings, inadequate board composition for periods, and the absence of a CFO for most of the year. While the company claims to have rectified these (appointing a CFO in May 2025 and new directors in August 2025), it points to a history of weak internal controls.

Management & Capital: Gearing Up for the Future

The board has seen a significant overhaul. New independent and non-executive directors have been appointed, and the company is seeking shareholder approval to:

- Increase its authorized share capital from ₹12 Cr to ₹20 Cr.

- Approve borrowing limits of up to ₹50 Cr.

These are clear indications that the management is preparing for future fundraising, either through equity or debt, to fuel expansion and manage the large order book.

Verdict: To Invest or Not to Invest?

From a Research Analyst’s perspective, Hiliks Technologies presents a high-risk, high-reward proposition.

The compelling “Reward” thesis is built on a proven FY25 performance and a game-changing ₹33 Cr order that alone represents nearly 50% of last year’s revenue. The company is debt-free, profitable, and appears to be strengthening its governance.

The significant “Risk” factors are the alarming rise in receivables, past compliance issues, and the inherent execution risks of a micro-cap company handling a large, complex project.

Investment Outlook:

- Aggressive Investors with a high-risk appetite might see this as a potential multi-bagger. If the company can successfully execute the railway order, improve its cash conversion cycle, and maintain profitability, the current market cap of ~₹63 Cr could seem like a steal in hindsight.

- Conservative Investors should adopt a “wait and watch” approach. The key metrics to monitor in the upcoming quarters will be:

- Cash Flow from Operations: Does it turn strongly positive?

- Receivables Cycle: Is the number of days sales outstanding (DSO) reducing?

- Order Execution: Timely and profitable execution of the ₹33 Cr project.

Conclusion:

Hiliks Technologies is at an inflection point. The 20% surge was a direct, knee-jerk reaction to the order news. The real test begins now. The company has lit the fuse with its order book; investors must now watch closely to see if it leads to a sustainable fireworks display of growth or fizzles out due to operational and financial constraints. For those considering an entry, any investment should be sized appropriately, acknowledging the potent mix of opportunity and risk that this micro-cap embodies.

Disclaimer: “BrightStake” is only an Educational Platform and is not registered under any SEBI Regulations. All Information on this page is for Educational and Entertainment purposes only. Our content does not constitute any Trading or Investment advice. We make no representation of the Timeliness, Accuracy, Profitability, or Suitability of any share on this Website, and we cannot be held liable for any Irregularity or Inaccuracy. Our research is conducted solely for educational purposes, so please utilise our knowledge to inform your investment strategy.